Options trading, a sophisticated and potentially lucrative financial strategy, offers a unique blend of calculated risks and potential rewards. By understanding the intricacies of options contracts, investors can leverage their market knowledge to enhance their portfolios and navigate market fluctuations with greater agility. This comprehensive guide delves into the world of options trading, empowering readers with the insights and strategies they need to harness the opportunities and mitigate the risks associated with this dynamic investment vehicle.

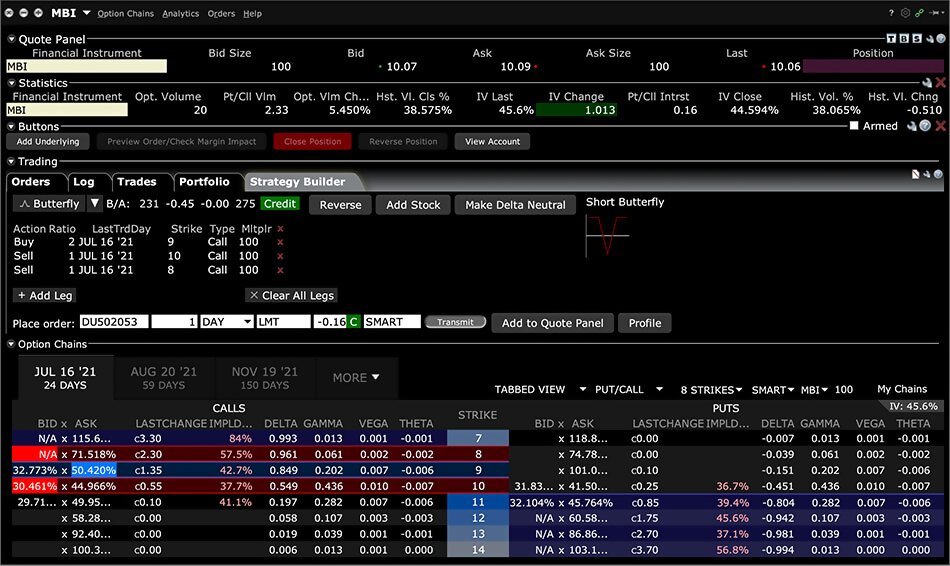

Image: www.interactivebrokers.co.uk

Defining Options Trading: A Journey into Versatility

Options trading involves the exchange of contracts that grant the buyer (or “owner”) the right, but not the obligation, to buy or sell an underlying asset (typically a stock, index, or commodity) at a predetermined price (the “strike price”) on or before a specified date (the “expiration date”). These contracts provide investors with a flexible instrument to speculate on market movements, hedge against potential losses, or enhance their investment returns.

The versatility of options trading stems from the wide range of strategies available to participants. From straightforward call and put options to more complex multi-leg strategies, options can be tailored to meet specific investor goals and risk tolerance. By understanding the different types of options and the nuances of each strategy, investors can tailor their trading approach to align with their objectives and market conditions.

The History of Options: From the Trading Pits to Digital Platforms

The origins of options trading can be traced back to ancient Greece, where merchants utilized forward contracts to manage the risks associated with their trade goods. However, it was not until the 19th century that options emerged in their modern form on the Chicago Board of Trade. The early days of options trading were characterized by open outcry in trading pits, where traders communicated and executed orders through hand gestures and vocalizations.

With the advent of electronic trading platforms in the late 20th century, options trading underwent a significant transformation. The digitization of the market improved transparency, increased liquidity, and facilitated faster execution times. Today, options are traded globally on exchanges and through electronic networks, providing investors with unprecedented access to this dynamic market.

Fundamental Concepts: Unraveling the Options Lexicon

To navigate the world of options trading effectively, a clear understanding of fundamental concepts is essential. Key terms include:

Call Option: A contract that grants the holder the right to purchase the underlying asset at the strike price on or before the expiration date.

Put Option: A contract that grants the holder the right to sell the underlying asset at the strike price on or before the expiration date.

Strike Price: The predetermined price at which the underlying asset can be bought (in the case of a call option) or sold (in the case of a put option).

Expiration Date: The date on which the option contract expires, rendering it worthless if not exercised or sold before.

Premium: The price paid to the seller of an option in exchange for the rights granted by the contract.

Grasping these fundamental concepts is paramount to understanding the mechanics and implications of options trading.

Image: info.artykulownia.pl

Real-World Applications: Options Beyond Speculation

While options are often associated with speculative trading, they offer diverse applications that go beyond basic speculation. These include:

Hedging Strategies: Options can be used to reduce risks associated with existing stock positions. For example, purchasing a put option against a stock portfolio can provide downside protection if the market declines.

Income Generation: Options can be employed to generate additional income through strategies such as selling covered calls or writing call options.

Market Neutrality: Options allow investors to take advantage of price movements without directional bias. Using option strategies like straddles and strangles, investors can profit from both rising and falling markets.

Understanding the real-world applications of options provides investors with a broader perspective on the utility of these contracts within a comprehensive investment strategy.

Options Trading Jo

Image: erainnovator.com

Technical Analysis: Empowering Informed Decisions

In the realm of options trading, technical analysis plays a vital role in identifying trading opportunities and assessing potential market trends. By studying historical price patterns, volume data, and momentum indicators, traders can gain insights into the supply and demand dynamics of the underlying asset. This information can be leveraged to make informed decisions about option premiums, strike prices, and expiration dates.

Technical analysis techniques range from simple moving averages to complex oscillators and chart patterns. By mastering these techniques and incorporating them into their trading approach, traders can enhance their ability to navigate market