In the realm of investing, options trading presents a plethora of opportunities for skilled traders. Among the various levels of options trading available, Level 4 clearance stands out as the pinnacle, granting access to an exclusive suite of strategies with the potential for substantial rewards. However, obtaining this coveted approval requires a rigorous and comprehensive process.

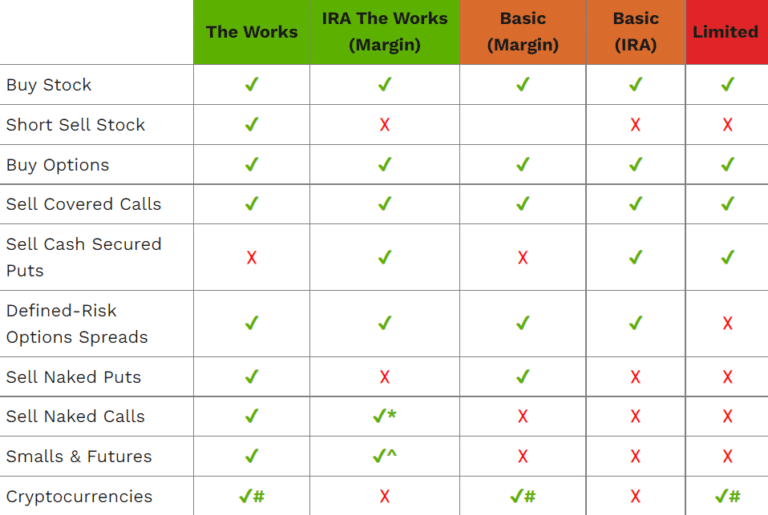

Image: www.projectfinance.com

This guide will meticulously outline the steps necessary to embark on your journey toward Level 4 options trading approval. Embrace the adventure, conquer the hurdles, and unlock the boundless possibilities that lie ahead.

Step 1: Establish a Solid Foundation

The path to Level 4 approval begins with laying a firm foundation in the world of options trading. This includes mastering fundamental concepts like options contracts, types of orders, and volatility. Engage in extensive research, enroll in courses, and seek guidance from experienced traders.

Step 2: Demonstrate Expertise and Breadth of Knowledge

To qualify for Level 4 approval, you must showcase your proficiency and understanding of options trading strategies. A comprehensive understanding of advanced options strategies, such as multi-leg options, covered calls, and short strangles, becomes essential. It’s crucial to demonstrate not only a theoretical grasp of these strategies but also practical experience in implementing them successfully.

Step 3: Acquire the Required Capital

Level 4 options trading comes with inherent risk, and regulatory agencies require traders to have sufficient capital to mitigate potential losses. The amount of capital required varies depending on your broker and the level of trading activity you expect to undertake. Be prepared to meet these capital requirements by maintaining a secure financial footing.

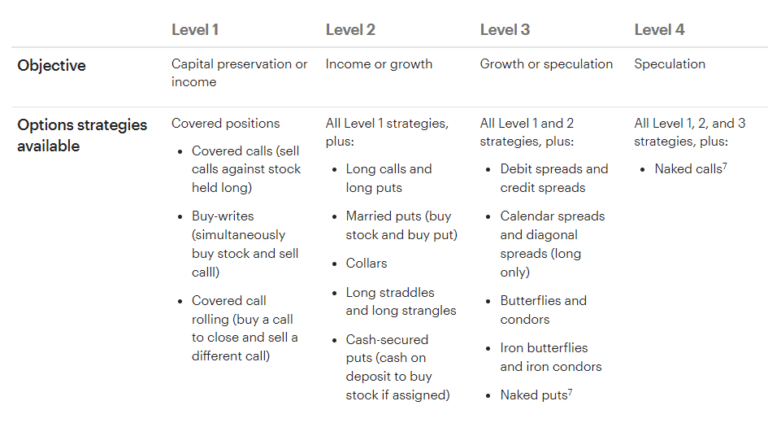

Image: www.projectfinance.com

Step 4: Pass the Series 7 Examination

The Series 7 examination serves as the gateway to Level 4 options trading. This comprehensive exam assesses your knowledge of securities products, financial markets, and trading practices. Extensive preparation and thorough understanding of the exam syllabus are key to successfully clearing this hurdle.

Step 5: Pass the Options Principal Examination

Once you’ve conquered the Series 7, it’s time to tackle the Options Principal Examination. This specialized exam delves into the intricacies of options trading, covering topics such as options pricing models, strategy analysis, and regulatory compliance. In-depth study of the official exam materials and practice tests will boost your chances of passing this challenging exam.

Step 6: Obtain Sponsorship from a FINRA Member Broker-Dealer

Securing sponsorship from a Financial Industry Regulatory Authority (FINRA) member broker-dealer is a crucial step. The sponsoring broker-dealer will oversee your activities and ensure compliance with regulatory requirements. Choose a reputable broker-dealer that aligns with your trading style and provides the necessary support and guidance.

Step 7: Submit Application to FINRA for Approval

With your qualifying credentials in hand and a broker-dealer’s sponsorship, you’re ready to submit an application for Level 4 options trading approval to FINRA. This application involves providing detailed information about your trading experience, financial status, and educational background.

Steps To Get Level 4 Options Trading Approval

Image: www.projectfinance.com

Embrace the Journey, Seize the Opportunities

The path to Level 4 options trading approval is undoubtedly challenging, but it’s also an adventure fraught with opportunities for personal and financial growth. By meticulously following these steps, proving your mettle, and embracing the complexities of options trading, you’ll not only unlock access to advanced strategies but also elevate your trading game to new heights. Remember, the road to success is paved with perseverance and unwavering determination. Take that first step today.