Trading in futures and options contracts offers the tantalizing prospect of quick profits and the allure of multiplying wealth. Yet, beneath the veneer of potential rewards lies a labyrinth of risks that can ensnare the unwary. For those considering venturing into this arena, it is imperative to fully grasp the potential disadvantages lurking in the shadows.

Image: www.slideserve.com

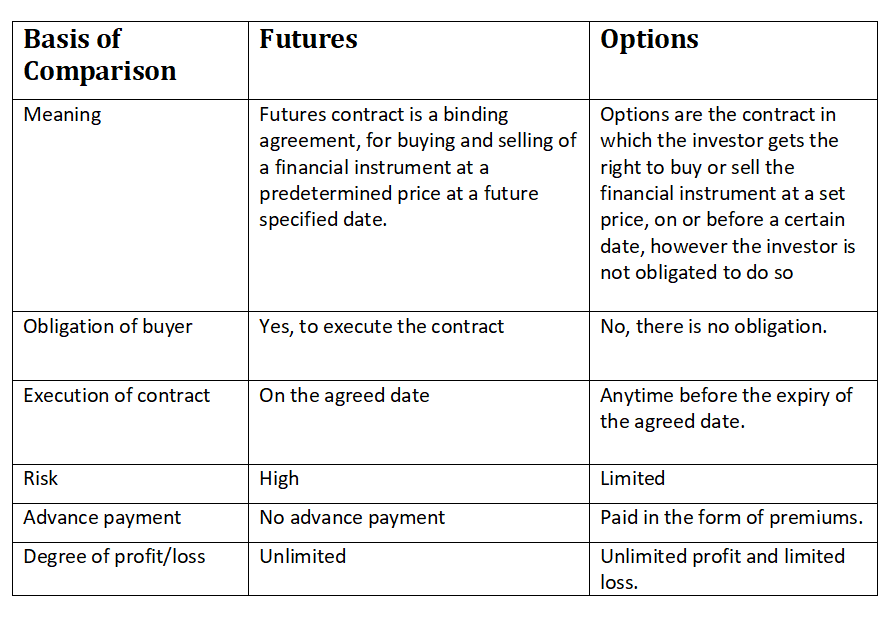

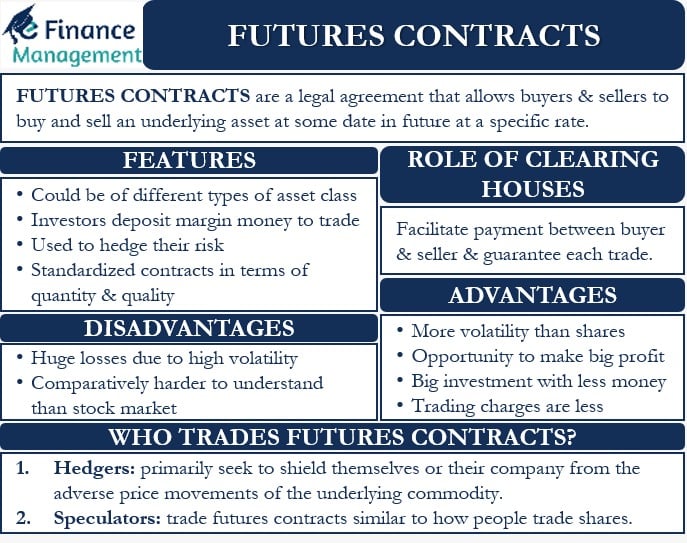

Futures and options are sophisticated financial instruments that carry a complex web of intricacies. These contracts provide the capability to speculate on the future prices of commodities, currencies, or stocks. However, this speculative nature transforms trading into a double-edged sword: it can amplify both profits and losses.

Unveiling the Disadvantages

1. Market Volatility: Taming the Unpredictable Beast

Futures and options trading are extraordinarily sensitive to market fluctuations. Prices can oscillate rapidly and unpredictably, subjecting traders to the whims of market volatility. Even seasoned traders can find themselves at the mercy of these capricious swings, rendering even the most well-conceived strategies vulnerable.

2. Margin Calls: The Sword of Damocles

Margin trading, a common practice in futures and options markets, magnifies the potential profits while concurrently amplifying the risks. Margin calls occur when account balances dip below the required threshold, obligating traders to deposit additional funds or face the liquidation of their positions. These margin calls can trigger a cascade effect, leading to catastrophic losses.

Image: www.5paisa.com

3. Leverage: A Double-Edged Sword

Leverage, the ability to control a larger position with a smaller investment, acts as a siren’s call for traders. While leverage can bolster profits, it magnifies losses with equal ferocity. Uncontrolled leverage poses a significant threat, capable of amplifying losses beyond the trader’s initial investment.

4. Time Decay: The Silent Thief

Options contracts have a finite lifespan, which introduces the insidious concept of time decay. As the expiration date nears, the value of options contracts inexorably dwindles. This time decay relentlessly erodes the value of the contracts, irrespective of whether the underlying asset price appreciates.

5. Counterparty Risk: Trusting the Unknown

In futures and options trading, the counterparty assumes the obligation to fulfill the contract. However, counterparty risk arises when one party fails to meet its commitments. Counterparty risk magnifies when trading in less regulated markets or with untrustworthy entities.

Navigating the Risks

While the disadvantages of trading in futures and options are substantial, they are not insurmountable. Prudent traders can mitigate these risks by adhering to sound trading practices.

First, embrace the principle of risk management. Set realistic profit targets, establish clear stop-loss levels, and strictly adhere to a risk-averse trading plan.

Secondly, avoid overleveraging. As tempting as it may seem, excessive leverage can amplify losses beyond control.

Finally, continuous education is the cornerstone of successful trading. Stay informed about market trends, study trading strategies, and seek guidance from experienced professionals.

Disadvantages Of Trading In Futures And Options

Image: derivbinary.com

Conclusion

Futures and options trading presents an enigmatic realm of opportunities and risks. Embracing this speculative world demands a profound understanding of its complexities and perils. By being fully aware of the disadvantages that lie in wait, traders can approach these markets with a healthy dose of caution, mitigate risks, and enhance their chances of success.