In the ever-evolving financial landscape, understanding options trading is paramount. As a seasoned investor, I vividly recall my initial foray into qtrade options trading. The intricate world of options may seem daunting, but through my journey, I’ve discovered its immense potential.

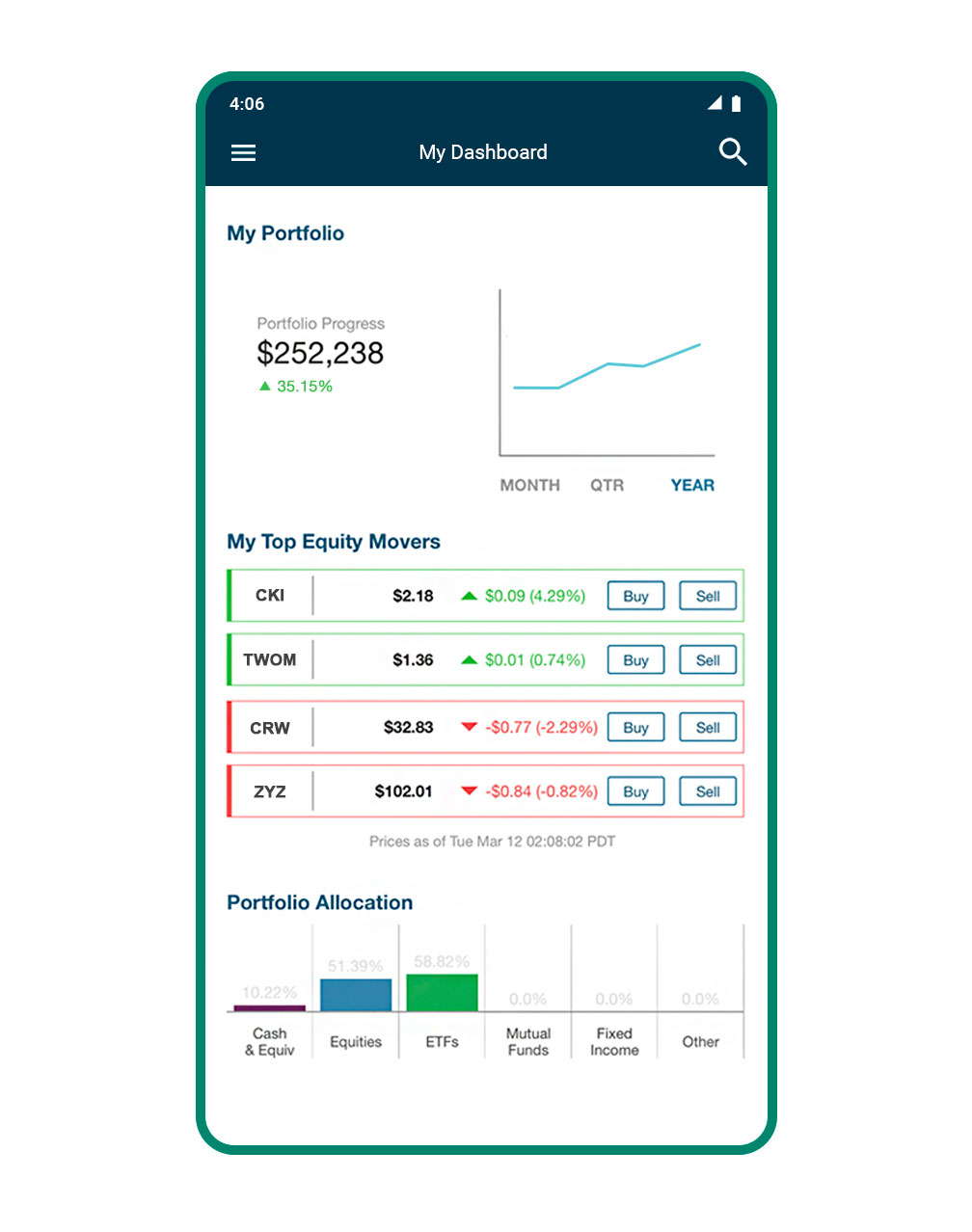

Image: www.qtrade.ca

With qtrade, a reputable trading platform, navigating the complexities of options trading becomes accessible. This guide will embark on a detailed exploration of qtrade options trading, shedding light on its history, intricacies, and the latest trends shaping its trajectory.

Comprehending the Essence of qtrade Options Trading

Options trading, simply put, involves contracts that grant the holder the right, not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) by a specific expiry date. This dynamic instrument empowers traders to speculate on the future behavior of an asset, leveraging potential market fluctuations to their advantage.

qtrade stands out as a preferred platform for options trading, offering a comprehensive suite of features that cater to both seasoned professionals and budding investors. Its user-friendly interface, advanced charting tools, and educational resources provide a supportive environment for traders to navigate the intricate world of options.

Demystifying the Dynamics of qtrade Options Trading

The complexities of options trading stem from the interplay of various factors. Let’s break down the key elements involved:

- Expiration Date: The date by which the option contract must be exercised or sold.

- Strike Price: The price at which the underlying asset can be bought (call) or sold (put) if the option is exercised.

- Option Premium: The price paid upfront to acquire the right to buy or sell the underlying asset at a future date and price.

- Call Option: Grants the holder the right to buy the underlying asset at the strike price.

- Put Option: Grants the holder the right to sell the underlying asset at the strike price.

Navigating the Latest Trends in qtrade Options Trading

The realm of options trading is constantly evolving, fueled by technological advancements and shifting market dynamics. Here’s a glimpse into the latest trends:

- Increased Automation: Sophisticated algorithms and trading bots are streamlining decision-making, enabling traders to respond swiftly to market changes.

- Social Trading Platforms: These platforms harness the collective intelligence of traders, facilitating knowledge sharing and collaboration.

- Enhanced Regulation: Regulatory frameworks are evolving to ensure market stability and protect investors.

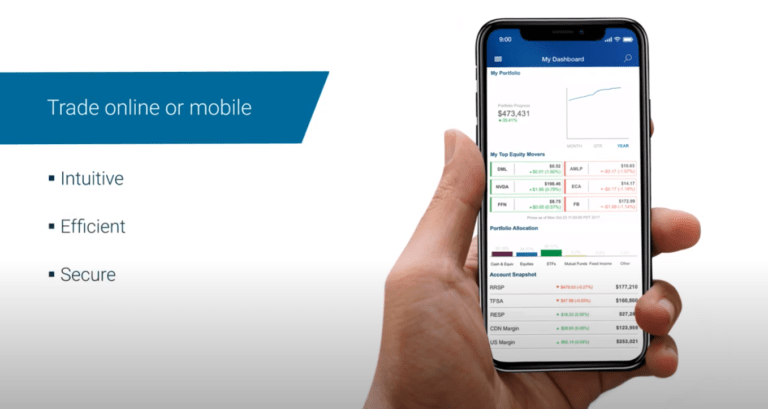

Image: milliondollarjourney.com

Unveiling Expert Advice for Successful qtrade Options Trading

To navigate the complexities of qtrade options trading effectively, it’s wise to heed the wisdom of experienced traders:

- Educate Yourself: Dive deep into the fundamentals of options trading before placing your first trade.

- Start with Paper Trading: Practice trading in a virtual environment to refine your strategies without risking real capital.

- Manage Your Risk: Never invest more than you can afford to lose. Diversify your portfolio and employ sound risk management techniques.

- Follow Market News: Monitor economic indicators, company reports, and industry trends to gauge the potential impact on underlying assets.

Decoding the FAQs of qtrade Options Trading

To dispel any lingering queries, let’s address some frequently asked questions:

- Q: What is the difference between a call and a put option?

A: A call option grants the right to buy, while a put option grants the right to sell the underlying asset.

- Q: Can I lose more money than the premium I paid?

A: Yes, if the underlying asset moves significantly against the option’s intended position, resulting in the option expiring worthless.

- Q: How do I calculate the potential profit of an option trade?

A: By subtracting the option premium from the difference between the underlying asset’s market price and the strike price.

Qtrade Options Trading

Embracing the Future of qtrade Options Trading

The advent of cutting-edge technologies, coupled with the increasing popularity of options trading, points to a promising future for qtrade. As the market evolves, traders will undoubtedly uncover new opportunities and challenges, making it imperative to stay informed and adapt accordingly.

To conclude, qtrade options trading offers a powerful vehicle for sophisticated financial maneuvers. By understanding its fundamentals, keeping abreast of the latest trends, and implementing sound strategies, traders can harness its potential and embark on a lucrative trading journey. Are you ready to delve into the thrilling realm of qtrade options trading?