Introduction

Options contracts have emerged as a powerful tool for savvy investors seeking to navigate the ever-evolving financial landscape. For the uninitiated, options contracts are agreements that bestow the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. Understanding the intricacies of options trading can empower investors to enhance their portfolios, mitigate risks, and potentially generate substantial returns.

Image: templates.rjuuc.edu.np

Demystifying Options Contracts

In essence, options contracts are essentially insurance policies purchased from options exchanges like the Chicago Board Options Exchange (CBOE). When you buy an option contract, you pay a premium in exchange for the option to engage in a future transaction. Call options provide the right to buy an asset at a specific price (the strike price) on or before a particular date (the expiration date), while put options grant the right to sell an asset at the strike price before the expiration date.

The Role of Time and Volatility

Time and volatility play significant roles in options pricing. Options contracts with more time until expiration tend to command higher premiums because of the greater potential for the underlying asset’s price to fluctuate. Additionally, high volatility in the underlying asset typically leads to higher options premiums.

Types of Options Strategies

The world of options trading offers a diverse array of strategies that cater to various investment objectives. Covered call and cash-secured put are popular options for generating income by selling existing shares or by utilizing margin. Risk-averse investors may opt for protective collars or protective spreads to hedge against potential losses. For those seeking potentially explosive returns, there are bullish call options and bear put options, although they come with increased risk.

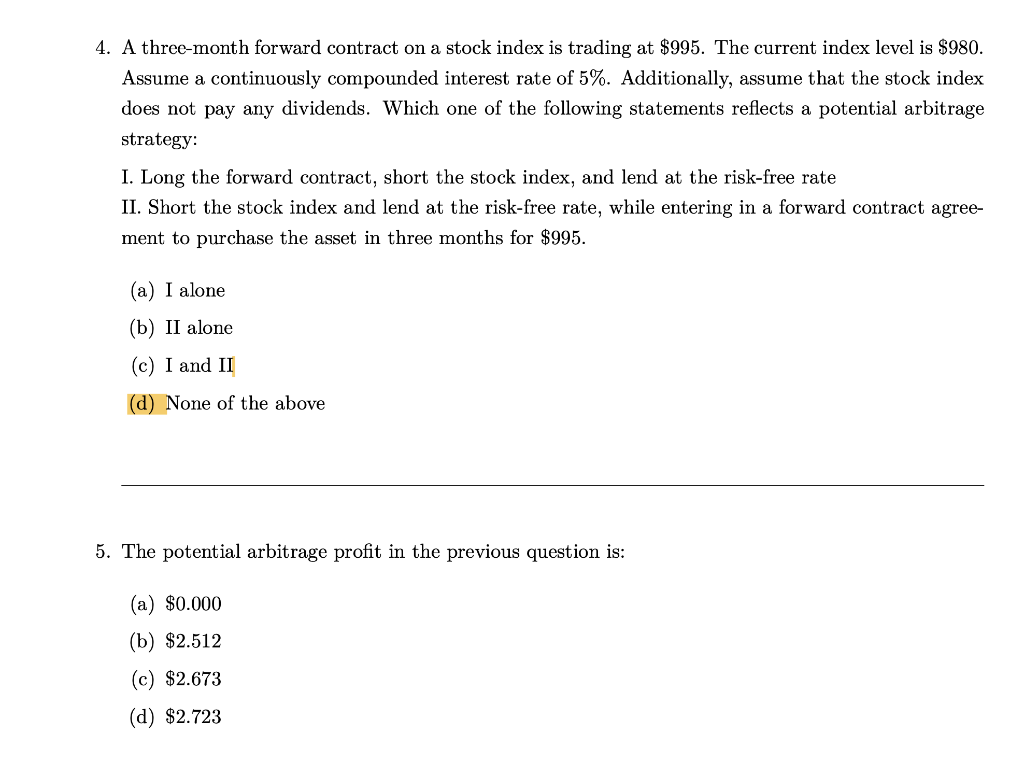

Image: www.chegg.com

Leveraging Option Analytics

Thoroughly assessing options contracts is paramount for informed decision-making. Key analytical tools include the option’s premium, the underlying asset’s price, the volatility of the asset, the time to expiration, and the historical fluctuations of the asset’s price. Consulting reliable resources like options calculators and historical charts can enhance your analytical prowess.

Expert Insights

“Successful options trading hinges on a deep understanding of risk management,” advises financial expert Robert C. Merton. “Traders must meticulously evaluate their risk tolerance and position size to maintain a balanced and sustainable trading strategy.”

Renowned options trader Larry McMillan emphasizes the importance of technical analysis in conjunction with options trading. “Technical indicators can provide valuable insights into the supply and demand dynamics of the underlying asset,” he notes. “By combining technical analysis with options, traders can optimize their timing and maximize their chances of success.”

Actionable Tips

- Thoroughly research and comprehend the intricacies of options trading before venturing into the market.

- Start small and gradually increase your position size as you gain experience.

- Exercise prudence by understanding and managing risk meticulously.

- Continuously monitor market conditions and adjust your strategies as needed.

- Seek guidance from experienced options traders or consult reputable resources to enhance your knowledge and skills.

Trading Options Contracts 5 Years

Image: unctad.org

Conclusion

Options contracts represent a powerful investment tool with the potential to enhance returns, hedge risks, and unlock new opportunities. By delving into the complexities of options trading, investors can equip themselves with the knowledge and strategies necessary to navigate the financial markets with greater confidence and success. Remember, embarking on this journey requires a commitment to continuous learning, disciplined risk management, and an unwavering pursuit of excellence. Embrace the world of options trading with the insights provided in this comprehensive guide, and you’ll be well on your way to realizing your investment aspirations.