Are you intrigued by the possibilities of call option trading but find it a bit bewildering? Don’t worry, you’re not alone. In fact, many aspiring investors contemplate the intricacies of call options, wondering how to harness their potential. This comprehensive guide, written in an engaging and easy-to-grasp style, will walk you through the basics of call option trading, empowering you with knowledge and elucidating the path to savvy investing.

Image: fity.club

Delving into Call Options: A Simple Explanation

A call option is a financial contract that grants you the right, but not the obligation, to buy a specific underlying asset at a predetermined price, termed the strike price, by a specified future date, known as the expiration date. Instead of committing to purchase the asset outright, a call option offers you the flexibility to potentially profit from a rise in its value.

Consider this scenario: You fancy the future prospects of a tech stock currently trading at $100. Employing a call option, you can establish the right to purchase this stock at $110 within the next three months. If the stock’s price surges beyond $110 during this period, you’re at liberty to exercise your call option, purchasing the stock at the agreed-upon price and potentially profiting from the difference. Conversely, if the stock’s price languishes below $110, you simply let the option expire, forfeiting your initial investment but limiting your losses.

Navigating the Dynamics of Call Option Trading

Understanding the dynamics of call option trading is crucial to maximizing your chances of success. Several factors synergistically influence the price of a call option, including:

-

Price Fluctuations of the Underlying Asset: Predictably, the value of a call option waxes and wanes with the price of the underlying asset. A stock’s price appreciation enhances the option’s value, whereas a price decline diminishes it.

-

Time Decay: Time is an inexorable force that erodes the value of a call option. As the expiration date approaches, the option’s value dwindles, primarily because there’s less time for the underlying asset’s price to rise above the strike price.

-

Volatility: Market volatility, often measured by metrics like implied volatility, exerts a significant impact on call option prices. Higher volatility translates into costlier options, since it increases the likelihood of the underlying asset experiencing large price swings.

-

Interest Rates: Interest rates can indirectly affect call option prices. Higher interest rates tend to curtail option prices, particularly long-term options. This is because investors can earn a greater return on risk-free investments, thus reducing their appetite for riskier options.

Real-Life Case Studies: Unraveling Call Option Trading Strategies

Let’s delve into a couple of real-life call option trading examples to solidify your understanding:

Image: www.call-options.com

Scenario 1: Riding the Bull Market with Call Options

Envision a scenario where you anticipate a thriving bull market. Armed with conviction and a desire for leverage, you embark on a call option strategy. You purchase a call option with a strike price of $50 for a stock currently trading at $45, giving you the right to purchase the stock at $50 within the next six months. If the stock’s price soars to $60, you can exercise your option, purchasing the stock at $50 and pocketing a profit of $10 per share. This strategy allows you to amplify your gains in a favorable market environment.

Scenario 2: Hedging against Risk with Call Options

Consider a seasoned investor who meticulously safeguards their portfolio against potential downturns. They own a substantial stake in a particular stock that has been on a remarkable bull run but now shows signs of vulnerability. To mitigate potential losses, they purchase a call option with a strike price just below the current stock price, giving them the right to buy more shares at a specific price. If the stock’s price nosedives, the investor can exercise their call option to acquire additional shares at a discounted price, shoring up their portfolio against significant losses.

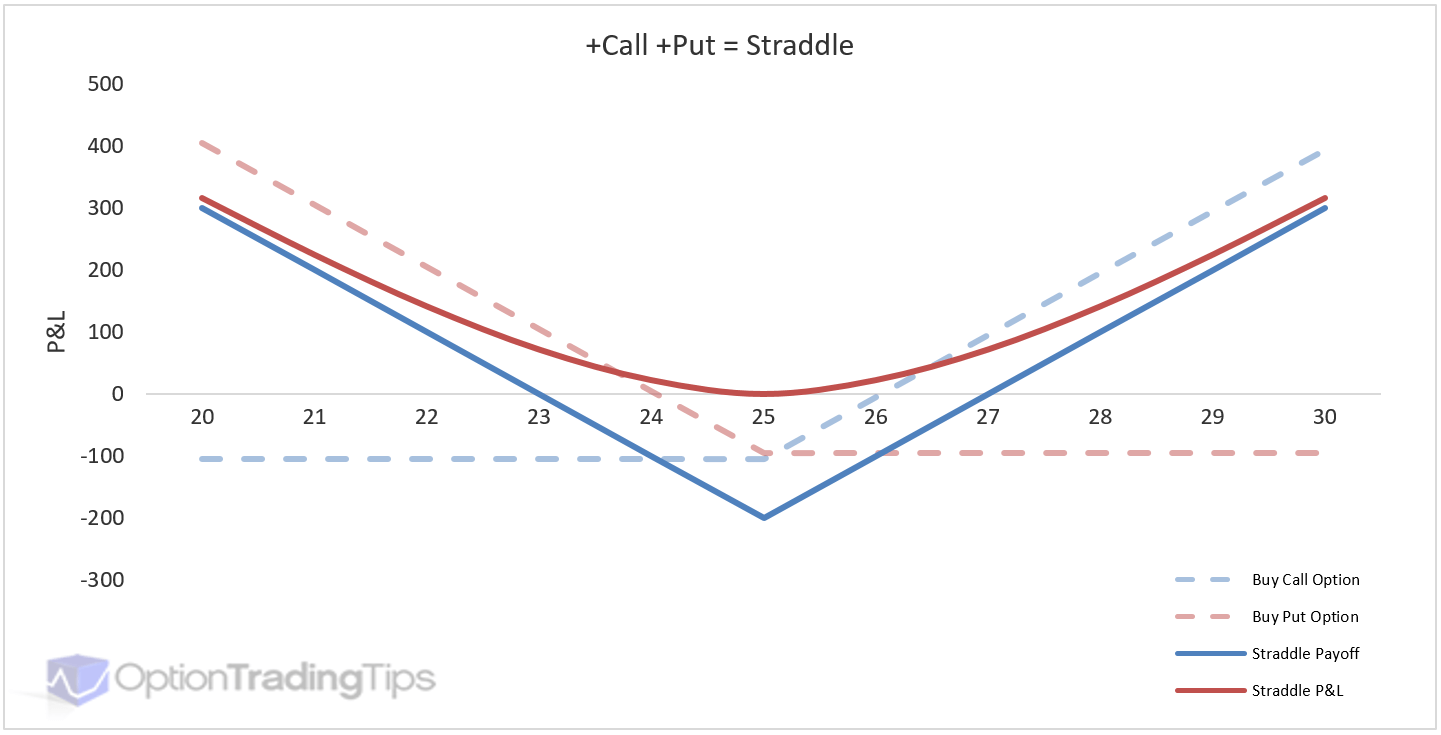

Call Option Trading Example

Conclusion: Embracing the Power of Call Options

Call option trading presents a dynamic and rewarding avenue to profit from rising markets or shield your investments against downturns. Recognizing the potential pitfalls and nuances of call option trading is pivotal to effective decision-making. Implement your strategies confidently, trail the performance, and refine your approach over time. Embracing call options can empower you to navigate market fluctuations with finesse, amplifying your investment prowess.