The financial markets offer an array of alluring opportunities for savvy investors to grow their wealth. Yet, within this labyrinth of complexities, options trading stands out as a particularly potent tool, empowering traders with the potential to amplify both their gains and their risks. Central to this intricate realm of options trading lies the concept of the ‘three-legged stool,’ a formidable trinity of foundational principles that anchors and stabilizes the trading strategies of countless seasoned traders.

Image: www.aihr.com

Understanding the Three-Legged Stool

Envision a sturdy three-legged stool, each leg representing an indispensable element in the framework of options trading: knowledge, discipline, and adaptability. Without any one of these legs, the very foundation of successful options trading teeters on the brink of collapse. Let’s delve deeper into each leg of the stool, examining its role in maintaining the trader’s balance in the volatile arena of options trading:

-

Knowledge: Knowledge is the bedrock upon which all successful endeavors are built. In the realm of options trading, this translates to a thorough comprehension of options concepts, strategies, and the intricate dynamics of the financial markets. Traders must possess a firm grasp of the Greeks, option pricing models, and the strategies they employ to navigate the complexities of the options market. Continuous learning and staying abreast of market trends are essential for informed decision-making.

-

Discipline: Discipline serves as the steadfast guide that steers traders through the turbulent waters of market fluctuations. It encompasses the resolute adherence to a well-defined trading plan that outlines parameters such as entry and exit points, risk management strategies, and emotional control. The ability to execute trades objectively, resist the temptations of fear and greed, and maintain a level head amidst market volatility are hallmarks of disciplined traders. Discipline is the rudder that keeps the trader’s course steady in the face of market storms.

-

Adaptability: The ever-changing landscape of the financial markets demands traders to be nimble and adaptable. This adaptability manifests in the trader’s ability to swiftly adjust their strategies and expectations in response to dynamic market conditions. Recognizing when a strategy is no longer viable and promptly shifting to a more suitable approach is a testament to a trader’s adaptability. The capacity to adapt ensures that the trader remains nimble and opportunistic in the face of unpredictable market movements.

Interdependence and Synergy

These three legs are not mere isolated elements but rather interdependent pillars that synergistically contribute to the success of options traders. Knowledge provides the foundation upon which discipline takes root. Discipline, in turn, fosters the trader’s adaptability by enabling them to execute trading decisions with conviction and agility. And adaptability allows traders to navigate the ever-changing market landscape and refine their strategies over time, drawing upon their knowledge and discipline.

Image: acasignups.net

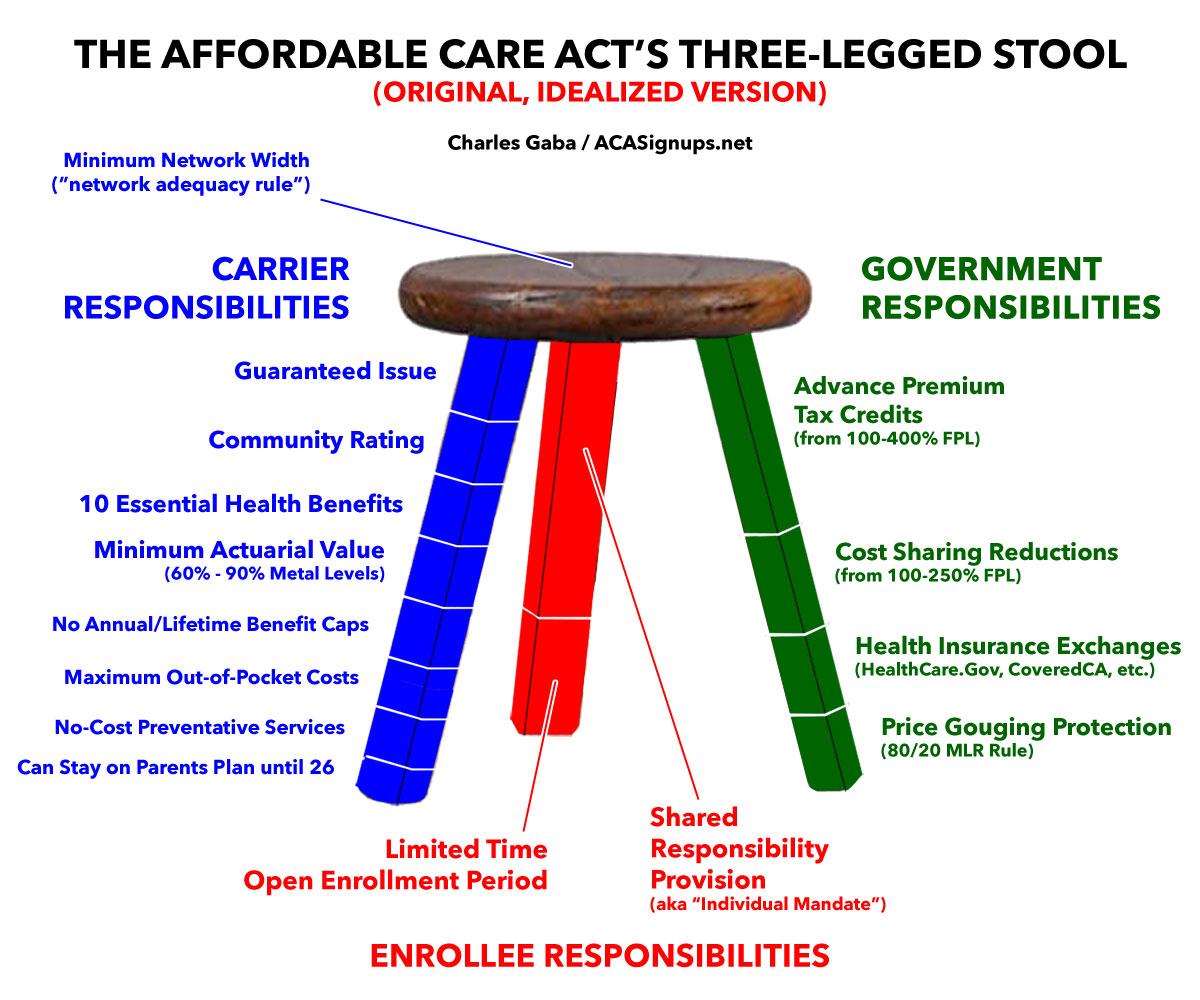

Options Trading Three Legged Stool

Image: www.researchgate.net

Conclusion

The three-legged stool of options trading – knowledge, discipline, and adaptability – embodies the essential elements that empower traders to navigate the complexities of the options market with poise and precision. By embracing this trinity of principles, traders can strengthen the foundation of their trading strategies, enhance their resilience amidst market fluctuations, and position themselves for consistent profitability in the dynamic realm of options trading.