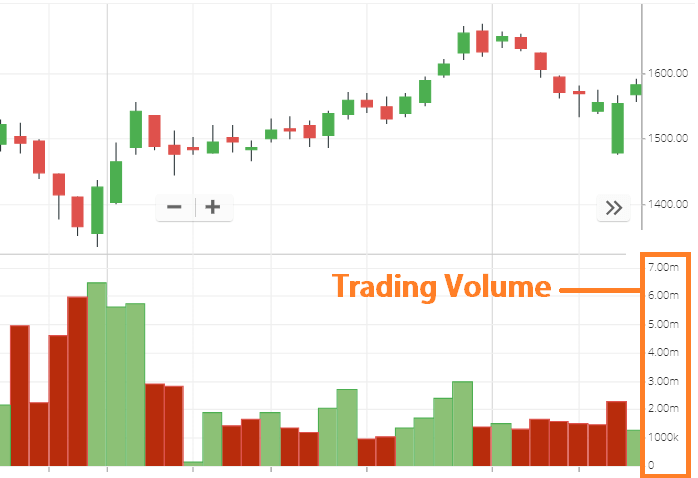

Options trading is an intricate skill that requires a keen understanding of both the market and individual stocks. One crucial aspect that can significantly enhance your trading success is using volume data. Volume, which represents the number of shares traded during a specific period, provides valuable insights into market sentiment and momentum.

Image: earnfo.com

By studying volume patterns, options traders can gauge the strength of buy and sell orders, identify potential breakouts, and make more informed decisions. In this article, we’ll delve into the world of options trading with volume, exploring its benefits, strategies, and expert tips to help you harness this powerful indicator.

**Trading Options with Volume: A Guiding Light**

Volume is a key indicator that reflects the level of participation in a stock’s trading. High volume typically signifies strong market interest, while low volume can indicate a lack of interest or indecision. Volume data is particularly useful in conjunction with price action and chart patterns to confirm or refute trading signals.

By analyzing volume trends, options traders can gain valuable insights into the momentum behind a stock’s price movement. High volume during a market uptrend suggests a strong buying force, increasing the likelihood of the rally continuing. Conversely, high volume during a market downtrend indicates a powerful selling pressure, raising the probability of a further decline.

**Strategies and Tactics: Volume in Action**

There are various strategies that incorporate volume data into options trading. Here are a few popular methods:

**Expert Tips for Mastering Options with Volume**

Combining experience and market knowledge, experts have formulated valuable advice for traders using volume in options trading:

Image: theforexscalpers.com

**FAQs on Options Trading with Volume**

Q: Which volume indicators are most reliable?

A: While various volume indicators are available, some of the most common and reliable include the Chaikin Money Flow index, the On Balance Volume indicator, and the Accumulation/Distribution line.

Q: Can volume alone provide an accurate prediction of price movement?

A: Volume is a significant factor, but it’s important to use it in conjunction with other technical indicators and fundamental analysis. It can provide valuable insights but should not be solely relied upon.

Trading Options With Volume

Image: www.adorebooks.in

**Conclusion**

Traders who incorporate volume into their options strategies gain a valuable edge in the market. By deciphering volume patterns and applying expert advice, you can enhance your trade execution, identify potential market turning points, and increase your chances of success in options trading.

Are you ready to dive into the world of options trading with volume? Let this article be your guide as you navigate the markets with increased confidence and effectiveness.