Navigating the intricacies of option trading demands a discerning eye for market trends. As an experienced trader, I’ll guide you through the labyrinth of moving averages to unveil which one reigns supreme in the realm of option strategies.

Image: excellenceassured.com

A moving average (MA) is a vital technical indicator that gauges price movement by calculating the average of a particular period of time. Traders deploy MAs to identify support and resistance levels, visualize trends, and time their entries and exits.

The Battle of the Moving Averages

In the arena of option trading, two MAs emerge as contenders: the simple moving average (SMA) and the exponential moving average (EMA). Both methodologies possess distinct characteristics, catering to different trading styles and market conditions.

The SMA computes the average of closing prices over a specified period, extending equal weightage to each data point. Its simplicity and ease of interpretation make it a popular choice among traders. In contrast, the EMA assigns greater significance to recent price action by exponentially weighting the closing prices, effectively reacting more swiftly to market fluctuations.

Choosing the Champion

While both MAs have their merits, selecting the optimal one hinges on the trader’s objectives and trading style. For traders seeking a smoother, trailing average that highlights longer-term trends, the SMA offers a reliable solution. Conversely, the EMA’s responsiveness to recent price action makes it ideal for traders seeking to exploit shorter-term market movements.

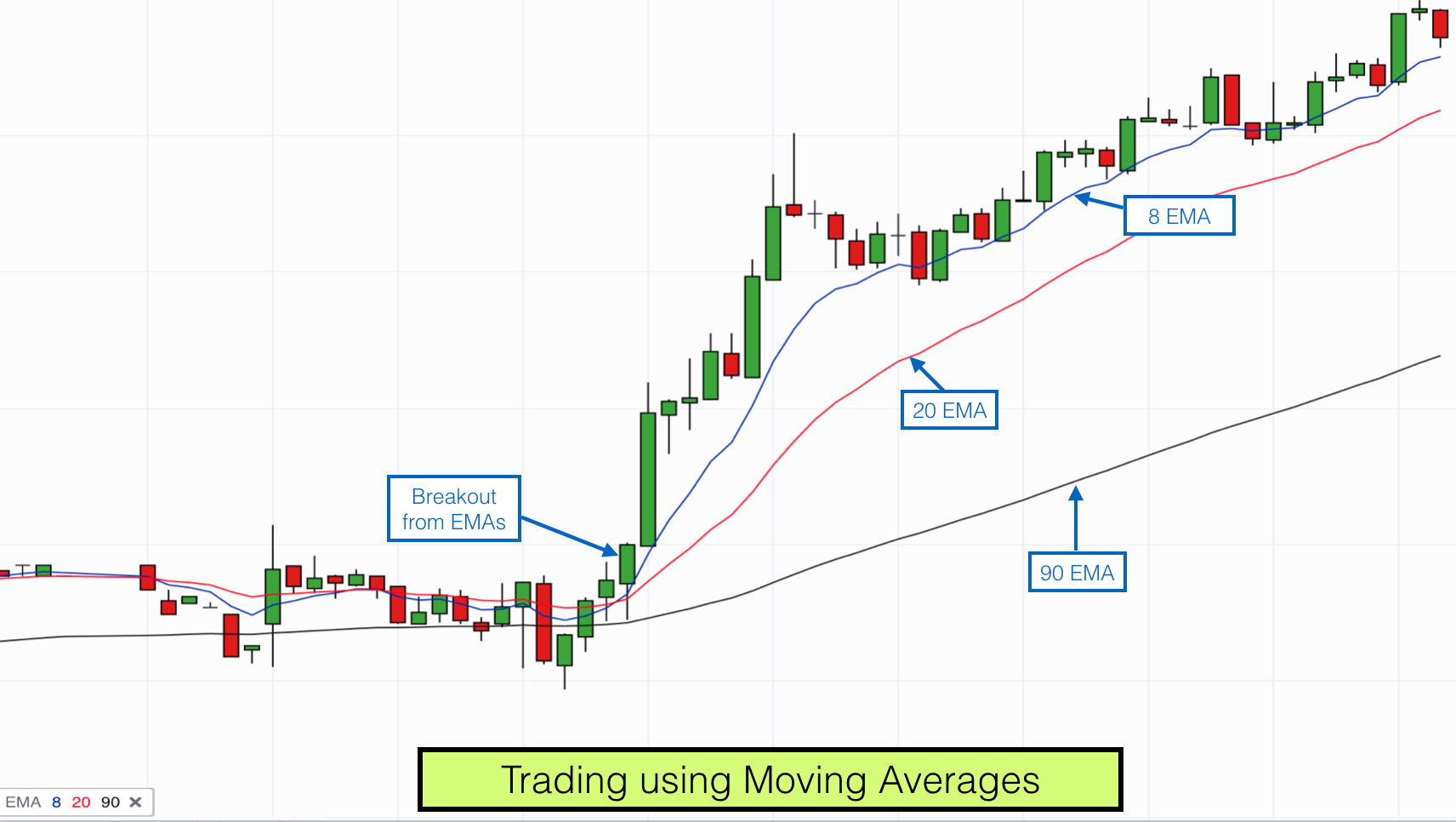

Seasoned traders often combine multiple MAs to gain a comprehensive perspective of market behavior. By incorporating different time frames and MA types, traders can extract valuable insights, refine their trading strategies, and maximize their profit potential.

Tips from the Trading Trenches

Having tested numerous MAs in diverse market conditions, I’ve honed a few expert recommendations to enhance your option trading prowess:

- Determine the Trading Time Frame: Define the appropriate time frame for your trading strategy. Scalpers and day traders may opt for shorter-term MAs, while swing traders and long-term investors should consider longer-term MAs.

- Consider the Market Volatility: The volatility of the underlying asset plays a pivotal role in selecting the right MA. In fast-moving, highly volatile markets, faster-reacting MAs like the EMA become more valuable.

- Experiment and Adapt: The optimal MA may vary depending on the market conditions, strategy, and individual trader preferences. Don’t hesitate to experiment with different MAs and adjust your strategies accordingly.

Image: www.tradingwithrayner.com

FAQ on Moving Averages

Q: Which MA is the most accurate?

A: Accuracy is subjective, as different MAs are designed for specific purposes and market conditions.

Q: What is the best time frame for using moving averages?

A: The optimal time frame depends on the trading style and strategy, ranging from short-term (10-50 day) to long-term (200-day) MAs.

Q: How do I optimize my MA settings?

A: Experiment with different MA types and time frames to find the combination that best suits your trading style and the market conditions.

Which Moving Average Is Best For Option Trading

Conclusion

Unearthing the optimal moving average for option trading empowers traders with a potent tool to dissect market trends and optimize their trading decisions. Whether you prefer the steady pace of the SMA or the swift response of the EMA, leveraging the insights provided in this article will guide you towards selecting the MA that aligns perfectly with your trading objectives.

Interested in further exploring the intricacies of moving averages in option trading? Join our exclusive community, where seasoned traders share their insights and strategies, empowering you to elevate your trading game.