In the vibrant world of options trading, a profound understanding of Option Greeks, particularly time volatility, is paramount for navigating the complexities and unlocking potential profits. These enigmatic variables offer invaluable insights into an option’s behavior and evolution over time, providing traders with a crucial edge in capitalizing on market movements.

Image: www.paytmmoney.com

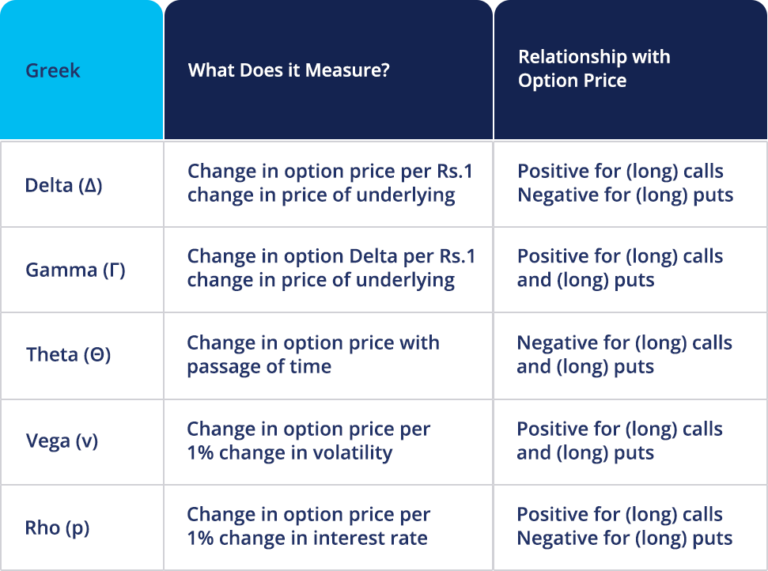

What are Option Greeks?

Option Greeks are parameters that quantify the sensitivity of an option’s value to various factors, including changes in the underlying asset’s price, time, volatility, interest rates, and dividends. By analyzing the Greeks, traders gain an in-depth perspective on how their options will respond to market dynamics, enabling them to make informed decisions and manage risk effectively.

Introducing Time Volatility: A Key Determinant

Among the Option Greeks, time volatility, denoted by the Greek letter “theta,” holds significant sway. It measures the rate at which an option’s value decays over time. As the expiration date approaches, time volatility plays an increasingly vital role, impacting the option’s premium and influencing trading strategies.

Comprehending the Dynamics of Time Volatility

Understanding how time volatility influences options entails examining its effects on call and put options separately. In the case of call options, which grant the holder the right to buy an underlying asset, time volatility plays a positive role. As expiration approaches, the time value of a call option decreases at an increasing rate, offering a tailwind to option holders who have purchased calls with the anticipation of an asset’s price appreciating.

Conversely, for put options, which confer the right to sell an underlying asset, time volatility serves as a countervailing force. As the expiration date draws near, the time value of a put option diminishes at an accelerating pace, favoring option sellers who have sold puts with the expectation of a price decline.

Image: www.tradesviz.com

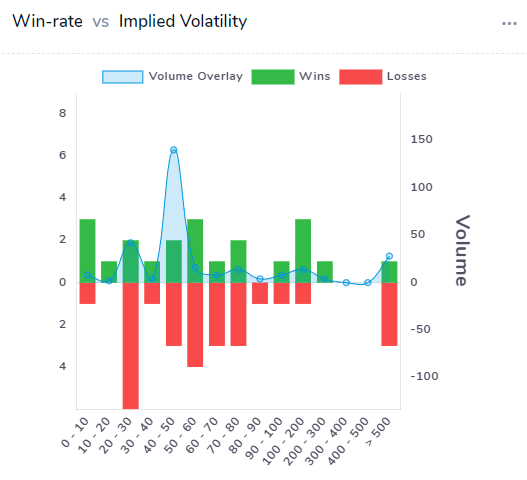

Capturing Market Shifts with Time Volatility

adeptly exploiting time volatility is crucial in options trading. By thoroughly comprehending the decay patterns associated with different option types, traders can time their trades strategically, capitalizing on favorable market conditions and mitigating potential losses.

To illustrate, consider a scenario where an analyst anticipates a swift surge in the price of a certain stock. By purchasing a call option with ample time to expiration, the trader may capture a substantial portion of the stock’s potential appreciation while simultaneously benefiting from the positive effects of time volatility. Conversely, if the anticipated price increase is anticipated to be more gradual, a shorter-term call option with less time to expiration would be more appropriate, allowing the trader to capitalize on the initial upward momentum while mitigating the impact of time decay.

Trading Option Greeks How Time Volatility

Image: www.goodreads.com

Conclusion

Navigating the intricacies of option trading demands a comprehensive understanding of Option Greeks, particularly the omnipresent force of time volatility. By harnessing the power of these metrics, traders can gain profound insights into how their options are positioned to respond to the ebb and flow of the market. Armed with this knowledge, traders can optimize their trading strategies, unlock profit-making opportunities, and more effectively manage their financial endeavors. Embrace the wisdom of Option Greeks and embark on a transformative journey in the world of options trading.