Stepping onto the bustling streets of Toronto, the financial hub of Canada, the air buzzes with excitement. The city’s vibrant stock market has captured my interest, leading me to unravel the intricate world of stock option trading.

Image: programminginsider.com

Discover the Nuances of Stock Option Trading

What are Stock Options and How Do They Work?

Stock options are contracts that grant investors the right, but not the obligation, to buy or sell shares of a specific company at a predetermined price (strike price) before a specified date (expiration date). This allows traders to capitalize on potential price fluctuations without committing to outright purchase or sale of the underlying stock.

Navigating the Toronto Stock Option Market

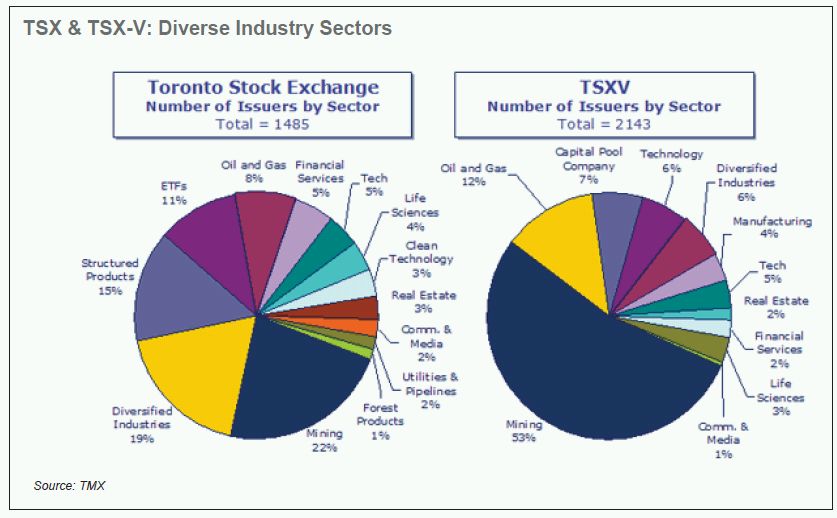

Toronto’s stock option market offers a robust platform for traders of all experience levels. With a wide range of underlying stocks available, investors can choose from blue-chip companies to up-and-coming ventures. The Toronto Stock Exchange (TSX) and the Canadian Securities Exchange (CSE) provide a regulated environment for option trading, ensuring transparency and protection for participants.

Mastering Stock Option Trading Strategies

Decoding the Latest Trends

The stock option market is constantly evolving, influenced by macroeconomic factors, company news, and market sentiment. By staying abreast of the latest trends and developments, traders can make informed decisions about their positions. Forums and social media platforms, such as RedFlagDeals and Stockhouse, offer valuable insights and up-to-date information.

Image: www.mondaq.com

Stock Option Trading Toronto

Image: www.mymcmurray.com

Expert Tips for Success

– **Understand the Risks:** Stock option trading involves inherent risks. Thoroughly research and comprehend the potential losses before entering the market.

– **Set Realistic Goals:** Establish clear and achievable financial targets based on your investment strategy.

– **Manage Your Time Wisely:** Stock option trading can be time-consuming. Allocate a dedicated portion of your day to monitor the market and make trades.

Stock Option Trading FAQ

-

Q: What is the difference between a call and a put option?

A: A call option gives the holder the right to buy shares at the strike price, while a put option gives the holder the right to sell shares at the strike price.

-

Q: What factors affect the price of stock options?

A: The price of stock options is influenced by the underlying stock price, time to expiration, strike price, and volatility.

-

Q: How do I get started with stock option trading?

A: To get started, you will need to open an account with a registered broker-dealer that offers stock option trading services.

Conclusion

Stock option trading in Toronto presents a wealth of opportunities for investors. By comprehending the intricacies of the market, staying informed about current trends, and implementing sound trading strategies, you can harness the potential of this dynamic financial instrument. Embrace the excitement of stock option trading and embark on a journey of financial mastery.

So, are you ready to delve into the world of stock option trading in Toronto and unlock its potential returns?