Trading options contracts can be an intricate arena, and navigating the tax implications is crucial to maximizing your financial returns. Enter the options trading calculator, an indispensable tool that empowers you to accurately determine your tax obligations and make informed decisions. In this comprehensive guide, we will delve into the world of options trading taxes, deciphering the complexities and equipping you with expert knowledge.

Image: luckysufyaan.blogspot.com

Demystifying Options Trading Taxes

Options trading revolves around the buying and selling of contracts that confer the right, not the obligation, to buy (call option) or sell (put option) an underlying asset like stocks or currencies at a predetermined price and date. Tax laws impose varying treatment on these transactions depending on whether they result in a gain or loss. Understanding these nuances is vital for calculating your tax liability accurately.

Taxes on Gains from Options Trading

When you sell an options contract for a profit, the proceeds are subject to taxation. Short-term gains, realized when the contract is held for less than a year, are taxed at ordinary income rates, while long-term gains, resulting from holding the contract for a year or more, qualify for lower capital gains rates.

Taxes on Losses from Options Trading

If you sell an options contract at a loss, it can be used to offset your capital gains. Short-term losses can be deducted against ordinary income, while long-term losses are deducted against capital gains. If your realized losses exceed your realized gains, you can carry them over to subsequent tax years to offset future gains.

Image: www.trickyfinance.com

The Power of an Options Trading Calculator

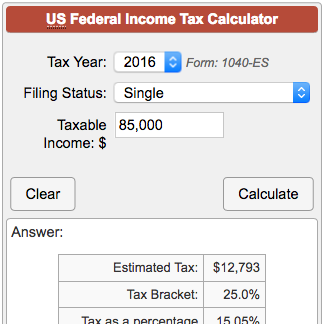

An options trading calculator serves as a valuable tool that simplifies the calculation of tax liabilities associated with options trading. By inputting essential details such as contract type, expiration date, purchase price, sale price, and any commissions incurred, the calculator generates a detailed estimate of your tax implications. This information empowers you to:

- Project your tax liability accurately and avoid any surprises during tax season.

- Optimize your trading strategies by accounting for tax implications.

- Track your capital gains and losses effectively for tax reporting purposes.

- Make informed decisions on when to sell or hold an options contract based on tax considerations.

Enriching Your Financial Lexicon: Key Concepts

To fully grasp the intricacies of options trading taxes, it’s essential to familiarize yourself with some fundamental terms:

- Basis: The cost of acquiring the options contract, including the purchase price and any commissions.

- Expiration Date: The date on which the options contract expires and becomes void.

- Strike Price: The predetermined price at which the underlying asset can be bought (call option) or sold (put option).

- Wash Sale Rule: A tax regulation that prohibits claiming a loss on an options contract if a substantially identical contract is purchased within 30 days before or after the sale.

Harnessing the Options Trading Calculator

Using an options trading calculator is a straightforward process that requires meticulous input of relevant information. Here’s a step-by-step guide:

- Gather essential data: Collate details like contract type, expiration date, purchase price, sale price, and commissions incurred.

- Select the appropriate calculator: Choose a calculator specifically designed for options trading taxes.

- Input contract information: Enter the details you have gathered into the designated fields.

- Generate the calculation: Click on the “Calculate” button to generate your estimated tax liability.

The calculator will provide a detailed breakdown of your taxes, including ordinary income tax, capital gains tax, and any applicable deductions. This information can then be used to make informed trading decisions and plan your tax strategy effectively.

Taxes On Options Trading Calculator

Image: warsoption.com

Conclusion

Mastering the complexities of options trading taxes is essential for optimizing your financial returns and avoiding costly mistakes. By employing the power of an options trading calculator and gaining a thorough understanding of the key concepts involved, you can confidently navigate the intricate landscape of options trading and make informed decisions that maximize your financial well-being. Embrace the knowledge provided in this guide and elevate your options trading strategies to new heights of efficiency and success.