Introduction

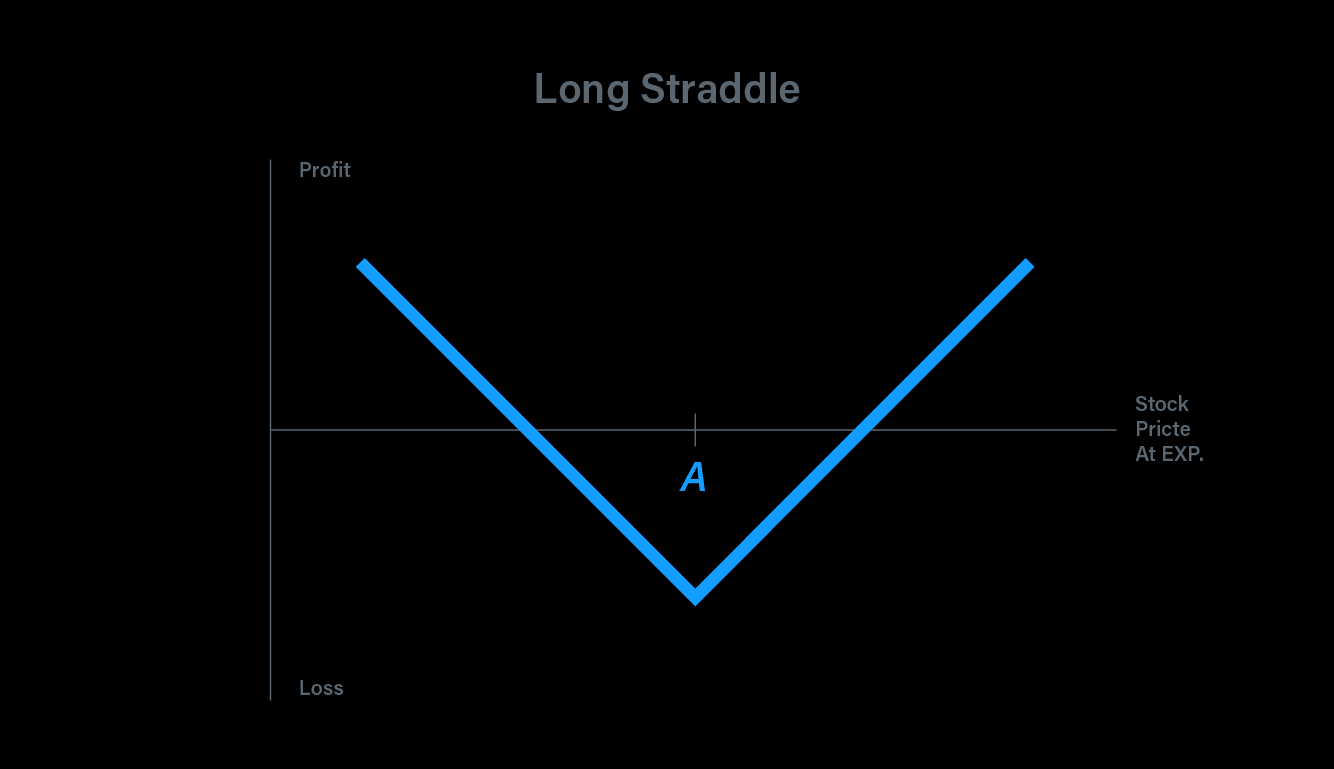

In the realm of options trading, where risk and reward dance delicately, the concept of option straddles emerges as a strategic maneuver. Picture this: you’re a seasoned trader who senses an impending market event that could send the underlying asset’s price soaring in either direction. You’re eager to capitalize on this potential spike in volatility, but you’re uncertain of the direction the market will take. Enter the option straddle, a financial instrument that grants you the flexibility to profit regardless of the asset’s price movement.

Image: www.profiletraders.in

Option Straddles: What Are They?

An option straddle is a neutral trading strategy that involves simultaneously purchasing both a call option and a put option at the same strike price. The call option gives you the right, but not the obligation, to buy the underlying asset at a predetermined price on or before a specified date. The put option, on the other hand, gives you the right to sell the underlying asset at the same strike price. By combining these two options, you’re essentially creating a “straddle” that covers both the upside and downside potential price movements.

Unveiling the Benefits of Option Straddles

Option straddles offer a unique set of advantages that appeal to traders seeking flexibility and protection:

- Profitability from Both Upside and Downside Moves: Unlike traditional options, which only profit from directional movements, option straddles can generate profits regardless of the direction the underlying asset moves. This makes them particularly suitable for scenarios where market volatility is expected to increase but the direction of the move is unclear.

- Limited Risk: The maximum loss on an option straddle is limited to the premium paid for both the call and put options. This predefined risk profile provides a buffer against excessive losses in either direction.

- Flexibility: Option straddles provide traders with the flexibility to adjust their strategies as market conditions evolve. If the market moves in a specific direction, the trader can choose to exercise one of the options while letting the other expire.

Trading Option Straddles: A Step-by-Step Guide

To successfully trade option straddles, follow these steps:

- Identify an Underlying Asset: Select an underlying asset, such as a stock, index, or commodity, that you believe will experience increased volatility.

- Choose a Strike Price: Determine the strike price for your call and put options. This price should be close to the current market price of the underlying asset.

- Set an Expiration Date: Decide on an expiration date for your options. Generally, shorter-term options with lower time decay are preferred for straddle strategies.

- Purchase Call and Put Options: Simultaneously purchase both a call option and a put option with the same strike price and expiration date.

- Monitor Your Position: Continuously monitor your option positions as market conditions change. Adjust your strategy as needed by exercising or selling one of the options.

/surging-oil-industry-brings-opportunity-to-rural-california-82038293-596ebd6122fa3a0011329cbe.jpg)

Image: www.thebalance.com

Tips for Effective Option Straddle Trading

- Understand the Risk Involved: Option straddles can have a limited risk, but it’s crucial to be aware of the potential for losses. Only trade with capital you can afford to lose.

- Trade in Low Volatility Markets: While option straddles are designed for high-volatility scenarios, excessive volatility can erode premiums and lead to losses. Opt for markets with moderate to low volatility.

- Consider Hedging Strategies: Option straddles can be combined with other hedging strategies to mitigate risk. For example, selling covered calls against your straddle can reduce the potential for losses.

FAQ on Option Straddles

- Q: What are the risks associated with option straddles?

A: The main risk with option straddles is that the market may not move significantly in either direction, resulting in the expiration of both options worthless. Time decay is another risk that can erode option premiums over time. - Q: When is it appropriate to trade an option straddle?

A: Option straddles are most suitable when you anticipate increased market volatility but are uncertain of the direction of movement. They can also be used as a non-directional way to play an expected earnings announcement or other market event. - Q: How can I minimize losses when trading option straddles?

A: Minimizing losses involves carefully managing your risk by setting a stop-loss order and considering hedging strategies. Proper position sizing and selecting appropriate expiration dates can also help reduce the potential for adverse outcomes.

Trading Option Straddles

Image: chainslab.ghost.io

Conclusion

Option straddles offer a unique approach to trading in volatile markets, allowing traders to potentially profit regardless of the direction of the price movement. By understanding the mechanics of option straddles and applying prudent trading strategies, you can harness the potential and mitigate the risks associated with this versatile financial instrument.

So, are you ready to embrace the exciting realm of option straddle trading? Remember, proper research, prudent risk management, and a clear understanding of the topic are the keys to success.