In the ever-fluctuating world of stock trading, the ability to capitalize on both market rallies and downturns can be a formidable advantage. Short trading stocks, a technique that involves profiting from falling stock prices, offers savvy investors a unique opportunity to turn market volatility into earnings. When paired with swing trading and options strategies, short selling can amplify profit potential while mitigating risk.

Image: scuba-dawgs.com

Unraveling Short Trading: A Strategic Maneuver

Short trading, in its simplest form, entails borrowing shares of a stock from a brokerage, selling them at their current price, and subsequently repurchasing them at a lower price. If executed successfully, short sellers reap the difference between the initial sale and the repurchase price. This strategy earns its moniker from the notion of aiming to sell high and buy low, unlike traditional stock trading where the goal is to buy low and sell high.

Leveraging Swing Trading: Capturing Market Swings

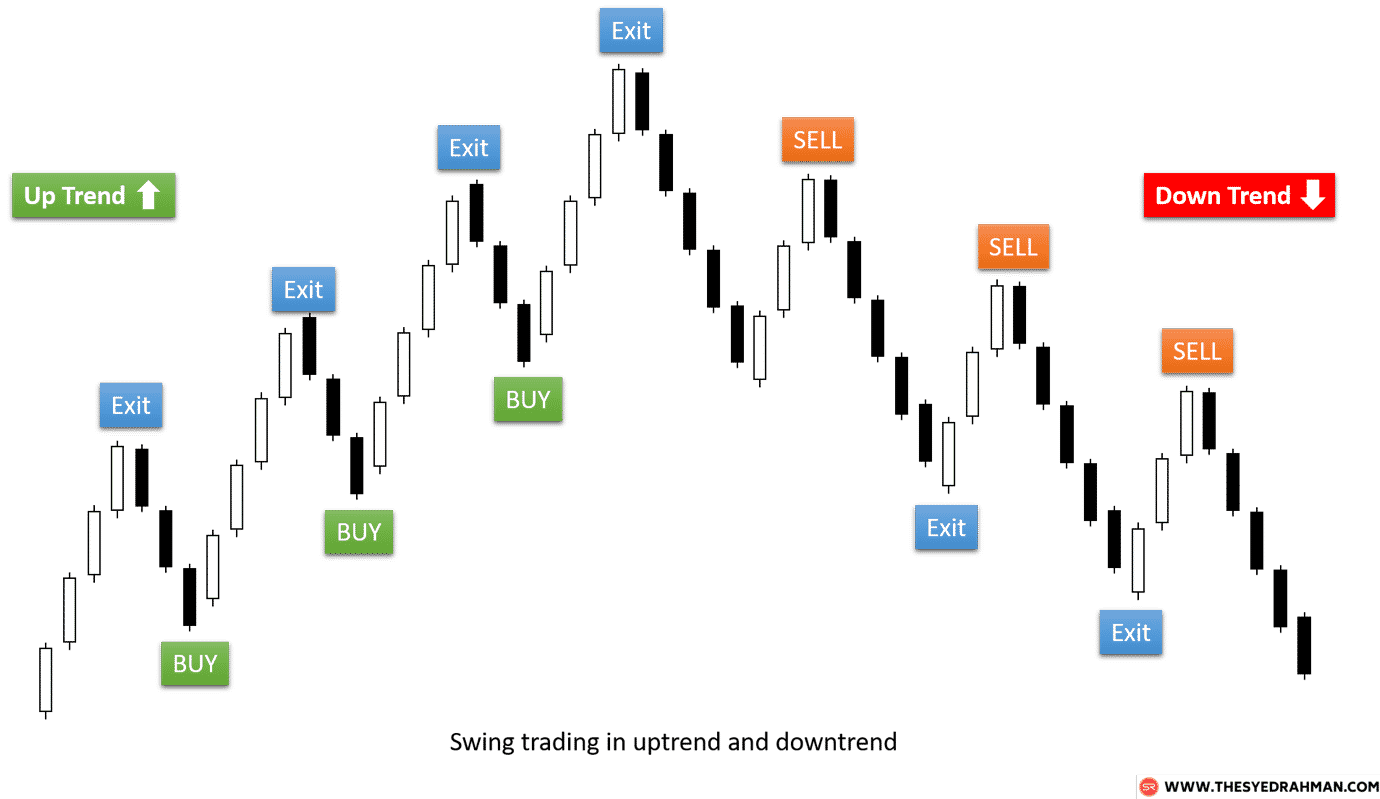

Swing trading, when combined with short selling, allows investors to seize on short-term price fluctuations within a stock’s overall trend. Swing traders typically hold positions for a few days to a few weeks, riding the momentum of upward or downward swings. By aligning short trades with bearish market conditions or identified downtrends, investors can potentially maximize their profits when stock prices decline.

Options Strategies: Enhancing Flexibility and Leverage

In the realm of short trading, options offer an array of versatile strategies that can further enhance profitability and risk management. Options, like shorting stocks, involve the sale of contracts but provide a spectrum of rights and obligations determined by the type of option traded.

One notable option strategy, known as covered calls, plays a defensive role in short trading by generating premium income to offset potential losses from a short position. By selling call options against the underlying stock, investors can create a buffer that limits downside risk and potentially increases the probability of profit.

Image: www.5paisa.com

Short Trading Stocks: Profit With Swing & Options Trading

Image: optionstradingiq.com

Concluding Insights: Navigating Short Trading with Prudence

Unlocking the full potential of short trading through swing & options stratégies requires a comprehensive understanding of market dynamics, risk tolerance, and sound trading techniques. Patience and discipline are crucial in executing short trades, as market reversals can occur unexpectedly. Additionally, it’s essential to conduct thorough research and due diligence on the underlying stock to assess its financial health, market trend, and potential risks.

For those willing to embrace market volatility and navigate its complexities, short trading stocks with swing & options strategies presents a strategic avenue to generate profits. By leveraging an array of techniques, investors can capitalize on both upward and downward market movements, maximizing their potential earnings in a dynamic trading environment.