Navigating the Regulatory Landscape of Options Trading

For many aspiring traders, the alluring world of options beckons with the promise of lucrative returns and the exhilaration of leveraged trading. However, before embarking on this financial adventure, it is essential to understand the regulatory landscape governing options trading. Specifically, one crucial question arises: Do you need a license to trade options?

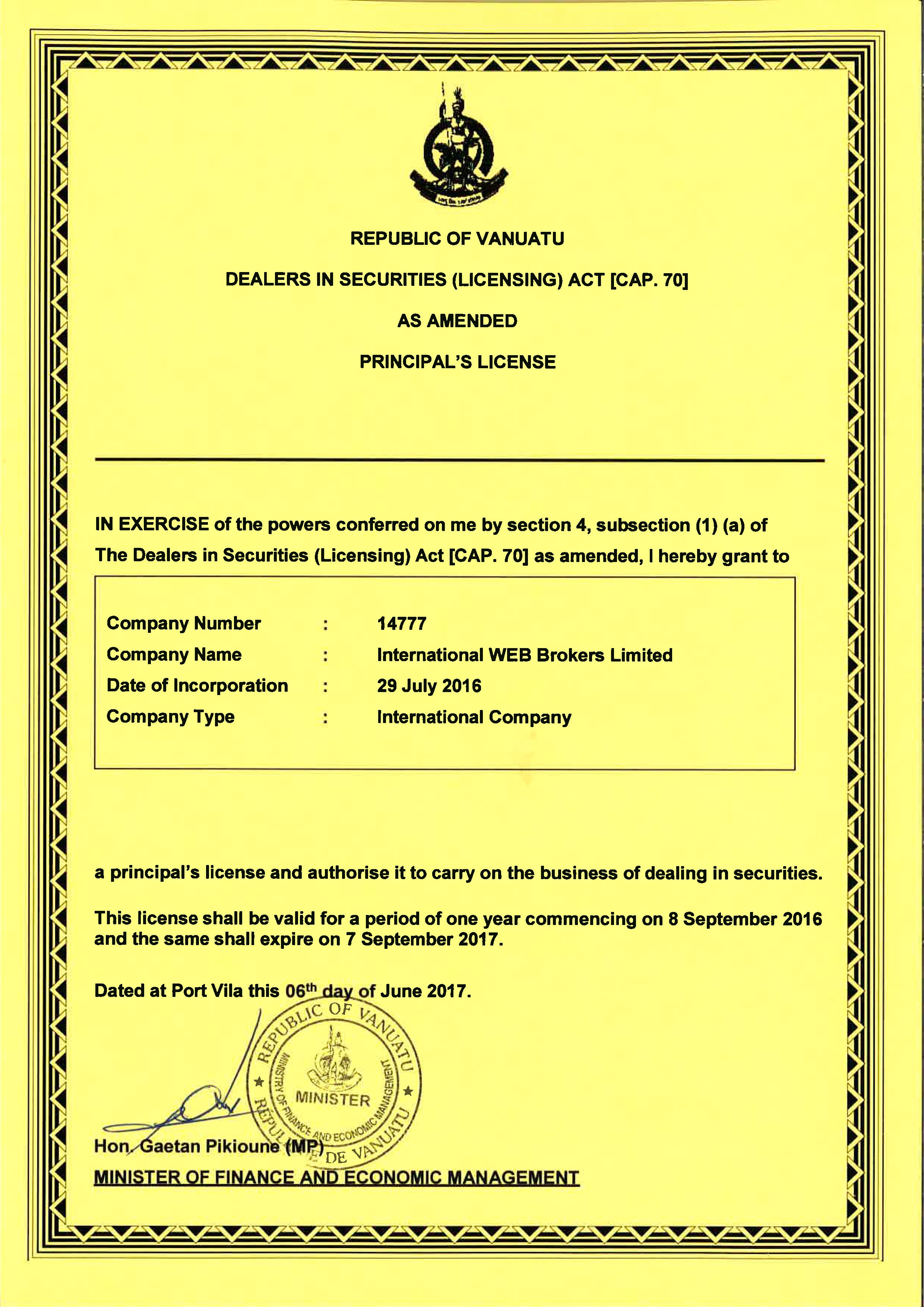

Image: everest.trade

The Regulatory Mandate: Navigating FINRA’s Requirements

In the United States, options trading falls under the purview of the Financial Industry Regulatory Authority (FINRA). This self-regulatory organization, established in 2007, oversees the activities of broker-dealers and investment banks, ensuring market integrity and investor protection. As such, FINRA mandates that all individuals seeking to engage in options trading must:

- Be associated with a registered broker-dealer: Traders must have an account with a broker-dealer that has been approved by FINRA and meets specific regulatory requirements.

- Pass FINRA’s Series 7 Exam: This rigorous examination covers the fundamentals of options trading, including the characteristics, risks, and strategies involved.

These requirements are designed to ensure that traders possess a comprehensive understanding of the complexities and risks associated with options trading. By fulfilling these regulatory mandates, traders gain access to the markets and demonstrate their competence in managing these sophisticated financial instruments.

The Series 7 Exam: Unlocking the Gateway to Options Trading

The FINRA Series 7 examination, commonly known as the “General Securities Representative Exam,” is the gateway to professional options trading. This comprehensive exam encompasses a vast curriculum, including:

- Types, characteristics, and valuation of options contracts

- Risk management principles and hedging strategies

- Regulatory framework governing options trading

- Customer suitability and fiduciary responsibilities

Passing the Series 7 Exam requires diligent preparation and a thorough understanding of these complex concepts. Traders can enroll in preparatory courses offered by various institutions or independently study using study materials and online resources. Passing this exam not only unlocks the opportunity to trade options but also demonstrates a high level of professionalism and competence in the financial industry.

Expert Insights: Navigating the Options Market with Confidence

Navigating the options market requires a blend of knowledge, experience, and expert advice. Here are a few tips to help you succeed:

- Conduct thorough research: Stay informed about market trends, economic news, and industry developments that can impact option prices.

- Understand risk management: Determine your risk tolerance and develop a strategy to mitigate potential losses.

- Seek guidance from a financial advisor: Consider working with a qualified financial advisor who can provide tailored advice and guidance based on your individual circumstances.

By following these expert insights, you can increase your understanding of options trading, participate in the market with confidence, and make informed decisions that align with your financial goals.

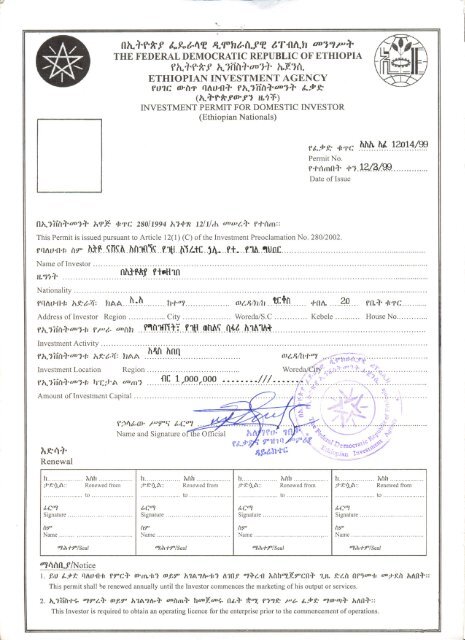

Image: www.yumpu.com

Frequently Asked Questions on Options Trading Licensing

Q: Can I trade options without a Series 7 license?

A: No, FINRA requires individuals to pass the Series 7 Exam to engage in options trading.

Q: What are the prerequisites for taking the Series 7 Exam?

A: Typically, candidates must be at least 18 years of age, have a high school diploma or equivalent, and be sponsored by a registered broker-dealer.

Q: Is there a time limit to complete the Series 7 Exam?

A: Yes, candidates have 6 hours to complete the exam and pass with a score of 72% or higher.

Q: Do I need to renew my Series 7 license?

A: Yes, Series 7 licenses must be renewed every three years through continuing education and professional development.

To Trading Options Do You Need License

Image: www.hackersforcharity.org

Conclusion: Embracing Options Trading with Knowledge and Compliance

The world of options trading offers immense potential for financial growth, but it also demands a deep understanding of the underlying complexities and regulatory requirements. By obtaining the necessary license and embracing the principles of risk management, traders can navigate the options market with confidence and unlock the opportunities it presents.

Are you eager to explore the realm of options trading? Let this article serve as your guide, providing you with the knowledge and insights to make informed decisions and succeed in this dynamic financial arena.