Within the realm of options trading, indicators serve as invaluable tools, empowering traders to decipher market intricacies and enhance their trading decisions. These technical tools analyze historical price data, market trends, and volatility patterns, providing traders with critical insights into future price movements. By leveraging trading options indicators, traders can gain a competitive edge, optimizing their trading strategies and maximizing their profit potential.

Image: www.andrewstradingchannel.com

Unveiling the Significance of Trading Options Indicators

Options indicators are indispensable for options traders seeking to navigate the complexities of the market effectively. Their ability to quantify market sentiment, forecast price trends, and identify potential trading opportunities makes them crucial for informed decision-making. By incorporating these indicators into their trading strategies, traders can improve their risk management practices, refine their entry and exit points, and ultimately amplify their trading performance.

Delving into the Essential Indicators for Options Trading

Traders must comprehend the fundamentals of several key indicators to harness the full potential of trading options indicators. These indicators are meticulously designed to capture distinct aspects of market dynamics, enabling traders to construct a comprehensive picture of market trends.

Volatility Indicators: These indicators measure the magnitude of price fluctuations, providing traders with insights into market volatility. Popular volatility indicators include Bollinger Bands, Average True Range (ATR), and the Volatility Index (VIX).

Trend Indicators: Trend indicators help traders identify the overall direction of the market, indicating potential reversals or continuations. Some widely used trend indicators include moving averages, trendlines, and the Relative Strength Index (RSI).

Momentum Indicators: Momentum indicators measure the rate of change in price, aiding traders in identifying potential breakouts and pullbacks. Prominent momentum indicators include the Moving Average Convergence Divergence (MACD), the Stochastic Oscillator, and the Commodity Channel Index (CCI).

Directional Indicators: Directional indicators provide clues about the strength and direction of market moves, helping traders anticipate potential trend reversals. Notable directional indicators include the Average Directional Index (ADX), the Directional Movement Index (DMI), and the Parabolic SAR.

Harnessing Trading Options Indicators for Strategic Execution

To effectively utilize trading options indicators, traders must meticulously integrate them into their trading strategies.

Implementing a Multi-Indicator Approach: Combining different types of indicators can provide a more comprehensive market perspective, reducing the risk of relying solely on a single indicator.

Choosing Indicators Aligned with Trading Style: Different indicators cater to various trading styles. Scalpers may opt for momentum indicators, while long-term investors may prefer trend indicators.

Customized Indicator Settings: Traders should adjust indicator settings to suit their specific trading preferences and risk tolerance levels. Optimization techniques can enhance indicator performance based on historical data.

Confirming Signals with Other Analysis: While trading options indicators are valuable, they should not be used in isolation. Consider corroborating indicator signals with other forms of analysis, such as fundamental analysis or chart patterns.

Image: www.vectorvest.com

Trading Options Indicators

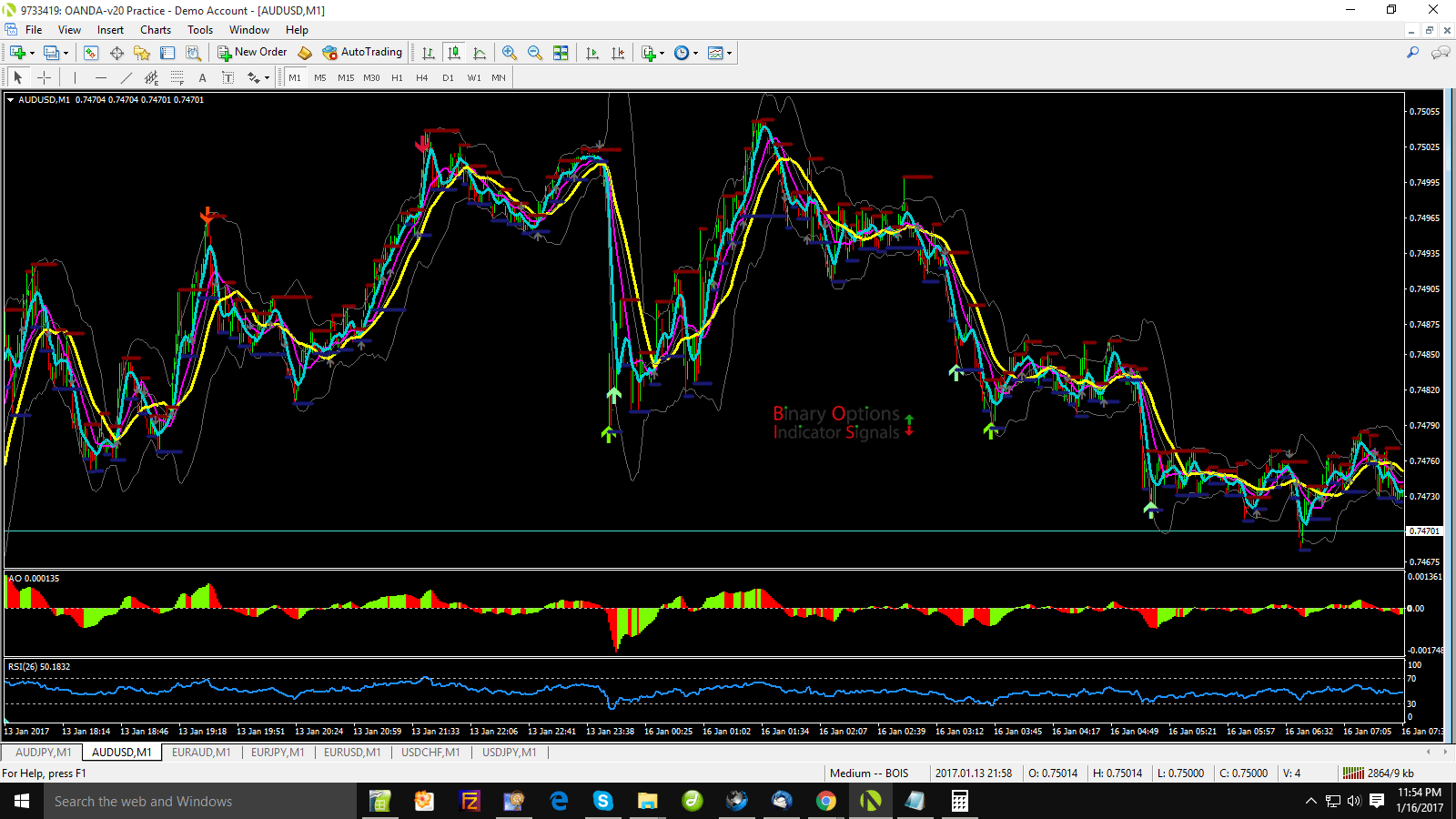

Image: binaryoptionsindicatorsignals.com

Conclusion

Trading options indicators serve as an invaluable resource for options traders, providing them with a deeper understanding of market dynamics and empowering them to make informed trading decisions. By diligently employing these indicators and integrating them seamlessly into their trading strategies, traders can navigate market complexities more effectively, minimize risk, and maximize profit potential. However, it is essential to remember that indicators are just tools, and their effectiveness hinges on the trader’s ability to interpret and utilize them wisely.