Embark on a Lucrative Trading Journey with QQQ Options

Image: tradingstrategyguides.com

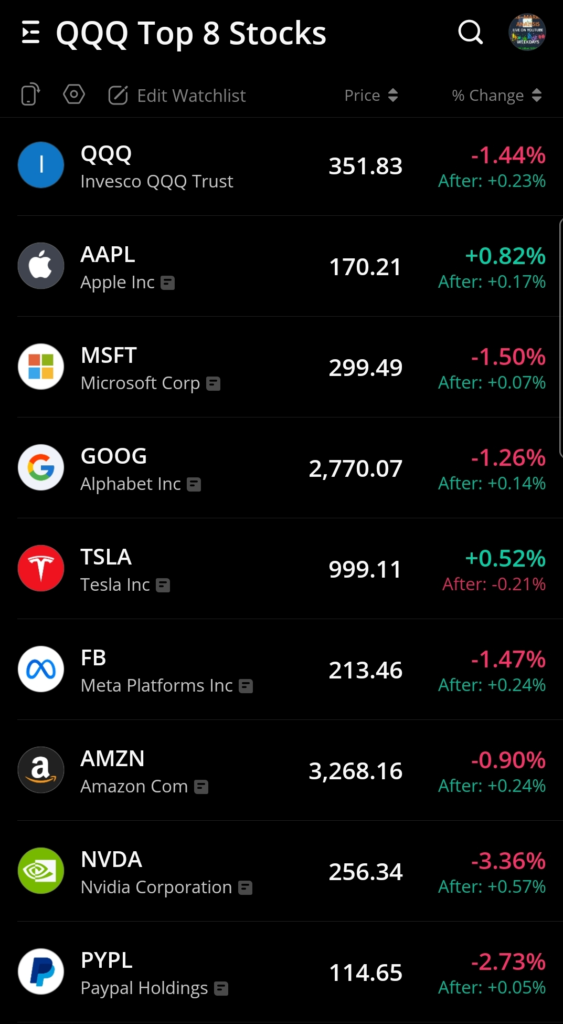

Are you yearning for a dynamic and potentially profitable trading experience? Look no further than QQQ options. Traded on the Nasdaq exchange, QQQ tracks the Nasdaq-100 Index, providing exposure to some of the world’s most innovative technology companies. Its liquidity and affordability make it an ideal instrument for both novice and seasoned traders.

Unveiling the World of QQQ Options

Options are financial contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specific price, known as the strike price, on or before a predetermined date. QQQ options empower traders with the flexibility to speculate on the future price movements of the Nasdaq-100 Index while mitigating risk.

Options Trading at Its Finest

To navigate the dynamic world of QQQ options trading, you need a cost-effective approach. Consider the following strategies to minimize your expenses while maximizing returns:

1. Opt for ITM Options:

In-the-money (ITM) options, especially those with a strike price close to the current market value, tend to be more expensive. To minimize costs, consider trading out-of-the-money (OTM) options, which have a strike price significantly higher (for call options) or lower (for put options) than the current market price.

2. Choose Weekly or Monthly Expiries:

QQQ options offer various expiration dates ranging from weekly to monthly. Weekly options, while more volatile, can provide significant returns in a shorter timeframe. Monthly options, on the other hand, provide more time for the market to move in your favor but may incur higher premium costs.

3. Manage Your Risk:

Options trading involves inherent risks. To safeguard your capital, employ risk management strategies such as setting stop-loss orders to limit potential losses. Only trade with capital you can afford to lose and never overextend yourself financially.

Expert Insights for Successful QQQ Trading

- Focus on a few key areas: Don’t spread yourself too thin across multiple sectors or stocks. Instead, specialize in a specific niche, such as the technology industry.

- Stay updated on market trends: Keep abreast of the latest economic data, earnings reports, and geopolitical events that may impact the Nasdaq-100 Index.

- Embrace patience: Options trading requires patience and discipline. Avoid making impulsive trades and stick to your carefully crafted strategies.

Maximize Your Earnings with QQQ Options

Delving into QQQ options trading can be a rewarding experience with the right approach. Remember to minimize expenses, choose suitable contracts, manage your risk, and learn from experts. By embracing a smart trading strategy, you can unlock the full potential of this innovative instrument and potentially amplify your returns.

Image: tradingforexguide.com

Options Trading Qqq With At Least Expensive

Image: successfultradings.com