Introduction

Image: markets.businessinsider.com

In the dynamic landscape of financial markets, options trading has emerged as a powerful tool for investors seeking to enhance their returns or hedge against risks. SoFi, a leading digital financial services provider, has introduced a user-friendly platform that makes options trading accessible to a wider audience. Embark on this comprehensive journey as we delve into the complexities of SoFi trading options, empowering you with the knowledge and strategies to navigate this exciting arena.

Exploring the World of SoFi Trading Options

SoFi trading options offer investors a versatile range of possibilities. Through call options, you can gain the right to buy a specific stock at a set price within a specified period. Conversely, put options grant you the privilege to sell a stock at a predetermined price during that timeframe. These options provide flexibility and potential profit opportunities, but they also carry inherent risks that must be carefully considered.

Understanding the Key Players

To fully comprehend the mechanics of SoFi trading options, it’s essential to introduce two critical concepts: the underlying asset and the option premium. The underlying asset is the security (e.g., stock, ETF, or index) upon which the option contract is based. The option premium represents the price you pay to acquire the option contract and establish your rights or obligations.

Navigating the Options Contract Timeline

Every options contract has a defined expiration date. These contracts typically expire on the third Friday of each month. Understanding the time decay of options is crucial. As the expiration date nears, the value of the options premium erodes, potentially reducing your investment value. Therefore, it’s vital to assess the optimal time frame for your trading strategies.

Unlocking the Strategies

The versatility of SoFi trading options empowers investors with a wide array of strategies. For those seeking to capitalize on market volatility, consider covered calls or naked puts. Alternatively, investors looking to protect their portfolios against downturns may opt forProtective Put or Collar strategies. Each approach requires a unique understanding of risk tolerance and market dynamics.

Expert Insights on SoFi Trading Options

“Options trading provides investors with greater flexibility to manage risk and enhance returns,” says Martha Reyes, Senior Investment Strategist at SoFi. “However, it’s essential to approach options trading with knowledge, sound research, and a deep understanding of your investment objectives.”

Harnessing the Power of Technology

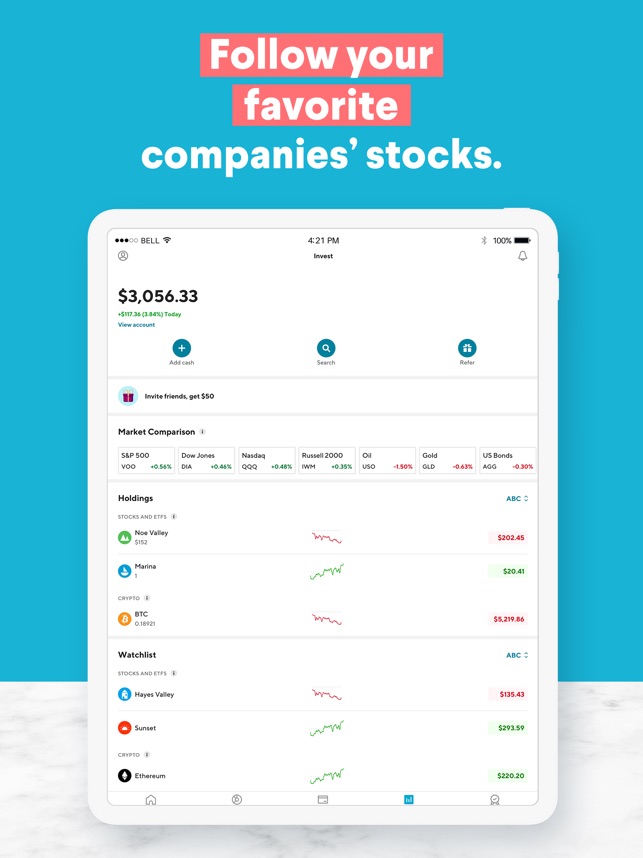

SoFi’s user-friendly platform simplifies options trading, making it accessible to both experienced investors and beginners. The platform offers educational resources, intuitive charting tools, and real-time market data to empower traders in making informed decisions. Whether you’re navigating complex strategies or just starting your options trading journey, SoFi provides a supportive environment.

Closing Thoughts

SoFi trading options offers a compelling avenue for investors seeking to enhance their financial strategies. By understanding the fundamentals, weighing risks and rewards, and leveraging expert insights, you can confidently navigate the complexities of options trading and unlock its potential. As with any investment, thorough research, prudent risk management, and a long-term perspective are essential for maximizing success in the dynamic realm of options trading.

Image: prisoniconicinterest.blogspot.com

Sofi Trading Options

https://youtube.com/watch?v=aH2ffMjJwrU