In the labyrinth of financial markets, where volatility reigns supreme, astute investors seek strategies to navigate the ebb and flow of the tides. Among these strategies, delta neutral option trading stands out as a beacon of stability, a technique that neutralizes market risks, allowing investors to capture consistent returns regardless of the direction the market takes.

Image: www.talkdelta.com

Delta neutral trading, in its essence, is the art of balancing long and short positions in options with opposing deltas. Delta, a Greek letter used in finance, measures the sensitivity of an option’s price to changes in the underlying asset’s price. By carefully calibrating long and short positions with equal but opposite deltas, the investor creates a portfolio that remains relatively unaffected by market fluctuations, achieving a state of delta neutrality.

Diving into the Mechanics

Understanding the mechanics of delta neutral trading requires a grasp of its core components: options and their Greeks. Options are contracts that give the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price, known as the strike price, on or before a specific expiration date. Greeks, on the other hand, are mathematical values derived from options prices that measure various aspects of their behavior, with delta being one of them.

Delta measures the rate at which an option’s price changes in relation to the underlying asset’s price. For example, a call option with a delta of 0.5 indicates that for every $1 increase in the underlying asset’s price, the call option’s price will increase by $0.5. Conversely, a put option with a delta of -0.5 implies that for every $1 decrease in the underlying asset’s price, the put option’s price will increase by $0.5.

In delta neutral trading, the goal is to construct a portfolio of options with opposing deltas that offset each other. This is achieved by buying one option (usually a call option) and simultaneously selling another option (usually a put option) on the same underlying asset, both with the same expiration date and strike price. By carefully calibrating the number of contracts traded, the investor ensures that the positive delta of the long position is equal to the negative delta of the short position, resulting in a delta-neutral portfolio.

Navigating the Market with Delta Neutrality

The beauty of delta neutral trading lies in its ability to hedge against market volatility. When the underlying asset’s price rises, the long call option gains value, while the short put option loses value. However, since the deltas of the two options are equal but opposite, the overall portfolio remains relatively stable. Conversely, if the underlying asset’s price falls, the long call option loses value, but the short put option gains value, again resulting in a balanced portfolio.

This hedging effect makes delta neutral trading an attractive strategy for investors seeking to protect their capital from market fluctuations while still capturing potential returns. By mitigating the impact of volatility, delta neutral portfolios can provide consistent returns over time, regardless of the market’s direction.

Mastering the Art of Delta Neutrality

While the concept of delta neutral trading is relatively straightforward, successfully implementing the strategy requires a thorough understanding of options trading and risk management. Here are some essential tips to consider:

-

Choose the right underlying asset: Delta neutral trading is most suitable for assets with high volatility, as the strategy thrives on market fluctuations.

-

Select appropriate options: The choice of call and put options depends on the investor’s market outlook. If expecting a上涨 , a long call option with a higher delta should be paired with a short put option with a lower delta. Conversely, if expecting a decline, a short call option with a lower delta should be paired with a long put option with a higher delta.

-

Calibrate the positions: Accurately calculating the number of contracts to trade is crucial to achieve delta neutrality. This involves understanding the delta values of the chosen options and the desired level of balance.

-

Manage risk: Delta neutral trading, while hedging against market fluctuations, does not eliminate risk entirely. Unexpected market events or changes in the underlying asset’s volatility can still impact the portfolio. Proper risk management measures, such as stop-loss orders and position sizing, should be implemented.

Image: www.pinterest.com

Expert Insights and Actionable Tips

Renowned options trader Jayanthi Gopalakrishnan emphasizes the importance of understanding the underlying asset. “It’s not just about finding the right options,” she advises, “but about having a deep understanding of the underlying asset’s behavior and market dynamics.”

Another seasoned professional, Mark Sebastian, advises aspiring delta neutral traders to start small. “Begin with a small portfolio,” he suggests, “and gradually increase the size as you gain experience and confidence.”

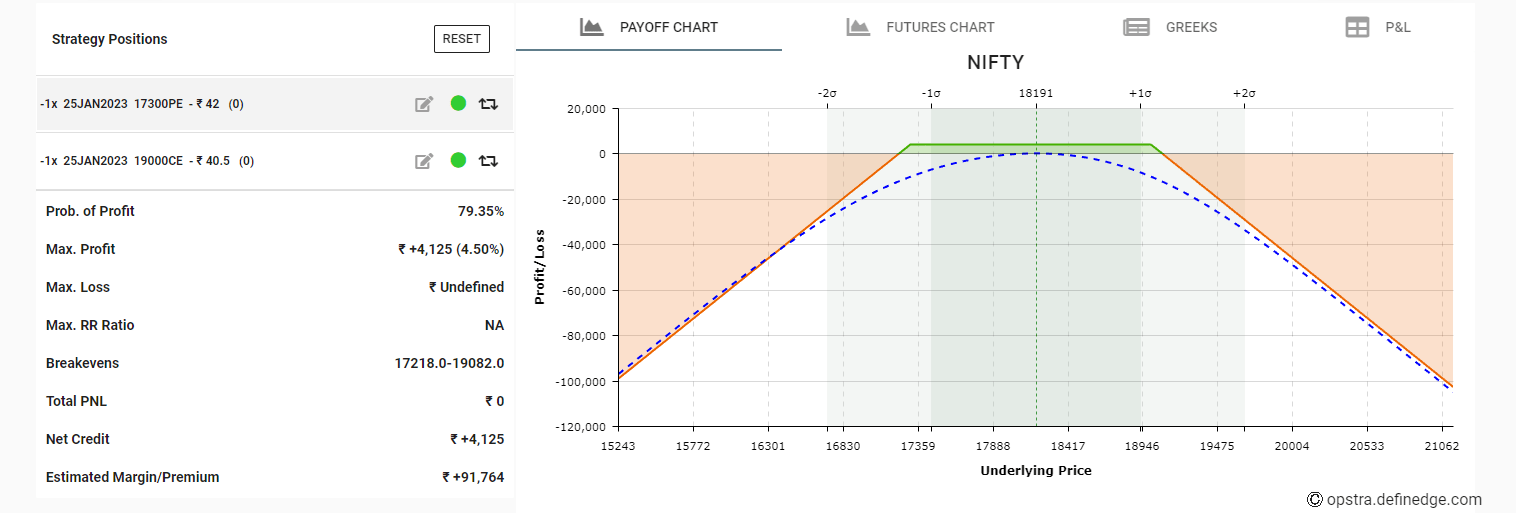

Delta Neutral Option Trading Strategy

Image: www.marketcalls.in

In Conclusion

Delta neutral option trading offers a sophisticated strategy for hedging against market volatility while capturing consistent returns. By carefully calibrating opposing deltas in a portfolio of options, investors can mitigate the impact of market fluctuations, creating a more stable and resilient investment strategy. However, it’s essential to remember that delta neutral trading is not a risk-free endeavor and requires a thorough understanding of options and risk management principles. With proper research and execution, though, it can be a powerful tool for navigating the ever-changing landscape of financial markets.