In today’s bustling financial landscape, options trading has emerged as an alluring path for individuals seeking to elevate their financial acumen and capitalize on market fluctuations. Among the reputable platforms that provide access to this exciting arena, selfwealth stands tall, offering an unparalleled suite of tools and resources for seasoned traders and novices alike.

Image: cryptoabc.net

Understanding Options Trading: A Journey into Market Dynamics

Options trading revolves around the concept of options contracts, which confer the right – not the obligation – to buy (call options) or sell (put options) an underlying asset at a predetermined price within a specified time frame. This empowers traders with the flexibility to speculate on future market movements, potentially amplifying their profits and mitigating potential losses.

The Significance of Options Trading: Shaping Financial Outcomes

Options trading presents a spectrum of advantages that can reshape financial prospects. By harnessing these contracts, traders gain the ability to:

-

Heighten Risk Management: Manage risk strategically by setting limits on potential losses

-

Magnify Returns: Amplify the potential profits from market movements through leverage

-

Generate Income: Earn income through option premiums even if the underlying asset’s price remains stagnant

Navigating Options Trading with selfwealth: A Guide to Success

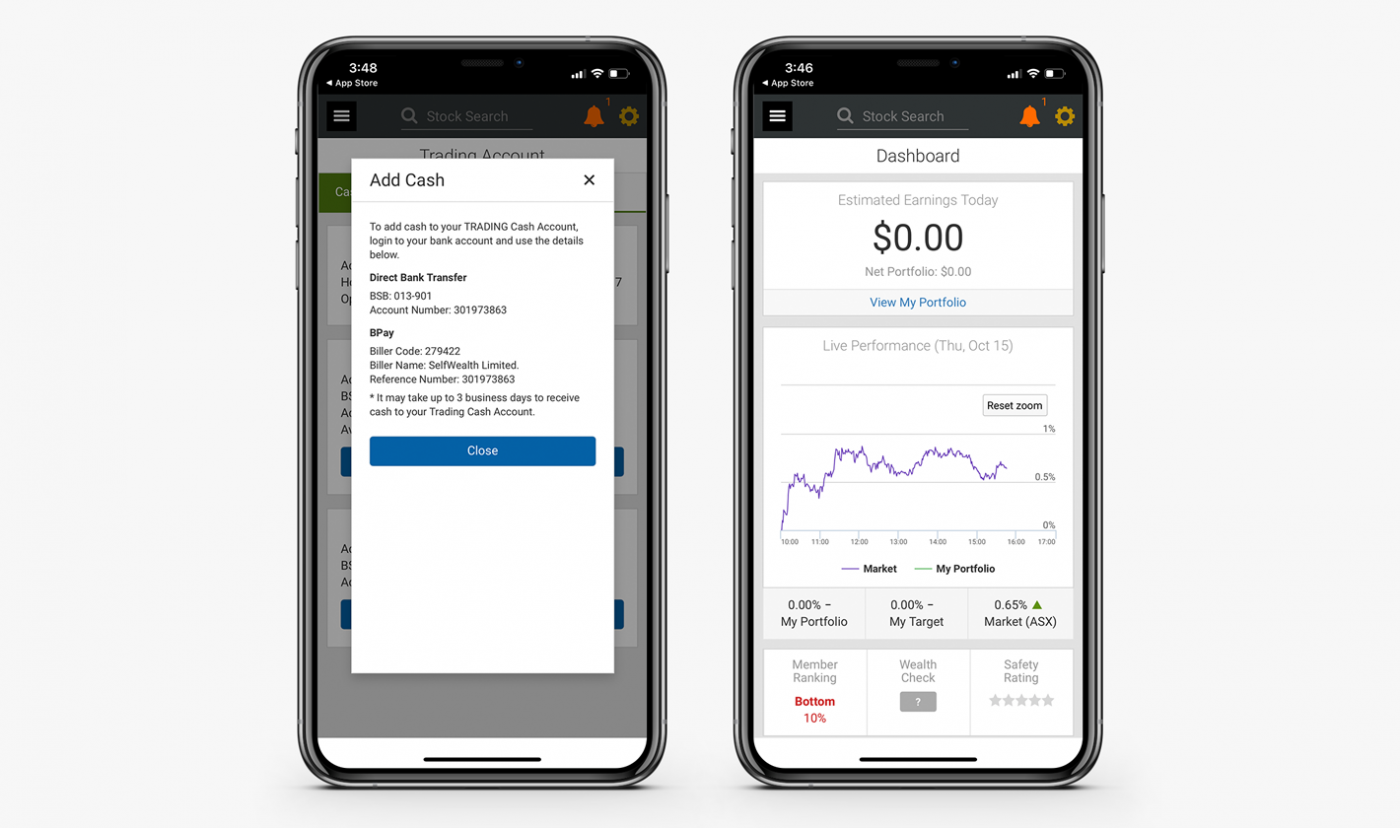

For those seeking a reliable and intuitive platform for options trading, selfwealth emerges as an ideal choice. Boasting a user-friendly interface and an array of educational resources, selfwealth empowers traders with the knowledge and tools they need to navigate the market’s complexities.

Essential Elements of Successful Options Trading

Venturing into options trading requires a solid grasp of core concepts, including:

-

Understanding Underlying Assets: Familiarize yourself with the assets you’re trading, their historical price movements, and the factors influencing their value.

-

Mastering Option Greeks: Delve into option Greeks – Delta, Gamma, Theta, Vega, and Rho – which quantify the sensitivity of options to various market variables.

-

Recognizing Trading Strategies: Explore diverse trading strategies, including bullish and bearish option spreads, which cater to different market conditions and profit objectives.

-

Managing Risk Effectively: Implement prudent risk management practices, such as setting stop-loss orders, to protect your capital and mitigate potential losses.

Expert Insights: Unlocking the Secrets of Options Trading

Renowned experts in options trading have generously shared their insights to guide aspiring traders:

-

“Options trading is like a superpower when used judiciously,” says renowned trader Mark Sebastian. “It amplifies your ability to capture market opportunities while managing risk.”

-

Legendary investor Warren Buffett advises, “Options trading can be a powerful tool for investors, but it’s crucial to fully comprehend the risks involved.”

Actionable Tips: Empowering Your Options Trading Journey

-

Start Modestly: Begin with smaller trades to gain familiarity with the mechanics and nuances of options trading.

-

Embrace Education: Dedicate time to learning about options trading through books, online courses, and webinars.

-

Seek Expert Guidance: Consult with experienced traders or mentors to glean valuable insights and strategies.

Conclusion: Embarking on a Path of Financial Mastery

Options trading, when embraced with a well-informed approach, can unlock a world of financial possibilities. By partnering with reliable platforms like selfwealth and embracing expert guidance, you can harness the power of these contracts to amplify your returns, manage risk, and shape your financial destiny. Remember, knowledge, prudence, and a relentless quest for excellence are the cornerstones of success in this captivating realm of market opportunities.

Image: blog.stockspot.com.au

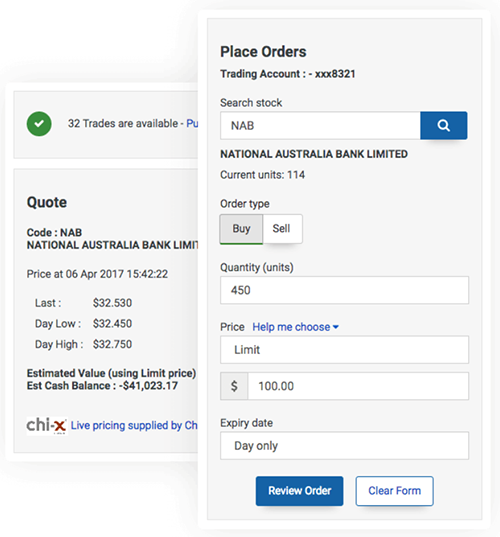

Selfwealth Options Trading

Image: nextinvestors.com