Navigating the World of Options Trading with Confidence

In the fast-paced world of finance, options trading has emerged as a powerful tool for investors seeking enhanced returns and risk management. With the advent of advanced option trading platforms, accessing this dynamic market has become more accessible than ever. In this comprehensive guide, we will delve into the nuances of option trading platforms, empowering you to make informed decisions and maximize your trading potential.

Image: www.btcc.com

Unlocking the Potential of Option Trading Platforms

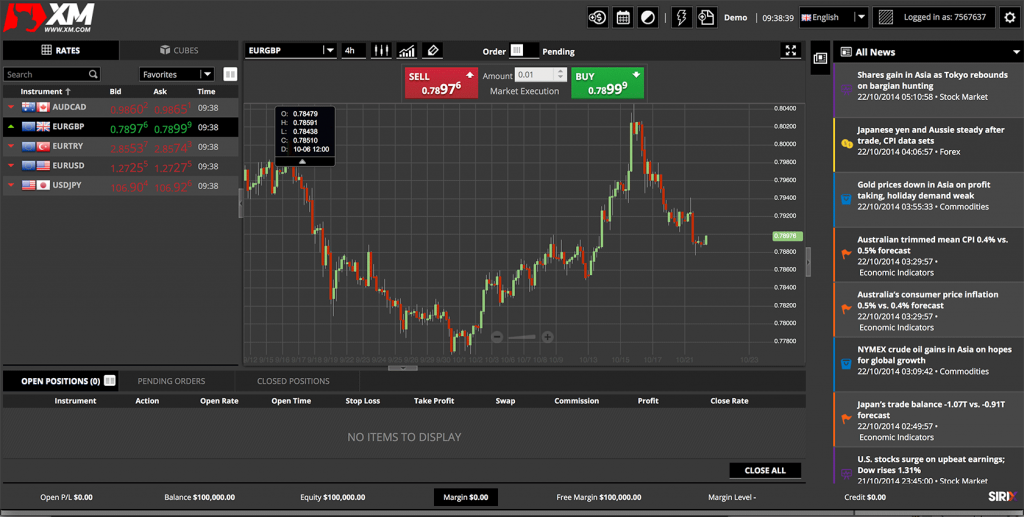

Option trading platforms are purpose-built software applications designed to streamline the process of options trading. These platforms provide a comprehensive suite of features and tools that empower traders to analyze markets, evaluate options contracts, and execute trades with precision.

Through real-time data feeds, charting capabilities, and advanced analytics, option trading platforms provide a comprehensive view of the market landscape. Traders can access historical data, study price patterns, and identify trading opportunities with enhanced clarity and confidence. Furthermore, these platforms facilitate efficient order placement and management, enabling traders to execute their strategies swiftly and seamlessly.

A Comprehensive Overview of the Option Trading Market

Understanding Options and their Significance

Options are financial contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. They derive their value from the underlying asset’s price movements and market volatility. Options can be used for a wide range of strategies, including speculation, hedging, and income generation.

Image: www.the-pool.com

Exploring the Types of Option Trading Platforms

A diverse range of option trading platforms is available, each catering to specific trading styles and preferences. Desktop platforms offer advanced functionality, while mobile platforms prioritize convenience and accessibility. Web-based platforms provide a balance between features and ease of use. Research and compare various platforms to identify the one that best aligns with your trading needs and preferences.

Choosing the Ideal Platform for Your Trading Needs

Selecting the right option trading platform is crucial for maximizing your trading potential. Consider the following factors when making your choice:

- Functionality: Determine the platform’s suite of features and tools, ensuring it meets your trading requirements.

- User Interface: The platform’s user interface should be intuitive, allowing you to navigate and execute trades effortlessly.

- Support: Reliable technical support is essential for resolving queries and troubleshooting issues promptly.

- Cost: Compare the subscription fees and commissions associated with different platforms to find one that provides value for money.

Expert Advice on Optimizing Your Option Trading Strategy

Mastering option trading requires a combination of knowledge, experience, and effective strategies. Leverage the following expert advice to enhance your trading performance:

- Conduct Thorough Research: Understand the underlying asset, its market dynamics, and the potential risks and rewards involved.

- Manage Risk Effectively: Employ stop-loss orders and position sizing techniques to mitigate potential losses.

- Employ Technical Analysis: Study price charts and identify patterns to make informed trading decisions.

- Leverage Fundamental Analysis: Consider the underlying asset’s financial health, industry trends, and economic factors.

- Control Your Emotions: Practice discipline and avoid impulsive trading decisions based on emotions.

Frequently Asked Questions about Option Trading Platforms

Is it necessary to use an option trading platform?

While it is possible to trade options without a platform, using one significantly enhances the trading experience. Platforms provide access to real-time data, advanced tools, and streamlined order execution, giving traders a competitive edge.

How much capital is required to start option trading?

The capital required to start option trading varies depending on the trading style, strategy, and risk tolerance. Begin with a small amount to gain experience and gradually increase your capital as your confidence grows.

What is the difference between a call and a put option?

A call option gives the buyer the right to buy an underlying asset at a predetermined price, while a put option gives the buyer the right to sell an underlying asset at a predetermined price.

Https Fxglory.Com Option Trading-Platforms

Image: www.trusted-broker-reviews.com

Conclusion

Option trading platforms have revolutionized the way traders access and navigate the complex world of options. By partnering with reliable platforms and leveraging expert guidance, traders can unlock the full potential of this dynamic market. Embrace the power of options trading platforms, harness the latest insights and strategies, and embark on a journey toward financial empowerment.

Are you intrigued by the possibilities of option trading? Harness the power of our recommended platforms and take your trading to new heights. Delve into the world of options today and unlock a world of opportunity and financial growth.