The adrenaline rush of options trading has captivated countless individuals seeking financial freedom and the allure of high returns. Among the vibrant marketplaces where options are traded, the “street” offers traders unique opportunities and challenges. Enter the captivating world of street options trading, where the stakes are high, and the thrill is palpable.

Image: benandsophiaphotography.blogspot.com

A Glimpse into the Origins and Essence of Street Options Trading

As trading evolved from traditional floor-based exchanges to electronic platforms, a new breed of traders emerged – street options traders. They operated off the exchange, directly connecting with market makers and other traders to negotiate option prices. This decentralized approach allowed for more flexibility and customization, attracting a diverse group of traders.

Initially, street options trading was a relatively small-scale affair, conducted over phones and in-person meetings. However, with the advent of electronic trading platforms, it has grown into a global market, offering access to a vast array of options contracts.

Navigating the Street Options Trading Landscape

The street options trading market is a complex and dynamic environment, requiring traders to possess a deep understanding of options strategies and market dynamics. Street traders often specialize in specific strategies, such as spreads, covered calls, and naked puts, utilizing various analytical tools and market insights to make informed trading decisions.

Unlike exchange-based options trading, street options trading lacks centralized regulation. It operates on a network of market makers and traders, relying on trust and reputation. This decentralized nature can provide advantages, such as more tailored contracts and flexible trading hours. However, it also requires a high level of due diligence and the ability to assess the credibility of counterparties.

Essential Elements for Success in Street Options Trading

Treading the path of a successful street options trader demands mastery of both technical skills and risk management principles. The following are crucial elements for navigating this exhilarating marketplace:

-

Technical Proficiency: A thorough understanding of options contracts, pricing models, and trading strategies is paramount. Traders must stay abreast of market trends, analyze historical data, and develop a robust trading plan.

-

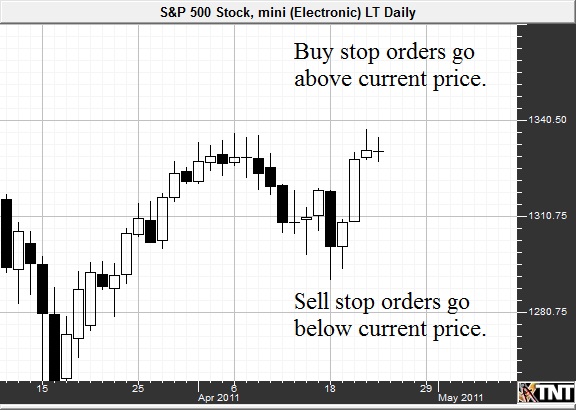

Risk Management: The volatile nature of options trading necessitates a strict risk management strategy. Traders should set clear stop-loss levels, monitor positions closely, and never risk more than they can afford to lose.

-

Market Savvy: Successful street options traders possess a deep understanding of market dynamics, including factors that influence option prices. Monitoring economic indicators, news events, and geopolitical factors can provide valuable insights for making informed trades.

Image: www.mql5.com

Unearthing the Essence of Emotional Intelligence in Street Options Trading

While the technical aspects of options trading are undeniably important, the role of emotional intelligence cannot be understated. Trading in fast-paced and unpredictable markets demands a mix of resilience, discipline, and the ability to manage emotions effectively.

-

Overcoming Emotional Biases: The thrill of trading can lead to impulsive decisions and chasing after short-lived profits. Traders must learn to control their emotions, avoid being swayed by greed, and stick to their trading plan.

-

Managing Uncertainty: Street options trading involves inherent uncertainty. Successful traders can tolerate ambiguity, deal with setbacks, and maintain a positive outlook even in challenging market conditions.

-

Dealing with Risk: Options trading carries substantial risk, and traders must develop a healthy relationship with risk. They should be able to assess their risk tolerance, accept potential losses, and adapt their trading strategies accordingly.

Embracing the Educational Journey of a Street Options Trader

Aspiring street options traders should embrace the continuous process of learning and professional development. The market is ever-evolving, new strategies emerge, and technology transformers the trading landscape. By engaging in diligent research, attending workshops, and seeking mentorship, traders can continuously enhance their skills and stay ahead of the curve.

The internet offers a wealth of resources for traders, including online courses, webinars, and discussion forums. Seasoned options traders often share their insights and experiences through books, articles, and online platforms.

The Potential Rewards and Risks of Street Options Trading

Street options trading offers the potential for significant financial gains, but it is crucial to be aware of the inherent risks involved. Volatility, unpredictable market conditions, and the decentralized nature of the market can lead to substantial losses.

Like any other financial instrument, options trading is not suitable for everyone. Individuals considering entering the street options market should carefully evaluate their risk tolerance, financial situation, and overall investment goals.

The Street Options Trading

Image: tradeciety.com

Conclusion: Unveiling the Allure and Nuances of Street Options Trading

The world of street options trading is a dynamic and thrilling landscape, offering both opportunities and challenges. By mastering technical skills, developing emotional intelligence, and embracing the learning journey, traders can navigate this market with confidence.

Whether striving for financial freedom, the allure of high returns, or simply an adrenaline rush, it is essential to approach street options trading with a balanced blend of knowledge, risk management, and emotional control. The street options market awaits those willing to tread its path and embrace its rollercoaster of emotions, promising both rewards and the valuable lessons that come with every trade.