In the fast-paced world of financial markets, options trading has emerged as a popular strategy for mitigating risk and capitalizing on market trends. Moving averages, a technical analysis tool, can be invaluable for honing your options trading strategies, especially when used in conjunction with other indicators.

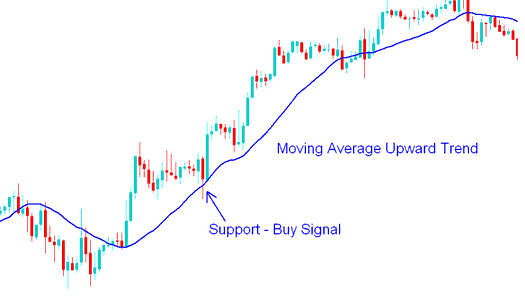

Image: www.tradeforextrading.com

This article will delve into the intricacies of trading options with moving averages, providing you with a comprehensive guide to understanding their significance and implementing them effectively. By the end, you’ll possess a well-rounded knowledge of this compelling trading technique, empowering you to navigate options markets with confidence and precision.

Understanding Moving Averages

Defining Moving Averages

Moving averages (MAs) are technical indicators that smooth out price fluctuations by plotting the average price of an asset over a specified period. They are categorized based on the number of periods used for averaging. Popular MA types include the Simple Moving Average (SMA), Exponential Moving Average (EMA), and Weighted Moving Average (WMA).

Interpreting Moving Averages

Moving averages provide valuable insights into market trends by indicating the overall direction and momentum of an asset. When an asset’s price is above its MA, it suggests a bullish trend, while a position below the MA indicates a bearish trend. The slope and crossover of multiple MAs can further refine trend analysis.

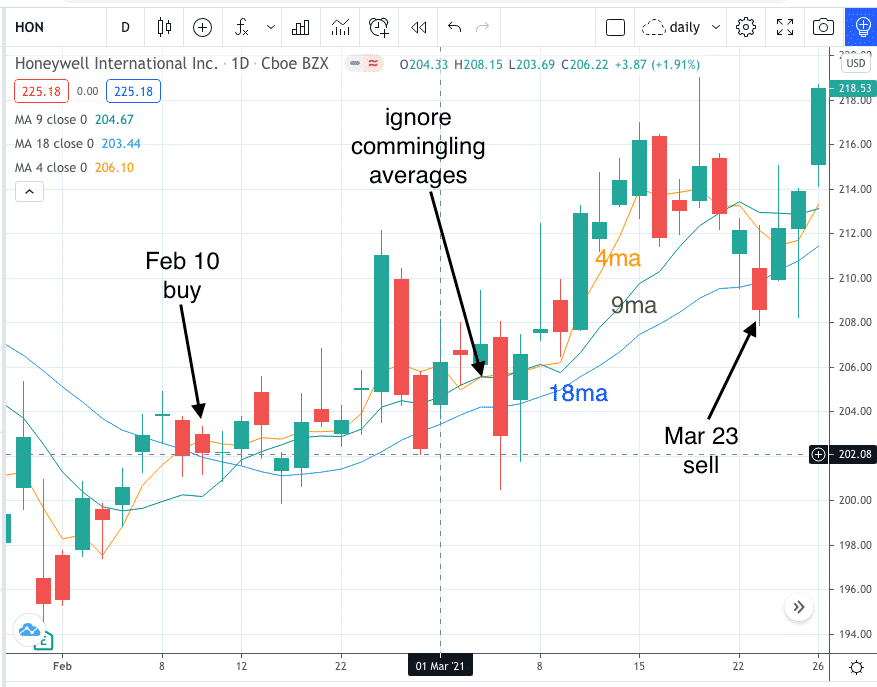

Image: s3.amazonaws.com

Trading Options with Moving Averages

Trend Following with Moving Averages

Options traders often use moving averages to identify and trade market trends effectively. By buying options that align with the direction indicated by the MA, traders can exploit favorable market conditions. For example, during an uptrend (price above MA), a trader might purchase call options to capture potential gains.

Breakout Trading with Moving Averages

Moving averages can also be employed for breakout trading, where traders anticipate and capitalize on significant market moves. By monitoring the price action in relation to MAs, traders can identify potential breakout opportunities. If an asset consistently exceeds a key MA, a breakout trade can be made in the direction of the trend.

Support and Resistance with Moving Averages

Traders may utilize moving averages to identify potential support and resistance levels. Historically, areas around key MAs have shown to offer these significant price points. When an asset falls towards its MA, it may act as a support level, while a rise towards its MA may encounter resistance.

Tips and Expert Advice

Mastering Moving Average Parameters

To optimize the efficacy of moving averages, thoughtful consideration of their parameters is crucial. Varying the period of the MA can cater to different trading styles and market conditions. Experiment with various MAs and ascertain which resonates most effectively with your trading strategy.

Combining Multiple Moving Averages

Enhancing trading accuracy is often achieved by incorporating multiple moving averages with diverse periods. This strategy enables traders to gauge market momentum from multiple perspectives, potentially minimizing false signals and enhancing trade execution.

Frequently Asked Questions (FAQs)

Q: Which type of moving average (SMA, EMA, WMA) is considered the most accurate?

A: Accuracy is subjective to individual trading styles and market behavior. SMA provides a straightforward average, EMA places more emphasis on recent price movements, while WMA assigns higher weightage to closing prices.

Q: What is the optimal period for a moving average in options trading?

A: Suitable periods vary with market volatility and trading strategies. Short-term traders may opt for periods like 10 or 20, while long-term traders may prefer periods such as 50 or 200.

Q: Can moving averages be used to predict future price movements?

A: While moving averages provide insights into past and current trends, it’s crucial to note that they cannot predict future price movements with absolute certainty. They should be used in conjunction with additional indicators to reinforce trading decisions.

Trading Options With Moving Averages

Image: optionstradingiq.com

Conclusion

Trading options with moving averages is a potent technique to enhance trading strategies and potentially maximize profits. By understanding the fundamentals, implementing effective techniques, and leveraging expert advice, you can unlock the potential of this powerful tool. Remember, continuous learning and market analysis are vital in refining your trading skills and achieving long-term success.

So, are you ready to explore the fascinating realm of options trading with moving averages and elevate your financial journey? The knowledge and strategies outlined here are at your disposal, empowering you to navigate markets with confidence, clarity, and potential profitability.