Title: Master the Art of Tax Calculator Options Trading: A Guide to Unlocking Profits

Image: exceljet.net

Introduction:

In today’s complex financial landscape, options trading has emerged as a powerful tool for investors seeking higher returns. However, navigating the intricate world of options can be daunting, especially when it comes to factoring in taxes. Enter tax calculator options trading – an invaluable tool that simplifies the process, empowering you to make informed decisions that maximize your earnings.

Join us as we embark on a journey into the realm of tax calculator options trading. Together, we will unravel its significance, delve into its intricacies, and uncover expert insights that will guide you towards financial success.

Understanding tax calculator options trading

Options are financial contracts that grant you the right, but not the obligation, to buy (in the case of calls) or sell (in the case of puts) an underlying security at a specific price on or before a certain date. While options offer the potential for significant gains, they also carry the risk of losses.

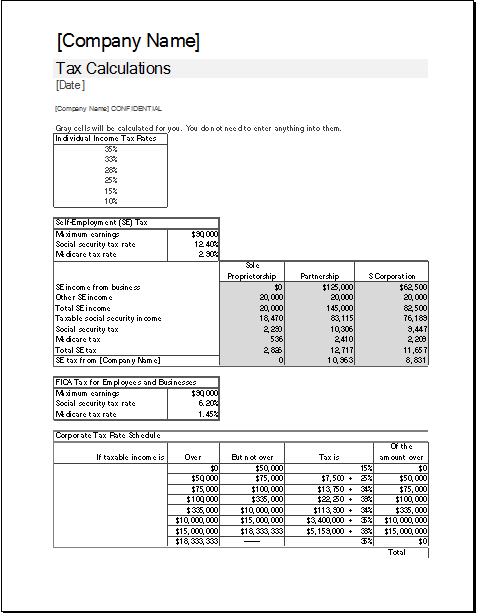

Tax calculator options trading simplifies the process of estimating the tax implications of options trades. It enables you to input the necessary details, such as the option’s type, strike price, expiration date, and underlying security, to generate a comprehensive breakdown of your potential tax liability.

Benefits of tax calculator options trading

-

Informed decision-making: By understanding the tax consequences of your trades, you can make more informed decisions that align with your financial goals and risk tolerance.

-

Tax optimization: Tax calculator options trading helps you identify strategies that can minimize your tax liability. This can lead to substantial savings over time, enhancing your overall returns.

-

Compliance assurance: Ensuring that your options trades are tax-compliant is crucial. Tax calculator options trading provides you with the peace of mind that your taxes are being handled accurately and efficiently.

Expert Insights and Practical Tips

-

Seek guidance from a financial advisor: A qualified financial advisor can provide personalized advice tailored to your unique situation, helping you navigate the nuances of tax calculator options trading.

-

Stay updated on tax laws: Tax laws related to options trading are subject to change. Staying informed about the latest updates is essential to ensure your tax strategies remain effective.

-

Keep meticulous records: Maintaining accurate records of your options trades is not only important for tax purposes but also for tracking your performance and making future decisions.

Conclusion

Tax calculator options trading is an indispensable tool for anyone looking to maximize their earnings from options trading. By understanding its significance, implementing practical tips, and accessing expert insights, you can unlock the full potential of this powerful strategy. Remember, while financial success is not without its complexities, being well-informed and prepared is the key to making informed decisions that drive your wealth towards its full potential.

Image: www.xltemplates.org

Tax Calculator Options Trading

Image: bitcourier.co.uk