Introduction

In the realm of finance, savvy investors employ various techniques to mitigate risks and safeguard their portfolios. Among these strategies, hedging stands out as a powerful tool that enables traders to minimize losses while maximizing potential gains. Particularly in the volatile world of option trading, hedging plays a crucial role in managing risk exposure. This article delves into the intricacies of hedging in option trading, equipping readers with a comprehensive understanding of its purpose, types, practical applications, and real-world examples.

Image: hercules.finance

What is Hedging in Option Trading?

Hedging in the context of option trading refers to employing specific strategies to counterbalance the potential risks associated with holding a specific position in the market. Options, financial instruments that convey the right but not the obligation to buy or sell an underlying asset at a predetermined price, come with inherent uncertainty. By implementing hedging techniques, traders strive to reduce the impact of adverse price movements and enhance the probability of a profitable outcome.

Types of Hedging Strategies

The landscape of hedging strategies in option trading is vast, with each approach tailored to specific risk profiles and market conditions. Some widely utilized hedging techniques include:

-

Delta Hedging:

This strategy involves offsetting the price risk associated with an option position by trading the underlying asset in the opposite direction. For instance, if you own call options on a stock, buying an equivalent amount of the underlying stock serves as a hedge against potential declines.

-

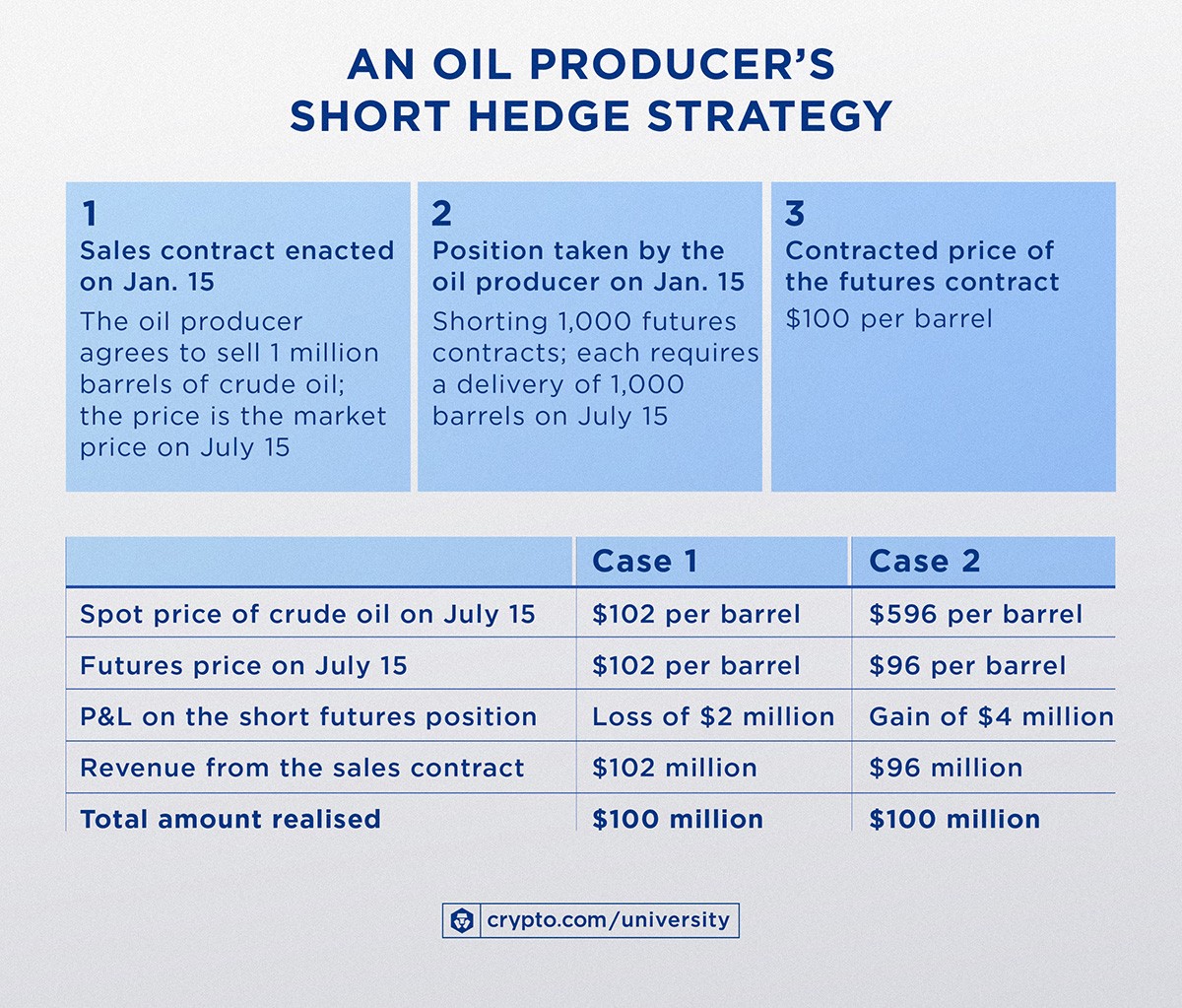

Image: crypto.comPairs Trading:

This technique entails simultaneously holding two correlated but inversely performing assets. By combining holdings that typically move in opposite directions, traders aim to minimize the impact of market downturns and capitalize on price fluctuations.

-

Collar Strategy:

This strategy involves buying an out-of-the-money call option while simultaneously selling an out-of-the-money put option with the same expiration date but different strike prices. This hedging combination creates a protective range around the underlying asset, limiting potential losses.

Importance of Hedging in Option Trading

Hedging in option trading holds paramount importance for traders seeking to navigate the unpredictable waters of the market. Embracing hedging practices offers a plethora of benefits, including:

-

Reduced Risk:

Hedging techniques serve as a shield against significant market downturns, reducing the potential for substantial financial losses.

-

Enhanced Returns:

By effectively managing risk exposure, hedging empowers traders to adopt bolder strategies, potentially leading to amplified returns.

-

Increased Confidence:

Hedging strategies instill confidence in traders, enabling them to make informed decisions while mitigating the emotional distress associated with market turbulence.

Real-World Example of Hedging

To illustrate the practical application of hedging in option trading, consider the following example:

Imagine you purchase 100 call options on Apple stock, each with a strike price of $150 and an expiration date of two months from now. The current market price of Apple stock stands at $160.

To hedge this position, you could employ delta hedging by simultaneously buying 100 shares of Apple stock. As the stock price fluctuates, you can adjust the number of shares held to maintain a neutral delta position, effectively offsetting the price risk associated with the call options.

What Is Hedging In Option Trading With Example

Conclusion

Hedging in option trading is an indispensable tool that empowers traders to navigate market uncertainties and maximize their chances of success. By implementing hedging strategies, traders can reduce risk, enhance returns, and augment their overall trading experience. Whether you’re a seasoned professional or a novice venturing into the world of options, this guide has equipped you with a comprehensive understanding of hedging. It’s now your turn to explore the various hedging techniques, optimize your strategies, and unlock the potential of this vital risk management tool.