The world of options trading is a complex and dynamic one, requiring a thorough understanding of various strategies and regulations. Among these regulations, wash sale rules play a crucial role in ensuring fair and orderly market practices. In this comprehensive guide, we delve into the intricacies of sell option and buy option trading wash sale rules, empowering you with the knowledge to navigate these intricate waters.

Image: groco.com

Unveiling Wash Sale Rules: A Foundation for Understanding

Wash sale rules were conceived to prevent artificial tax deductions by disallowing losses on sales of securities if substantially identical securities are acquired within 30 days before or after the sale. This intentionally minimizes the tax benefits of selling a security at a loss to eventually repurchase it at a lower cost.

When applied to options trading, wash sale rules deter traders from engaging in similar tactics to create artificial tax advantages. Specifically, these rules prevent taxpayers from claiming a loss on a sale of an option if they acquire a substantially identical option within the prescribed 30-day window.

Discerning the Essential Elements of Wash Sale Rules

To fully grasp the intricacies of wash sale rules, it’s imperative to dissect their fundamental components.

1. Substantially Identical Options

The concept of “substantially identical options” holds paramount importance in wash sale rules. Two options are deemed substantially identical if they fulfill the following criteria:

- They have the same underlying security

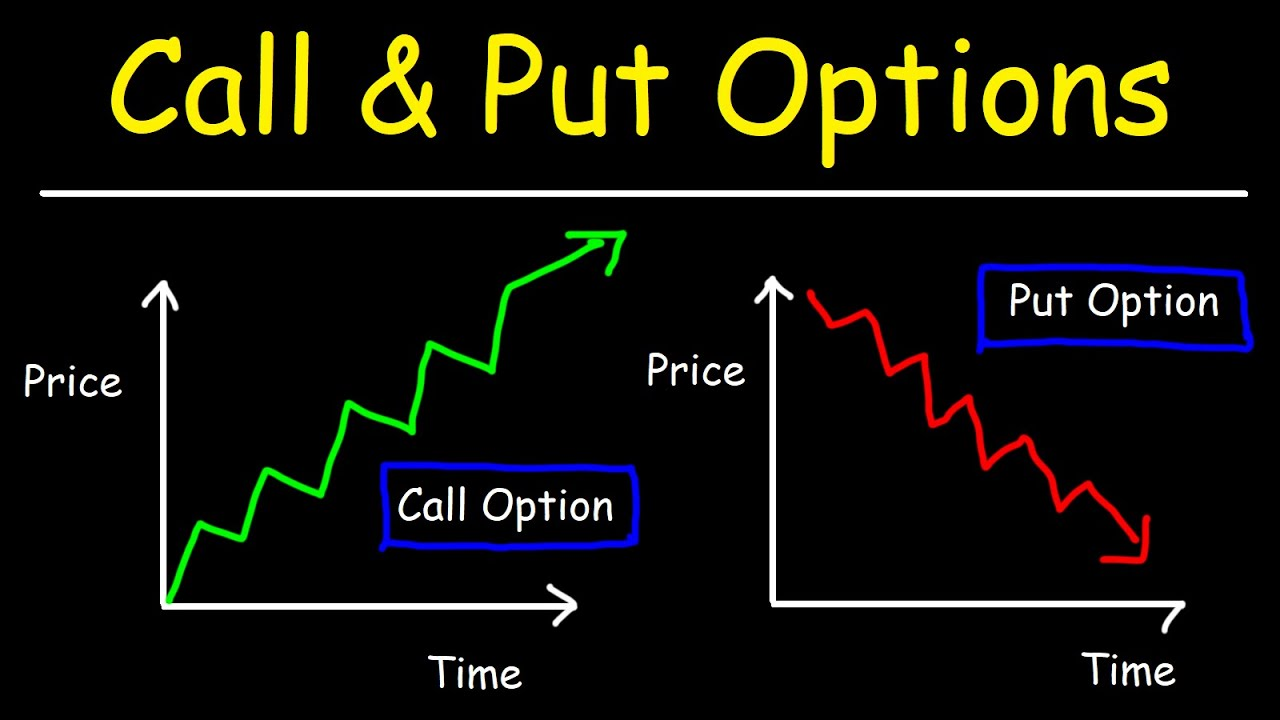

- They confer the same rights (i.e., call or put)

- They have the same expiration date

- They have the same strike price

Subtle variations, such as differing exercise types (e.g., European versus American), do not negate the substantial identity of options.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Image: www.investopedia.com

2. 30-Day Wash Sale Window

Wash sale rules delineate a pivotal 30-day window that frames their applicability. If a substantially identical option is acquired within 30 days before or after the sale of an existing option, the loss on the sale may be disallowed.

3. Exception: Closing Transactions

It’s imperative to note that wash sale rules do not apply to closing transactions. If a trader sells an option to close out an existing position, the sale is not subject to wash sale rules, even if a substantially identical option is acquired within the 30-day window. This exemption ensures that traders can manage their positions without incurring unnecessary tax burdens.

Practical Implications: Examples of Wash Sale Violations

To solidify our understanding, let’s delve into concrete examples of wash sale violations:

-

Example 1: A trader sells 10 call options on Apple stock with a strike price of $150 and an expiration date of January 20th at a loss. Within 20 days, the trader acquires 10 identical call options on Apple stock. This acquisition falls within the 30-day wash sale window, rendering the loss on the original sale non-deductible.

-

Example 2: A trader enters into a long position with 100 shares of Microsoft stock. Subsequently, the stock price declines, prompting the trader to sell a call option on Microsoft stock with a strike price of $250 and an expiration date of April 15th to hedge against potential losses. Within 15 days, the stock price recovers, and the trader decides to close out the hedge position by purchasing an identical call option. Since this is a closing transaction, it is exempt from wash sale rules.

Strategic Considerations: Mitigating the Impact of Wash Sale Rules

While wash sale rules serve a legitimate purpose, they can sometimes be perceived as an impediment to effective trading strategies. To mitigate their potential impact, traders can employ prudent measures:

-

1. Strategic Timing: Exercising patience and waiting beyond the 30-day wash sale window before acquiring substantially identical options can help avoid wash sale violations.

-

2. Diversification: Opting for a diversified portfolio that includes different underlying securities and option strategies can minimize the likelihood of triggering wash sale rules.

-

3. Long-Term Perspective: Adopting a long-term investment horizon and avoiding frequent trading of substantially identical options can help traders stay clear of wash sale concerns.

Sell Option And Buy Option Trading Wash Sale Rules

Image: tradewithmarketmoves.com

Conclusion: Empowering Traders with Knowledge and Compliance

Navigating the complexities of sell option and buy option trading wash sale rules can be challenging, but it’s essential for options traders to possess a comprehensive understanding of these regulations. By unraveling the intricacies of wash sale rules, traders are better equipped to optimize their trading strategies while adhering to ethical and legal standards.

Remember, knowledge is power, and when it comes to options trading, this power translates into informed decision-making and a greater likelihood of achieving your financial objectives. So, embrace the intricacies of wash sale rules, and equip yourself with the tools for successful and compliant trading.