Introduction:

Image: disneyartdrawingseasycoloringpages.blogspot.com

In the realm of options trading, swing trading put options presents a unique opportunity to capitalize on market downturns. Unlike buying stocks in anticipation of price increases, selling put options allows savvy investors to profit from declines in underlying assets. This versatile strategy offers numerous advantages and holds immense value for traders seeking downside protection or enhanced returns.

Put options, simply put, are contracts that grant the holder the right, but not the obligation, to sell a specific asset at a predetermined strike price on or before the contract’s expiration date. By selling put options, traders effectively bet against the rise in an asset’s price. When the market turns bearish, the value of these options increases, potentially generating significant profits.

Understanding Swing Trading Put Options

How it Works:

Swing trading involves holding positions for a period ranging from a few days to several weeks. In the case of put options, traders sell contracts with strike prices below the current market price, expecting the value of the underlying asset to decline. As the price falls towards or below the strike price, the put option gains value, enabling the trader to capitalize on the market’s descent.

Market Conditions:

Swing trading put options is particularly effective in volatile markets. When there is uncertainty or a perceived downward trend, options premiums tend to rise, creating opportunities for profit. Traders should carefully assess market conditions and identify assets with high potential for price declines.

Choosing Strike Prices and Expiration Dates:

Selecting appropriate strike prices and expiration dates is crucial for successful swing trading. Strike prices should be set below the current market price but not too far out of the money. Expiration dates should align with expected market movements and the trader’s risk tolerance.

Strategies and Tips for Success

Covered Put Strategy:

This strategy involves selling put options while simultaneously owning the underlying asset. It offers protection against potential downside risks and generates additional income from option premiums.

Cash-Secured Put Strategy:

Similar to the covered put strategy, this approach involves setting aside cash as collateral to secure the sale of put options. It provides limited downside protection but allows traders to participate in market declines without owning the underlying asset.

Optimal Risk Management:

Risk management is paramount in swing trading put options. Traders should carefully calculate their potential losses and avoid overleveraging their accounts. Prudent position sizing and stop-loss orders help minimize the impact of unfavorable market movements.

Real-World Examples and Case Studies

Case 1:

In August 2023, the S&P 500 index was trading around 4,000. A trader sells a December expiration put option with a strike price of 3,800. By October, the index has declined to 3,600, and the put option has gained substantial value. The trader exercises the option and sells the S&P 500 at 3,800, profiting from the market decline.

Case 2:

A cryptocurrency trader sells a Bitcoin put option with a strike price of $20,000 in the face of negative market sentiment. As Bitcoin plummets to $18,000, the trader’s put option significantly appreciates in value, generating a handsome return.

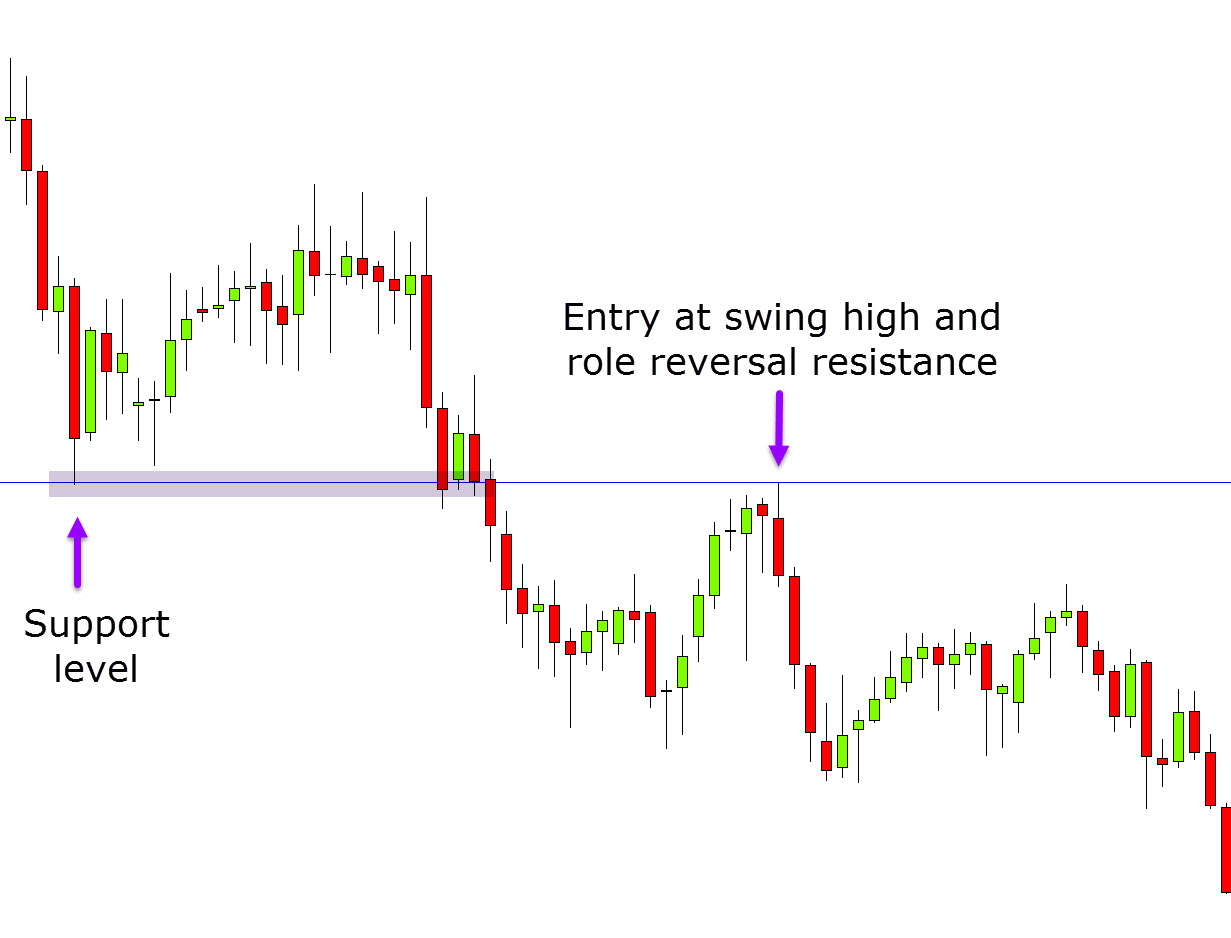

Image: patternswizard.com

Swing Trading Put Options

Image: derivfx.com

Conclusion

Swing trading put options empowers traders to exploit market downturns, bolster investment portfolios, and diversify their sources of revenue. By employing thoughtful strategies, managing risk effectively, and leveraging the volatility of financial markets, savvy investors can unlock the potential of this valuable options play. Whether seeking downside protection or enhanced returns, swing trading put options offers a powerful tool for financial success.