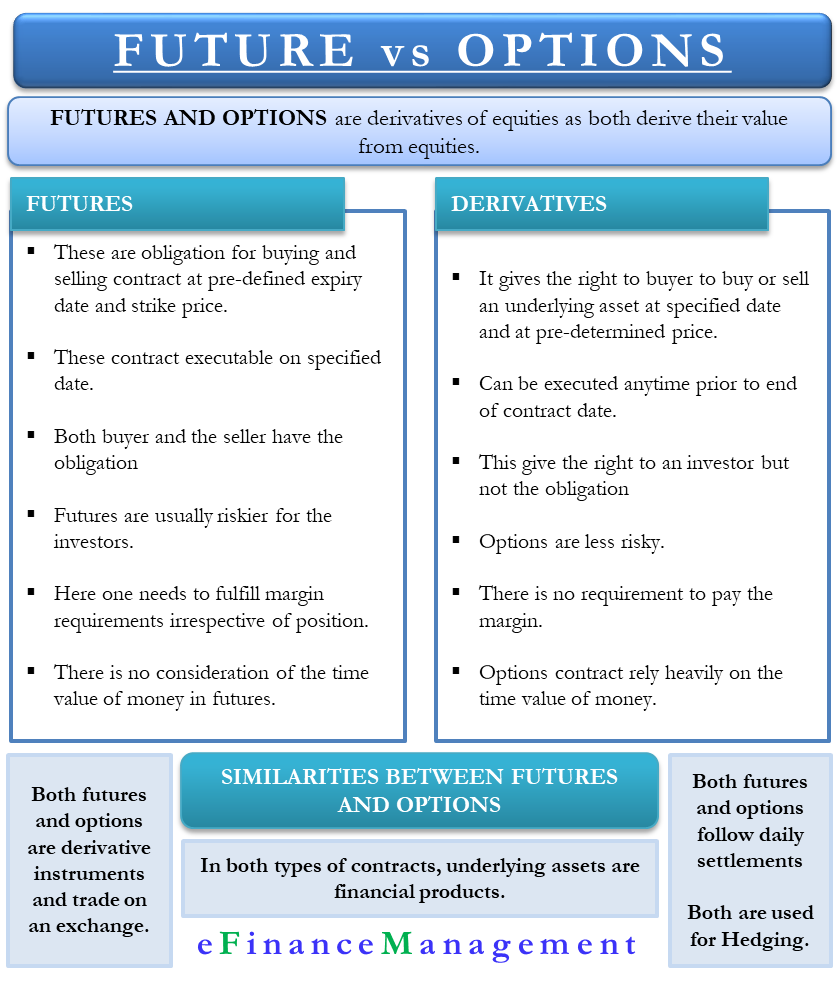

When it comes to trading derivatives, there are two main types to choose from: futures and options. Both offer unique opportunities and risks, so it’s important to understand the differences between them before you start trading.

Image: content.bitazza.com

Futures are standardized contracts that obligate the buyer to purchase a specific amount of an underlying asset at a predetermined price on a future date. In contrast, options give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date.

Key Differences Between Futures and Options

| Feature | Futures | Options |

|---|---|---|

| Contractual obligation | Buyer must purchase the underlying asset | Buyer has the right, but not the obligation, to buy or sell the underlying asset |

| Exercise price | Fixed at the time the contract is entered into | Specified at the time the contract is entered into, but the buyer can choose to exercise or not exercise the option |

| Expiration date | Fixed at the time the contract is entered into | Buyer can choose to exercise the option any time before the expiration date |

| Margin requirements | Typically higher than options | Typically lower than futures |

| Profit potential | Unlimited | Limited to the difference between the strike price and the underlying asset’s price |

| Risk | Higher than options | Lower than futures |

Advantages and Disadvantages of Trading Futures and Options

Futures

Advantages:

- Offer leverage, allowing traders to control a larger amount of the underlying asset with less capital

- Can be used to hedge against risk

- Provide liquidity and transparency

Disadvantages:

- Contractual obligation can lead to losses if the market moves against the trader

- Margin requirements can be high

- Can be complex to trade

Options

Advantages:

- Offer limited risk, as the buyer can choose not to exercise the option if the market moves against them

- Can be used to speculate on the direction of the market

- Provide flexibility, as the buyer can choose when to exercise the option

Disadvantages:

- Profit potential is limited

- Can be difficult to value

- Can be expensive to trade

Which One Should You Trade?

The best type of derivative for you depends on your individual trading goals and risk tolerance. If you are comfortable with taking on more risk and have a thorough understanding of derivatives, then futures may be a good option. However, if you are looking for a more conservative investment with limited risk, then options may be a better choice.

Image: www.quora.com

Trading Futures Versus Options

Image: www.thetechedvocate.org