Options trading, a sophisticated investment strategy, offers traders the potential for significant profits. However, with great rewards comes inherent risk. Enter hedging, a powerful risk management tool that can safeguard your investments and enhance trading outcomes. This comprehensive guide will delve into the intricacies of hedging in options trading, empowering you with the knowledge and strategies to navigate the complexities of this dynamic market.

Image: tradeoptionswithme.com

What is Hedging in Options Trading?

Hedging, simply put, involves using one investment to offset the potential loss in another. In options trading, this translates to using one option contract to mitigate the risks associated with another option or an underlying asset. By pairing offsetting positions, traders can effectively reduce the overall risk of their portfolio.

Types of Hedging Strategies

Options trading offers several hedging strategies, each tailored to specific risk profiles and trading objectives. Here’s an overview of three common methods:

-

Delta Hedging: This involves adjusting the number of options contracts held in a portfolio to maintain a neutral delta position. By balancing positive and negative delta exposure, traders can minimize the impact of underlying asset price movements.

-

Ratio Hedging: Unlike delta hedging, ratio hedging uses a combination of different types of options contracts. By combining long and short options in specific ratios, traders can create customized risk-reward profiles that align with their trading goals.

-

Pairs Trading: This strategy pairs two highly correlated assets and involves buying one asset while simultaneously selling the other. By exploiting price discrepancies between the two assets, traders can potentially profit from convergence without exposing themselves to significant directional risk.

The Benefits of Hedging

The primary benefits of hedging in options trading include:

-

Risk Reduction: Hedging effectively reduces the volatility and potential losses associated with options trading. By offsetting risk positions, traders can limit the potential downside of their investments.

-

Enhanced Portfolio Performance: Hedging strategies can enhance the overall performance of an options trading portfolio. By managing risk, traders can protect gains and increase the probability of positive returns.

-

Increased Confidence: A well-executed hedging strategy instills confidence and allows traders to navigate market fluctuations with greater peace of mind.

Image: hercules.finance

Common Hedging Strategies in Options Trading

-

Covered Call: This involves selling a call option against an underlying asset that you own. The premium received from selling the call option provides a buffer against potential losses if the underlying asset’s price falls.

-

Protective Put: This strategy involves buying a put option while owning the underlying asset. The put option creates a downside safety net, protecting against unexpected price declines.

-

Collar: A collar strategy combines a covered call and a protective put. By selling a call option above the current price and buying a put option below, traders create a defined range within which they accept profits and losses.

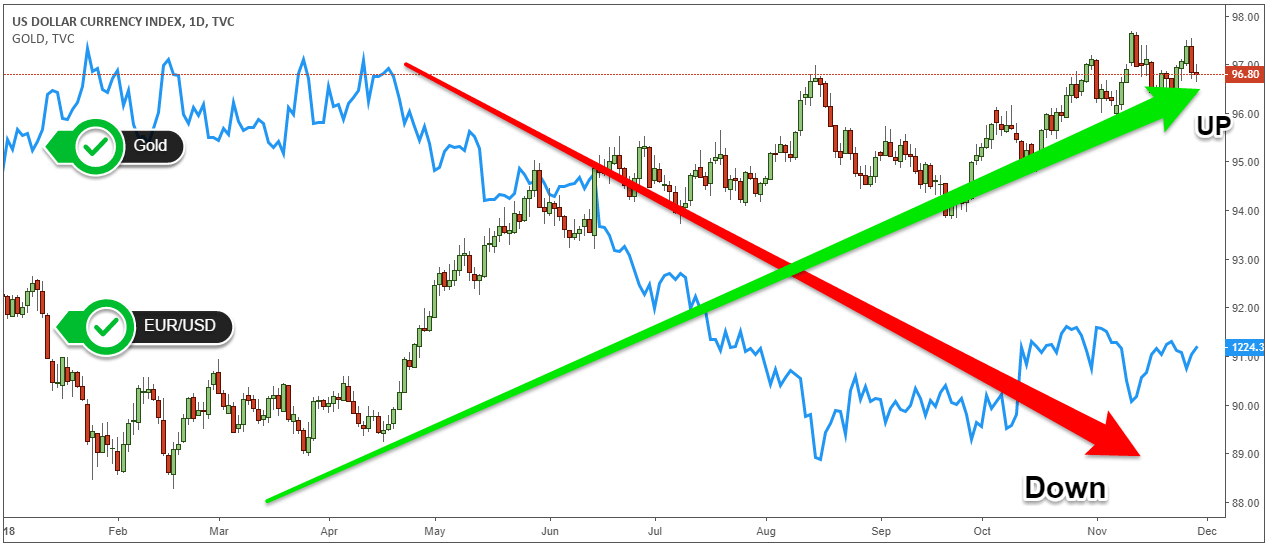

How To Use Hedging In Options Trading

Image: www.forex.academy

Conclusion

Hedging in options trading is a valuable tool that empowers traders to manage risk and enhance portfolio performance. By understanding the different types of hedging strategies and their applications, traders can mitigate the inherent risks of options trading and increase their chances of success. Armed with this knowledge, you’re well-equipped to navigate the dynamic landscape of options trading with confidence and a comprehensive risk management approach.