Delving into the World of Option Greeks

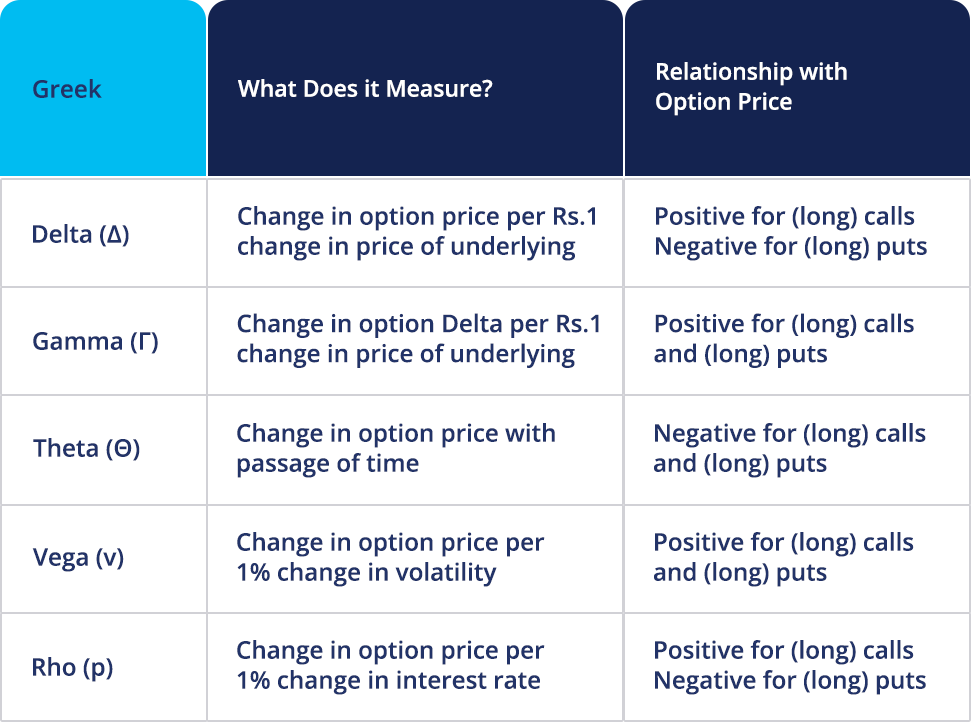

In the dynamic realm of options trading, understanding the concept of option Greeks is paramount. These Greeks are mathematical tools that measure the sensitivity of an option’s price to various factors, such as the underlying asset’s price, volatility, time to expiration, and interest rates. Among these Greeks, time and volatility hold immense significance, and their impact is often discussed in online forums like Reddit, where traders share insights and strategies.

Image: www.paytmmoney.com

Time and Volatility: Shaping Option Prices

Time plays a crucial role in option pricing. As time passes, the premium of an option decays, a process known as theta decay. This decay rate depends on the option’s time to expiration, with shorter-term options experiencing more pronounced theta decay. Volatility, on the other hand, measures the rate at which the underlying asset’s price fluctuates. Higher volatility leads to higher option premiums, as traders are willing to pay more for the potential to profit from larger price swings.

Exploring Vega and Theta Decay

Vega measures the sensitivity of an option’s price to changes in volatility. Higher volatility results in a higher Vega, indicating a greater potential increase in the option’s premium as volatility rises. Theta, in contrast, measures the sensitivity of an option’s price to the passage of time. A higher Theta indicates a greater rate of premium decay as time passes. Understanding these two Greeks allows traders to make informed decisions about option pricing and strategize their trades accordingly.

Analyzing Option Prices on Reddit

Reddit serves as a vibrant online community where option traders connect and share their experiences and strategies. Discussions surrounding time and volatility often take center stage, with traders seeking insights into the impact of these factors on option prices. Through these discussions, traders can gain a deeper understanding of the complexities of option pricing and make more educated trading decisions.

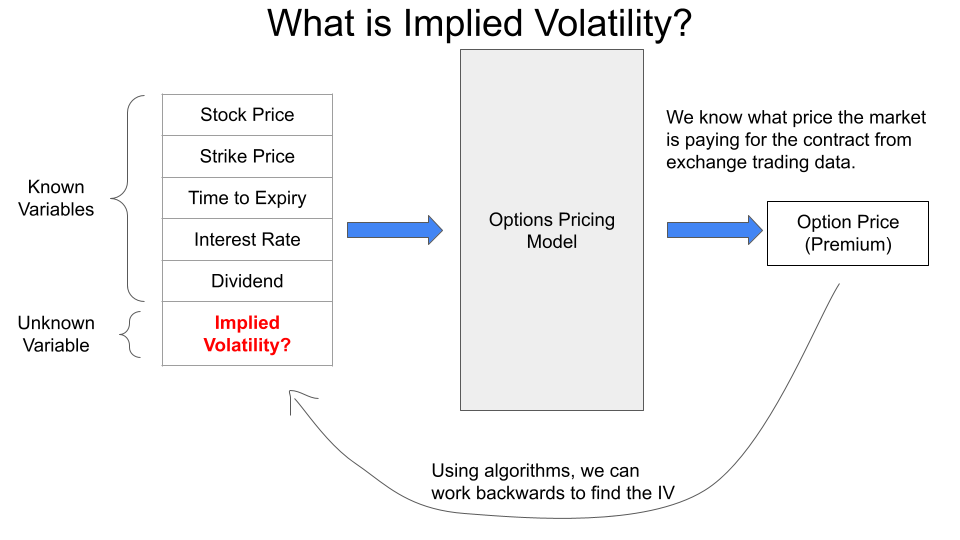

Image: medium.com

Deciphering PDF Documents for Option Greeks Analysis

PDF documents offer a valuable resource for traders seeking a comprehensive understanding of option Greeks. These documents provide detailed explanations of the various Greeks, their formulas, and their practical applications. By carefully studying these materials, traders can improve their grasp of Greek calculation and interpretation, empowering them to make more informed trades.

Tips for Navigating Time and Volatility

- Understand Theta decay: Be aware of the impact of time on option premiums and adjust your trading strategies accordingly.

- Monitor Volatility: Stay abreast of market volatility and identify potential opportunities for volatility-based trading strategies.

- 4.Manage Risk: Utilize risk management techniques, such as stop-loss orders and position sizing, to mitigate potential losses when trading options.

- Seek Expert Guidance: Consult with experienced option traders or financial advisors to gain insights and avoid costly mistakes.

Frequently Asked Questions

Q: How do I calculate Theta?

A: Vega measures the sensitivity of an option’s price to changes in volatility.

Q: What is the formula for Theta?

A:Theta is calculated as – (Premium / (Number of days until expiration)). It is an approximation of the time decay.

Q: How can I use Vega to my advantage?

A: Vega can be used to identify potential opportunities for volatility-based trading strategies.

Q: Are there any resources available to learn more about option Greeks?

A: Yes, numerous online resources, including PDF documents and forums like Reddit, provide valuable information on option Greeks.

Trading Option Greeks How Time Volatility Pdf Reddit

Image: blog.streak.tech

Conclusion: Empowering Option Traders through Knowledge

Understanding the impact of time, volatility, and PDF on option pricing is essential for success in option trading. Traders who possess a thorough grasp of these concepts and leverage resources like Reddit and PDF documents are well-equipped to make informed decisions and navigate the complexities of the options market.

Are you interested in further exploring trading option greeks?