Introduction

In 2017, the financial world witnessed the emergence of a sophisticated scam that targeted unsuspecting investors with promises of substantial profits through money calendar option trading. This deceptive scheme exploited the allure of quick riches and lured numerous individuals into a trap of financial loss. Understanding this scam and its modus operandi is crucial to safeguard against similar fraudulent practices in the future.

Genesis of the Scam

The Money Calendar Option Trading Scam originated in the early months of 2017, gaining traction through online advertisements and social media campaigns. These promotions painted a picture of a lucrative opportunity to generate income through a seemingly straightforward trading algorithm. Greed and desperation led many individuals to invest their hard-earned money in this fraudulent enterprise.

Perpetrators and Tactics

The mastermind behind the scam remained anonymous, operating through a network of offshore accounts and shell companies. Their strategy revolved around presenting an air of credibility through glossy brochures, webinars, and testimonials from purported satisfied customers. However, these testimonials were fabricated, further ensnaring victims in the illusion of a legitimate investment.

Modus Operandi

The scam involved a series of steps that preyed upon investor naivety. Initial investments were typically small, around $250, to instill a sense of trust and entice victims to invest larger sums. Once the victim had deposited the funds, they were assigned a personal account manager who provided daily trading signals supposedly based on the money calendar algorithm.

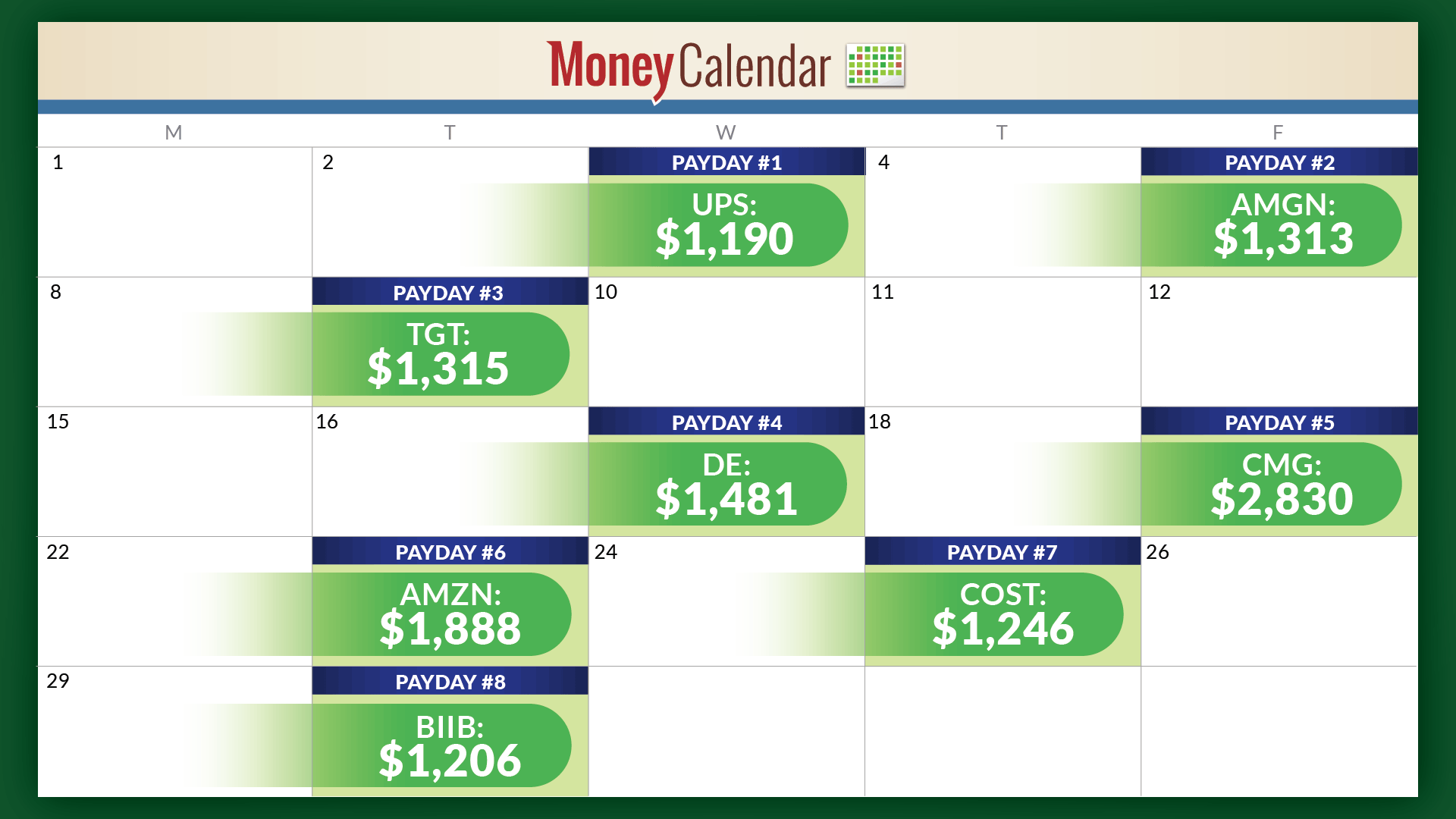

The so-called money calendar option trading algorithm claimed to predict market movements using proprietary software. Victims were led to believe that the signals generated by this algorithm would guarantee profitable trades. However, these signals were manipulated to slowly deplete investors’ accounts through a series of small losses.

Image: moneycalendarpro.com

As victims questioned the legitimacy of the trades, they were met with a barrage of justifications and excuses. They were often told that the market was experiencing fluctuations or that the algorithm was being refined. Victims were encouraged to invest more money to recoup their losses, leading them further down the path of financial ruin.

Unraveling the Deception

The fraudulent nature of the Money Calendar Option Trading Scam was exposed through meticulous investigations by financial regulators and law enforcement agencies. It was discovered that the trading signals were nothing more than random numbers, and the algorithm behind them was a mere façade. The perpetrators disappeared with the funds, leaving victims with empty accounts and shattered dreams.

Aftermath and Lessons Learned

The Money Calendar Option Trading Scam left a trail of financial devastation, with countless individuals losing their savings to this elaborate con. This incident highlighted the importance of thorough research and due diligence before investing in any financial opportunity. It also exposed the deceptive tactics employed by scammers to exploit financial desperation.

To prevent similar scams in the future, investors should remain vigilant. Be wary of promises that seem too good to be true, especially those involving significant returns with minimal effort. Conduct thorough research to verify the legitimacy of any investment opportunity and avoid investing with unregulated or offshore entities.

Image: www.youtube.com

Money Calendar Option Trading Scam 2017

![Money Calendar Pro - Scam or Legit? [Reviews]](https://nobsimreviews.com/wp-content/uploads/2019/09/Snip20190918_37.png)

Image: nobsimreviews.com

Conclusion

The Money Calendar Option Trading Scam of 2017 stands as a potent reminder of the ever-present threat of financial fraud. By understanding the modus operandi of such schemes, investors can equip themselves to protect their hard-earned money and ensure the integrity of the financial marketplace. Vigilance, skepticism, and a thirst for knowledge are essential tools in the fight against financial deception.