Introduction

Options trading offers a versatile range of strategies to manage risk and potentially enhance returns. Among these strategies, time spread orders (TSO) stand out for their flexibility and potential to generate income. In this article, we delve into the intricacies of TSOs, providing a comprehensive overview of their definition, history, and execution.

Image: tradingqna.com

Definition of a Time Spread Order

A time spread order involves the simultaneous purchase and sale of two options contracts with identical strike prices but different expiration dates. The underlying asset and the option type (call or put) remain the same. The primary intent behind a TSO is to capitalize on the anticipated movement of the underlying asset’s price over a specific time frame.

Execution and Types of TSOs

TSOs are typically executed as either calendar spreads or diagonal spreads. Calendar spreads involve options with different expiration dates but the same exercise date, while diagonal spreads involve options with both different expiration and exercise dates.

-

Calendar Spread: The calendar spread can be a bullish or bearish strategy. In a bullish spread, the trader buys a longer-term option and sells a shorter-term option with the expectation that the underlying asset’s price will rise. Conversely, in a bearish spread, the trader sells the longer-term option and buys the shorter-term option, anticipating a decline in the underlying asset’s price.

-

Diagonal Spread: Diagonal spreads also offer bullish and bearish strategies. In a bullish diagonal spread, the trader buys a shorter-term option and sells a longer-term option with the expectation of a price rise. In a bearish diagonal spread, the trader sells a shorter-term option and buys a longer-term option, anticipating a price decline.

Latest Trends and Developments in Options Trading TSOs

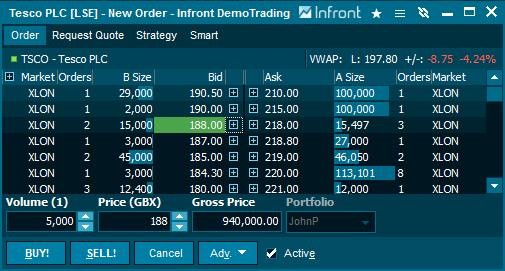

The advent of electronic trading platforms has revolutionized options trading, including TSO execution. Algorithmic trading and automated systems have enhanced order placement efficiency and precision.

Additionally, the advent of volatility indexes, such as the Volatility Index (VIX), has provided traders with valuable insights into market volatility, which is a crucial factor in TSO execution. Advances in market data analysis and risk management tools have also contributed to the growing popularity of TSOs.

Image: software.infrontservices.com

Tips and Expert Advice for TSO Trading

Successful options trading, including TSOs, requires a disciplined approach. Consider the following tips from experienced traders:

-

Understand the Basics: Thoroughly understand options pricing models, Greeks, and implied volatility before engaging in TSO trading.

-

Define Trading Goals: Clearly outline your trading objectives, whether it’s capital preservation, income generation, or speculation.

-

Manage Risk: Implement effective risk management strategies, including position sizing, stop-loss orders, and diversification.

-

Monitor the Market: Stay informed about macroeconomic conditions, market news, and technical indicators that affect the underlying asset’s price.

-

Seek Professional Advice: Consult with a financial advisor or broker for personalized guidance based on your financial situation and risk tolerance.

Frequently Asked Questions on Time Spread Orders

-

Q: What is the advantage of a TSO compared to buying or selling a single option?

-

A: TSOs offer potential income generation while limiting risk. By combining options with different expiration dates, traders can enhance the probability of profit in specific scenarios.

-

Q: How do TSOs differ from other option spread strategies?

-

A: Unlike vertical spreads, which involve options with different strike prices, TSOs involve options with identical strike prices. This distinction influences the risk-return profile and profit potential.

-

Q: Is TSO trading suitable for beginner traders?

-

A: While TSOs offer lower risk compared to single-leg option trading, they still require a solid understanding of options mechanics and market dynamics. Beginner traders should consider starting with simpler strategies.

Options Trading Tso

Image: www.stock-market-strategy.com

Conclusion

Options trading time spread orders (TSOs) provide traders with a flexible strategy for managing risk and potentially generating income. Understanding TSOs’ intricacies, incorporating the tips shared in this article, and maintaining a disciplined approach are key to successful execution. If you are intrigued by the possibilities of options trading TSOs, consider seeking further knowledge and guidance. Whether you are a seasoned trader or just starting your journey, embracing