The Defining Moments that Shaped Options Trading History

In the captivating realm of finance, stock options have emerged as a powerful tool for savvy investors seeking to capitalize on market movements. The annals of the financial world are adorned with countless tales of individuals who have seized opportunities and emerged as legends in the options arena. In this enthralling exploration, we will delve into some of the most pivotal stock options trading moments that have etched themselves into the collective memory of Wall Street.

Image: www.pinterest.co.kr

The Birth of the Black-Scholes Model (1973)

Like an intellectual thunderbolt, the Black-Scholes model emerged as a revolutionary tool that transformed options trading in its nascent days. This mathematical marvel, conceived by Fischer Black and Myron Scholes, provided a precise framework for pricing options, paving the way for investors to make informed decisions and manage risk with unprecedented accuracy. The model’s profound impact earned Black and Scholes the hallowed Nobel Prize in Economics in 1997.

The Crash of 1987 (Black Monday)

The ominous year of 1987 witnessed the Dow Jones Industrial Average plummeting by an unprecedented 22.6% in a single day, forever known as Black Monday. This cataclysmic event sent ripples of panic throughout the financial community, triggering a wave of options trading. Amidst the chaos, the giants of the options world, such as George Soros, made astute decisions that earned them astronomical profits. Yet, the aftermath also exposed the vulnerabilities of the options market, leading to the implementation of stricter regulatory measures.

Image: dollarsandsense.sg

Biggest Stock Options Trading Moments

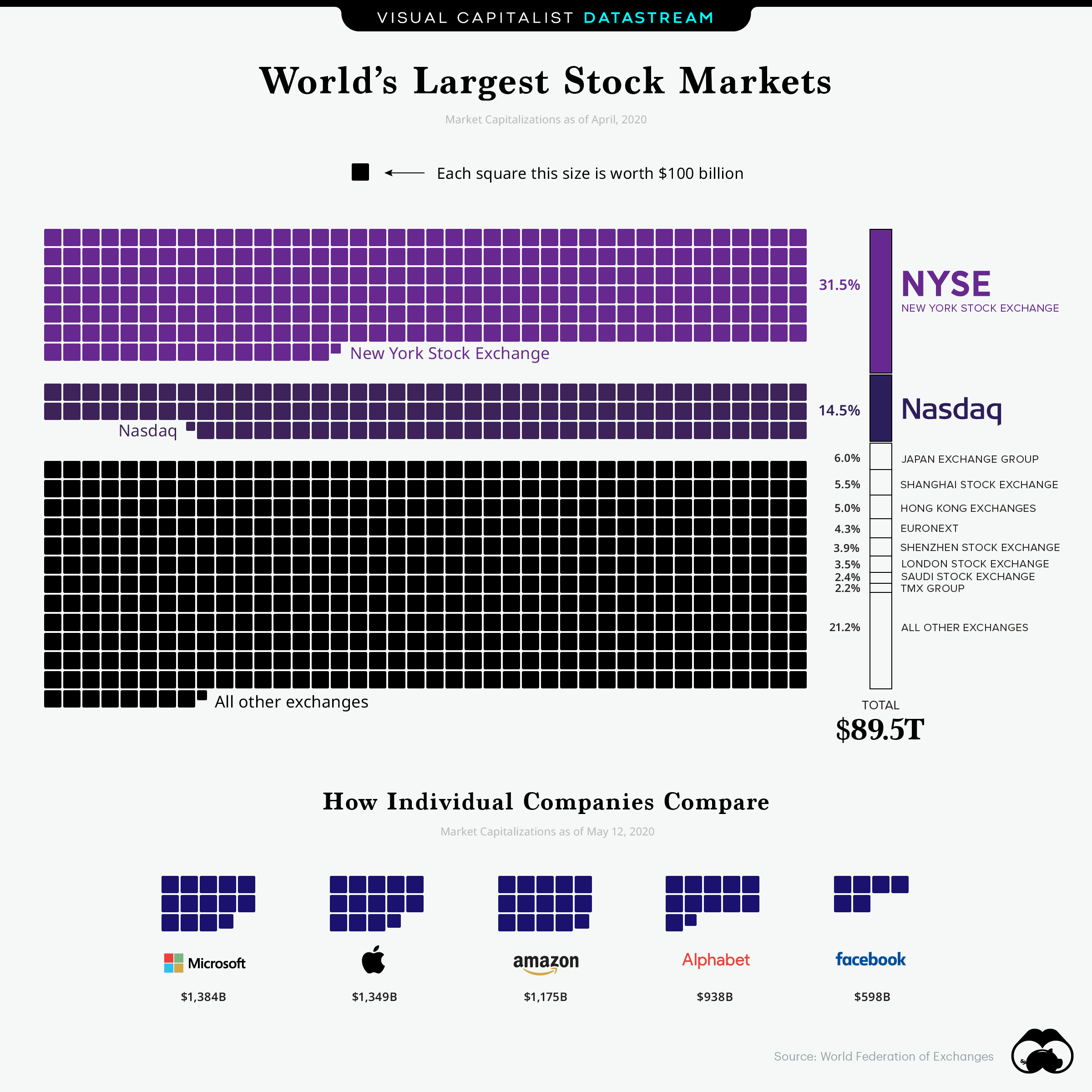

Image: www.visualcapitalist.com

The Rise of Electronic Trading (1990s)

In the early 1990s, the advent of electronic trading platforms revolutionized the options market, replacing the traditional open outcry system with the swift precision of digital exchanges. The introduction of platforms like the Chicago Board Options Exchange (CBOE) and the International Securities Exchange (ISE) escalated the pace of trading, allowing investors to execute complex strategies with remarkable speed and efficiency. This technological leapfrog propelled the options market to new heights, attracting a broader base of participants and enhancing liquidity.