Embrace Informed Options Trading with a Comprehensive Understanding of W

Options trading, a complex and potentially lucrative financial instrument, introduces the concept of “W,” representing the width of the bid-ask spread. Understanding W is critical for successful trade execution and optimizing returns.

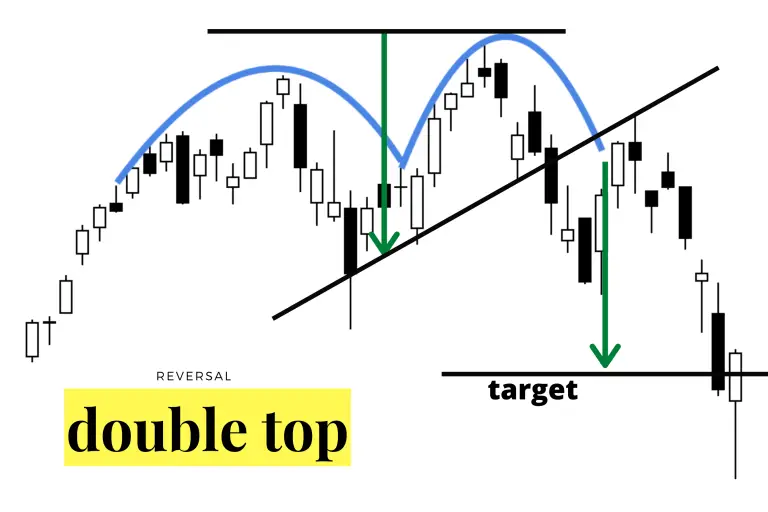

Image: futures.io

Decoding the Bid-Ask Spread

The bid-ask spread, calculated as the difference between the bid price (the highest price at which a buyer is willing to purchase an option) and the ask price (the lowest price at which a seller is willing to sell), serves as a measure of market sentiment and trading costs. W, measured in points or dollars per unit, plays a crucial role in determining the profitability and feasibility of an options trade.

Navigating W’s Impact on Options Trading

The width of the bid-ask spread significantly influences several aspects of options trading:

- Trade Costs: W represents the upfront cost of entering and exiting an options contract. A wider spread implies higher trading costs, reducing potential returns.

- Transaction Time: A narrow spread indicates higher liquidity, facilitating faster trade execution. Conversely, a wider spread may delay trade fills, impacting profitability.

- Profitability: The spread can erode potential profits. Traders must consider the spread when evaluating option premiums and calculating their profit targets.

Trends and Developments in W

Options trading dynamics continually evolve, influencing W. Recent trends include:

- Increased Volatility: Market volatility can widen spreads, creating opportunities for advanced traders.

- Electronic Trading: Technological advancements have enhanced market transparency, leading to narrower spreads.

- Algorithmic Trading: The use of algorithms and high-frequency trading can reduce spreads, benefiting liquidity.

Image: www.newtraderu.com

Expert Tips and Advice

Seasoned options traders share valuable tips for navigating W:

- Monitor Spread History: Track historical spread data to identify patterns and predict future spread trends.

- Consider Spread Width: Assess the spread width in relation to the total premium to determine if the trade is viable.

- Factor in Trade Volume: High trading volumes indicate lower spreads, offering potential for better execution prices.

Frequently Asked Questions

Common questions regarding W in options trading include:

Q: What factors influence W?

A: Market volatility, liquidity, and trading volume significantly impact the bid-ask spread.

Q: How can I minimize the impact of W?

A: Trading in liquid markets, aiming for large spreads, and understanding historical spread data can mitigate the impact of W.

Q: Can I predict W?

A: Predicting W with certainty is difficult, but monitoring market conditions and tracking spread behavior can provide valuable insights.

W In Options Trading

Image: www.asiaforexmentor.com

Conclusion

In options trading, understanding W empowers traders with the knowledge necessary for strategic decision-making. By carefully considering the bid-ask spread and utilizing expert advice, investors can navigate market complexities, optimize trade execution, and increase their chances of successful outcomes. Are you ready to embark on the journey of informed options trading?