Sailing Through the Complex Waters of IV

Imagine you’re paddling a kayak in a vast sea of financial possibilities. You’ve just set your sights on an enticing opportunity, a distant island that promises untold riches. But to reach your goal, you must navigate through treacherous waters filled with options contracts, volatility, and hidden currents. Enter the IV figure, your compass in this uncharted territory, guiding you towards informed decisions and market mastery.

Image: www.pinterest.com

Understanding Implied Volatility (IV)

At the heart of options trading lies a pivotal concept: implied volatility (IV). IV gauges the market’s perception of future price fluctuations. Simply put, it measures how much the market expects the underlying asset’s price to swing within a specific time frame. A high IV suggests anticipation of sharp price movements, while a low IV indicates a more stable market outlook.

The IV Figure: A Beacon of Knowledge

The IV figure, expressed as a percentage, provides a snapshot of the market’s expectations. It’s like a real-time thermometer, reflecting the collective breath held by investors as they anticipate future events. The higher the IV figure, the greater the pricing premiums on options contracts. The lower the figure, the cheaper the options become.

Historical Volatility: A Cautionary Tale

When interpreting the IV figure, it’s crucial to consider historical volatility (HV). HV measures past price fluctuations and serves as a benchmark against which IV is compared. If IV is significantly higher than HV, it may indicate a market mismatch. Traders should question this discrepancy and ponder why the market’s forward-looking expectations are so far removed from past behavior.

Image: riset.guru

Market Sentiment: The Invisible Conductor

The IV figure is heavily influenced by market sentiment. Bullish sentiment, characterized by optimism and expectations of rising prices, tends to elevate IV. Conversely, bearish sentiment, fueled by pessimism and fears of falling prices, often depresses IV. Traders must decipher these sentiment tugs-of-war to discern the underlying market forces that shape IV.

Expert Insights: Navigating the IV Matrix

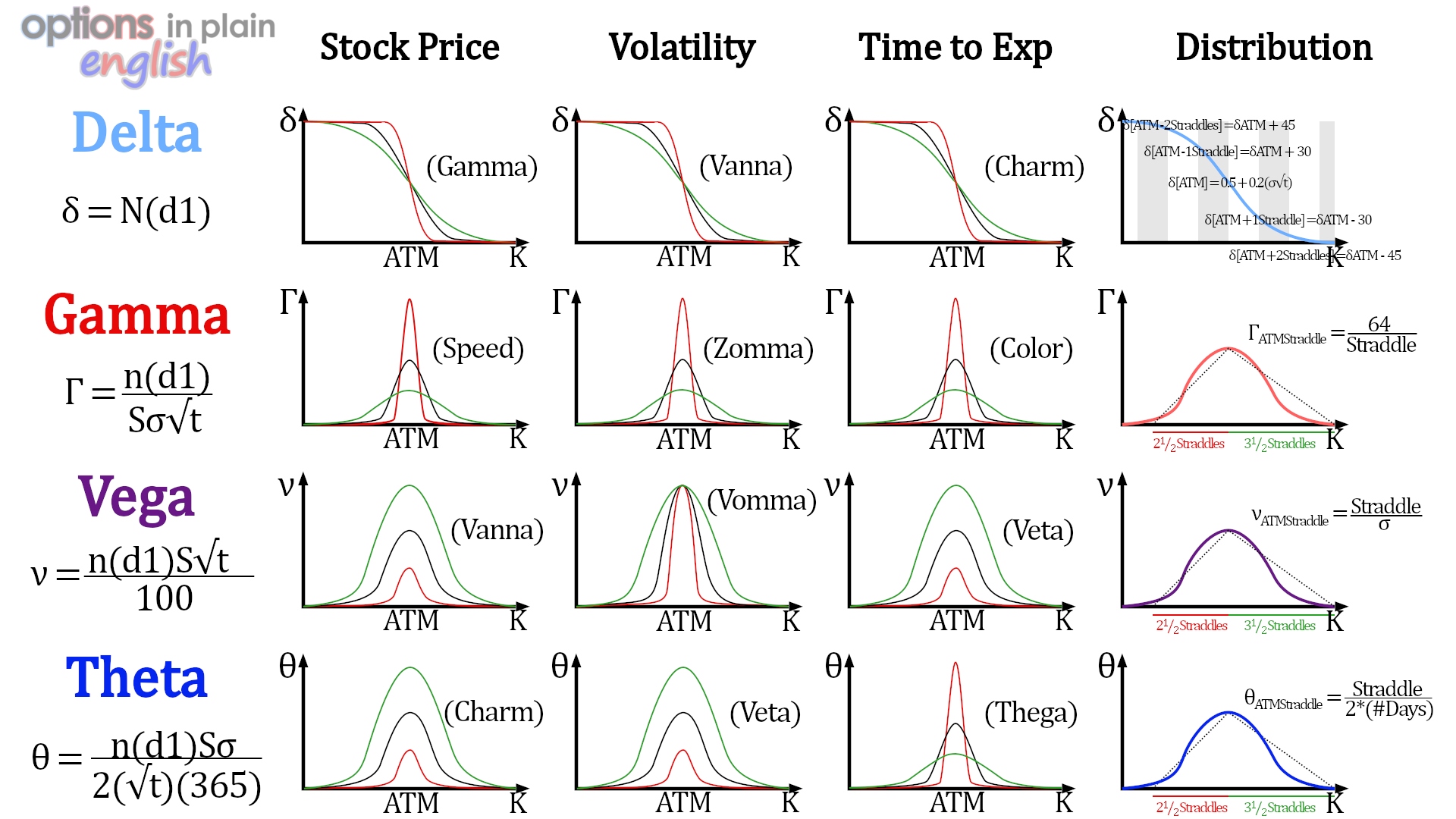

In this complex realm, guidance from experienced traders can be invaluable. They advise considering the options chain to analyze IV across different strike prices and expiration dates. This multi-dimensional perspective helps refine trading strategies. Furthermore, they emphasize monitoring IV changes over time, as sudden spikes or drops may signal market shifts that need to be addressed.

IV’s Role in Option Pricing

As IV rises or falls, option premiums adjust accordingly. The higher the IV, the pricier the options become. This relationship is particularly relevant for traders who utilize options strategies that involve selling or buying premium. Understanding how IV drives option premiums is key to maximizing trading efficiency.

Trading Strategies: Harnessing IV’s Power

Traders have devised various strategies to leverage IV to their advantage. Some seek to benefit from IV disparities between the market and historical data, while others pursue opportunities to sell options contracts when IV is inflated. The key is to align your strategy with IV’s dynamics and market conditions.

Trading Options Iv Figure Is

Image: www.pinterest.ca

Conclusion: Your IV Compass in Financial Seas

In the ever-changing world of options trading, the IV figure emerges as a crucial navigational tool. By understanding IV’s significance, traders can unlock market insights, make informed decisions, and set course for trading success. Remember, as you navigate these complex waters, the IV figure will be your guiding light, revealing the hidden currents and leading you to your desired financial destinations.