Spread options trading offers unique opportunities for investors to enhance their returns and hedge against potential losses. With such a complex technique, it’s essential to carefully consider the trading platform you choose. In this comprehensive guide, we delve into the key criteria to evaluate and the best platforms to empower your spread options trading strategy.

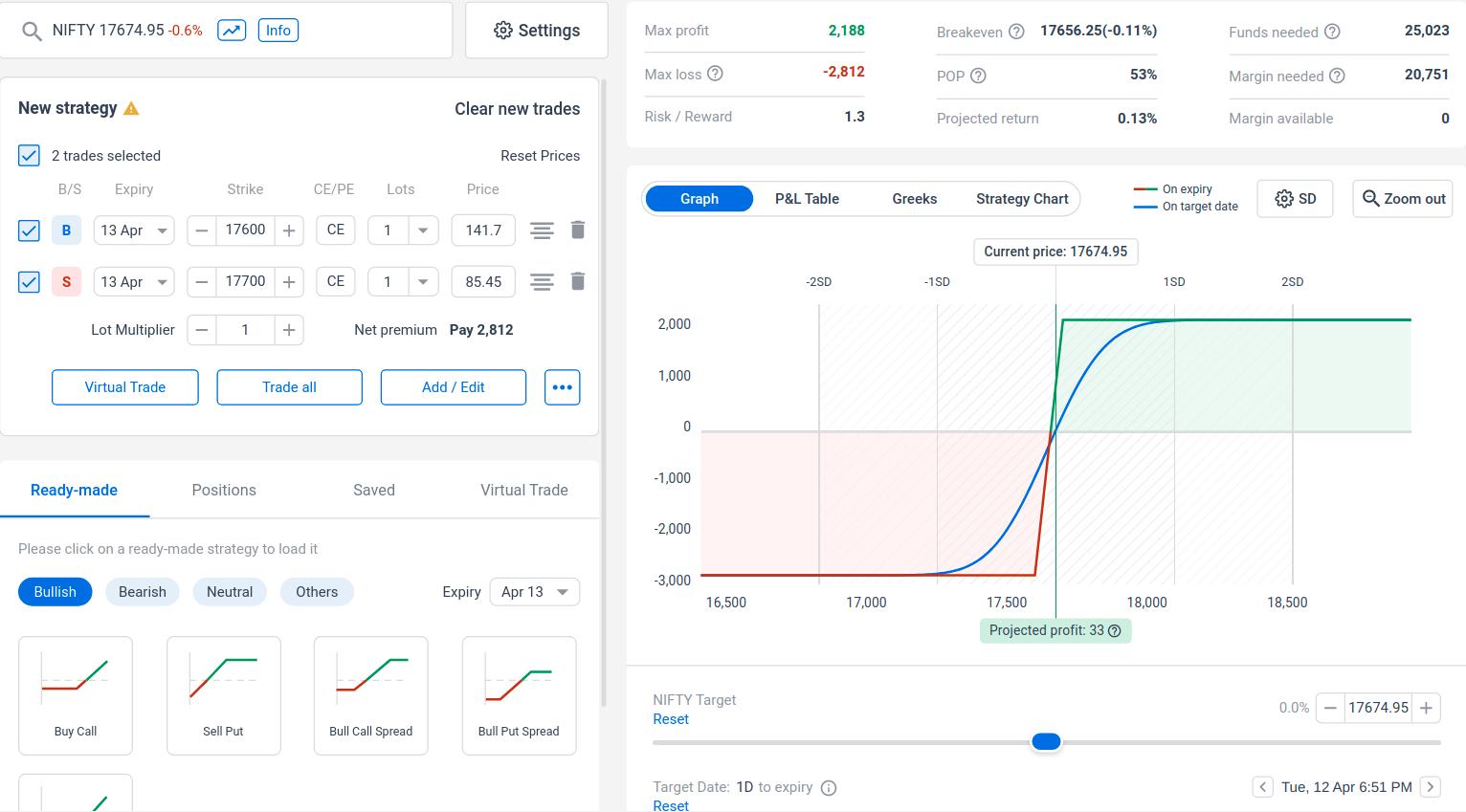

Image: tradersunion.com

Defining Spread Options

Spread options involve the simultaneous purchase and sale of options contracts with different strike prices and expiration dates. By combining these contracts, traders can create complex strategies to leverage market movements, manage risk, and tailor their profit potential.

Evaluating Spread Options Trading Platforms

When selecting the best platform for spread options trading, consider the following criteria:

- Trading Costs and Fees: Look for platforms with competitive commissions and transparent fee structures. Low fees can significantly increase profitability, especially for high-volume traders.

- Order Execution and Speed: A user-friendly order entry interface and swift order execution are crucial. Fast execution ensures you can capture favorable market conditions and minimize slippage.

- Product Range: Choose platforms that support a comprehensive range of spread options contracts, including various expiration dates and strike prices. This flexibility allows you to customize your strategies to match market dynamics and risk tolerance.

- Tools and Analysis Features: Advanced analytical tools, such as Greeks calculators, volatility scanners, and charting capabilities, empower traders to make informed decisions and assess risk effectively.

- Platform Stability: Reliable and stable platforms guarantee uninterrupted trading, minimizing the risk of missed opportunities or losses due to technical glitches.

- Customer Support: Responsive and knowledgeable customer support is invaluable, especially when navigating complex financial instruments and troubleshooting issues.

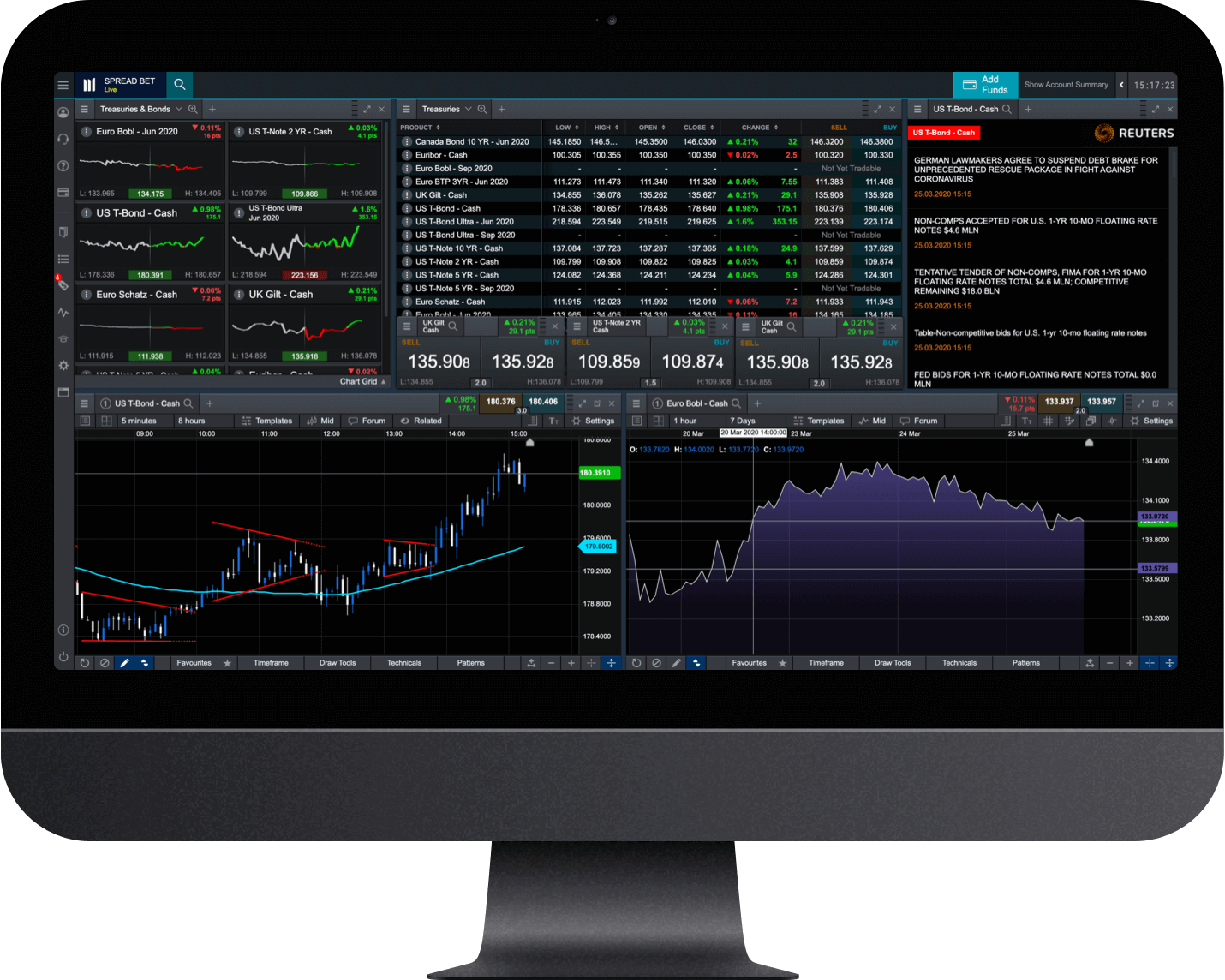

Top Platforms for Spread Options Trading

After thorough analysis, the following platforms stand out as the best choices for spread options traders:

- Interactive Brokers: Renowned for advanced order types, low fees, powerful analytical tools, and superior research capabilities.

- Tastyworks: A user-friendly platform designed specifically for options traders, featuring intuitive tools, educational resources, and fast order execution.

- thinkorswim (by TD Ameritrade): Offers advanced technical analysis, a comprehensive options chain, and exceptional trading simulations for strategizing.

- Fidelity Investments: A well-rounded platform with low trading costs, robust analysis tools, and a vast selection of options contracts.

- E*Trade: Known for its intuitive user interface, research capabilities, and competitive commissions.

Image: sensibull.com

Whats The Best Platform For Trading Spread Options

Image: howtotradeonforex.github.io

Conclusion

Choosing the right platform is paramount for successful spread options trading. By understanding key evaluation criteria, you can select a platform that aligns with your trading style, risk management approach, and profit goals. Remember to conduct thorough research, compare fees, and leverage available tools to maximize your trading outcomes and reap the benefits of these complex but rewarding strategies.