Introduction

In the world of investing, trading positions in options offers a unique opportunity to harness market volatility and potentially generate significant returns. As a novice option trader, navigating the complexities of this marketplace can be daunting, but with the right approach and a comprehensive understanding of the topic, you can unlock the potential of these versatile financial instruments.

Image: tradingtuitions.com

An option is essentially a contract that gives the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) an underlying asset, such as a stock, at a predetermined price (the strike price) on or before a certain date (the expiration date).

Types of Trading Positions

Long Positions

A long position involves buying an option with the belief that the price of the underlying asset will move in the direction that corresponds to your option type. For example, if you believe a stock price will increase, you would buy a call option. If your prediction proves accurate, you have the potential to profit from the price appreciation of the underlying asset.

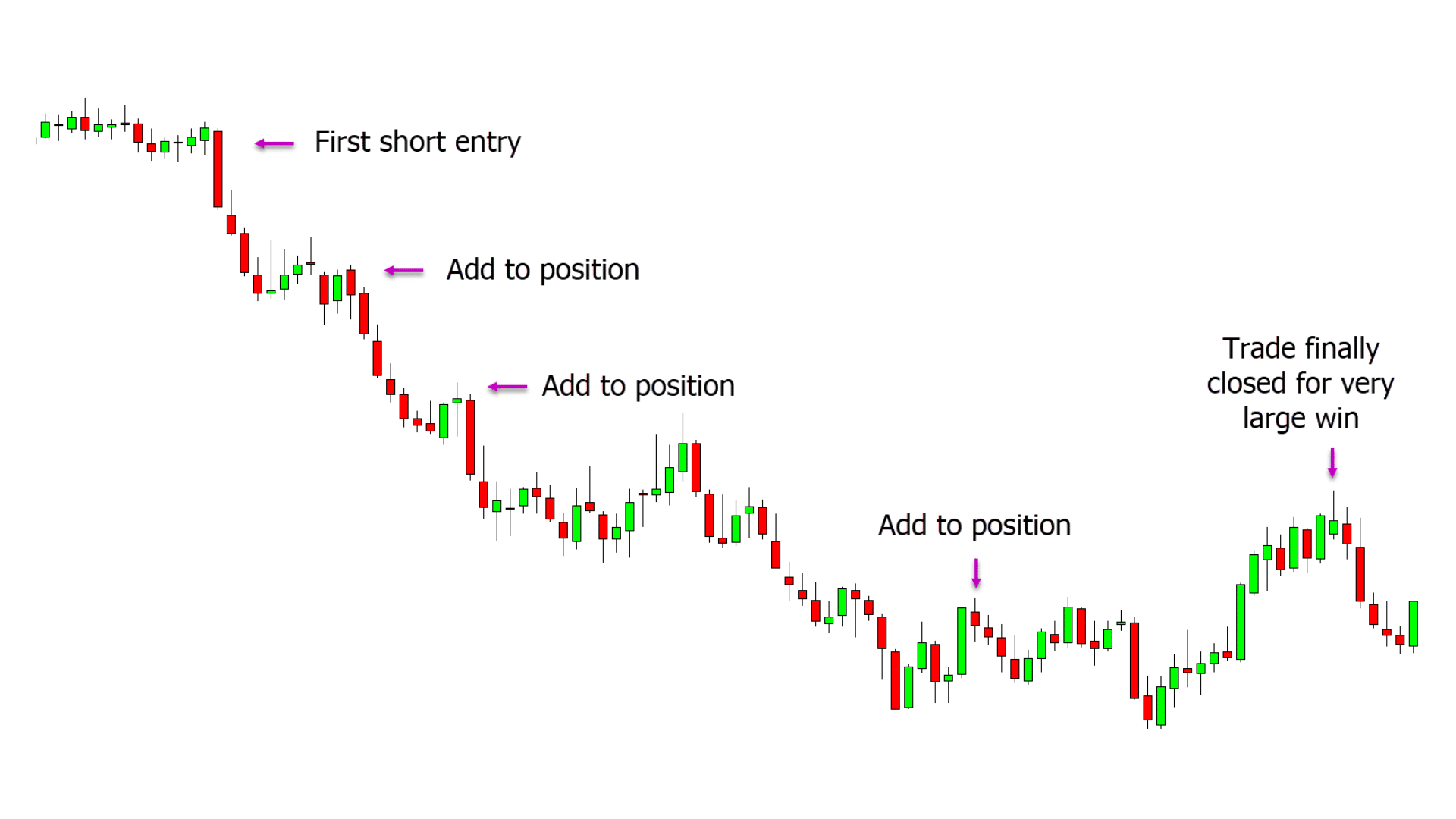

Short Positions

A short position, on the other hand, involves selling an option with the expectation that the price of the underlying asset will move against the direction of your option type. In this scenario, you profit if the price of the underlying asset declines. Short positions carry a higher risk than long positions, as you are obligated to fulfill the terms of the contract.

Image: forextraininggroup.com

Trading Strategies

There are numerous trading strategies that can be applied when trading options. Some of the most common include:

- Covered Call: Selling a call option against the underlying asset that you own.

- Protective Put: Buying a put option to protect a long position in the underlying asset.

- Iron Condor: A combination strategy that involves selling a call option and a put option at different strike prices.

Tips and Expert Advice

To enhance your chances of success in options trading, consider the following tips and expert advice:

- Educate Yourself: Thoroughly research the topic and understand the risks involved.

- Manage Your Risk: Never invest more than you can afford to lose, and diversify your portfolio.

- Monitor the Market: Stay abreast of economic news and events that could impact the underlying asset.

Frequently Asked Questions (FAQs)

- Q: What is the difference between a call and a put option?

A: A call option gives the buyer the right to buy, while a put option gives the buyer the right to sell. - Q: How long does an option contract last?

A: The duration of an option contract is determined by the expiration date. - Q: What factors affect the price of an option?

A: Factors such as the volatility of the underlying asset, time to expiration, and interest rates influence the price.

Trading Positions In Options

Image: learnpriceaction.com

Conclusion

Trading positions in options can be a rewarding endeavor, but it requires careful planning, risk management, and a deep understanding of the market. By immersing yourself in the topic, developing a trading strategy that aligns with your goals, and seeking expert guidance, you can increase your chances of success in this dynamic and challenging marketplace. Embrace the opportunities that options offer and harness the potential to generate substantial returns.

Are you ready to venture into the realm of options trading? Share your experiences or ask questions below, and let us navigate this exciting world together.