Unveiling the Secrets to Success

The world of options trading can be an exciting and rewarding endeavor, but it is crucial to navigate it with a strategic approach. Choosing the right stocks is paramount to maximizing your chances of success. In this article, we will delve into the intricacies of stock selection for options trading in the Indian market, empowering you with the knowledge and techniques you need to make informed decisions.

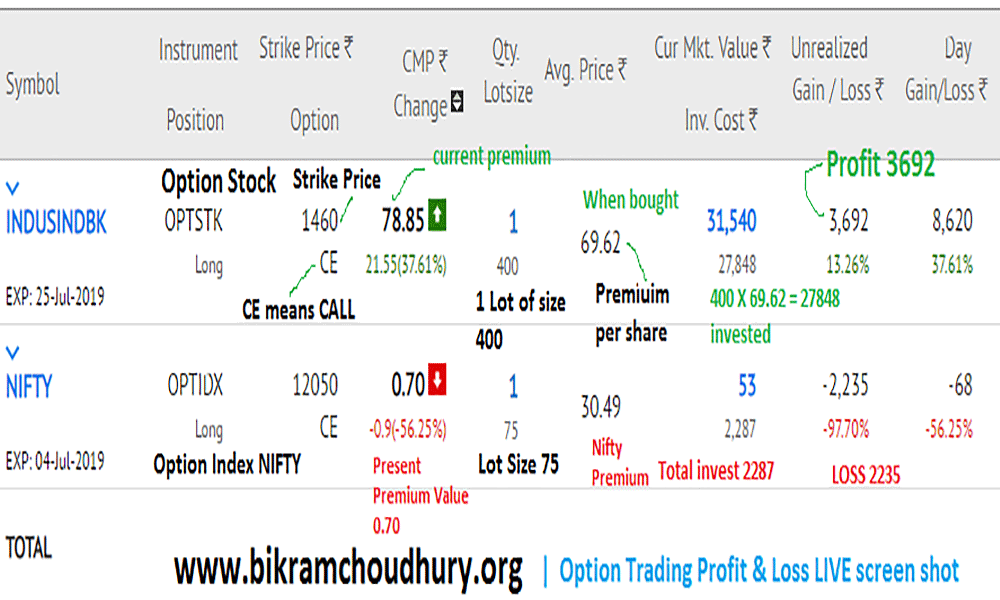

Image: www.bikramchoudhury.org

Mastering the Basics of Options

Understanding Options

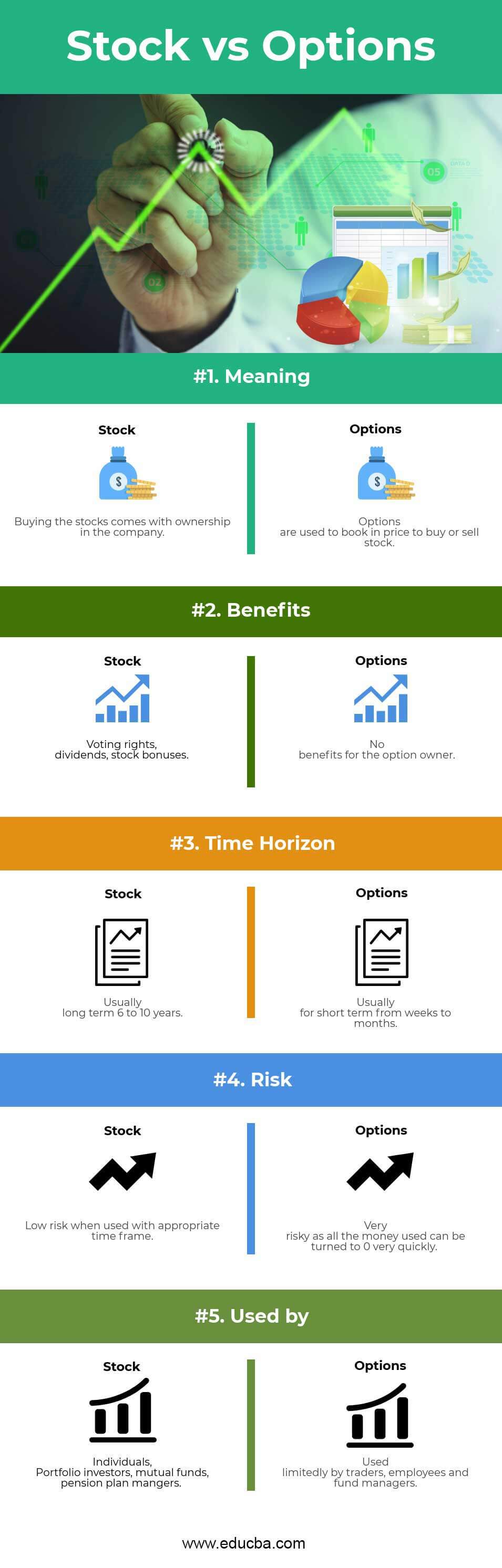

Options are financial contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset, such as a stock, commodity, or currency, at a predefined price on or before a specified date. The two main types of options are calls, which give the buyer the right to buy, and puts, which confer the right to sell.

Decoding the Stock Selection Methodology

Technical Analysis

Technical analysts examine historical price patterns and technical indicators to forecast future price movements. They use chart patterns, moving averages, and oscillators to identify potential trading opportunities.

Fundamental Analysis

Fundamental analysts assess a company’s financial performance, industry outlook, and management strategies to determine its intrinsic value. They consider factors such as revenue growth, profitability, debt levels, and dividend payments.

Image: www.educba.com

Market Trends

Monitoring market trends is essential for options traders. Sentiment analysis, news updates, and economic indicators can provide valuable insights into the broader market direction, which can influence stock prices.

Tips and Expert Advice from Seasoned Traders

-

Favor stocks with high liquidity: Options on highly traded stocks have ample bid-ask spreads, enabling traders to execute orders swiftly and efficiently.

-

Consider open interest: Open interest represents the number of outstanding contracts for a particular option. High open interest indicates strong market interest and enhances liquidity.

-

Analyze volatility: Volatility measures the magnitude of price fluctuations. Higher volatility can provide greater profit potential, but it also carries more risk.

-

Set realistic profit targets: Options traders should establish clear profit goals before initiating a trade to avoid overtrading and emotional decision-making.

-

Manage risk through diversification: Diversifying your options portfolio across different industries and sectors can mitigate portfolio risk and improve the chances of consistent returns.

FAQs on Stock Selection for Options Trading

-

Q: What is the best time frame for technical analysis?

-

A: The timeframe depends on the trading strategy. Short-term traders use intraday charts, while long-term traders prefer weekly or monthly charts.

-

Q: Can fundamental analysis predict stock prices accurately?

-

A: Fundamental analysis provides insights into a company’s health, but it cannot precisely predict stock prices. However, it can assist in identifying undervalued or overvalued stocks with potential for growth or correction.

-

Q: How much should I diversify my options portfolio?

-

A: Diversification depends on your risk tolerance and capital. A well-diversified portfolio typically includes stocks from different industries and sectors.

How To Pick Stocks For Options Trading In India

Image: medium.com

Conclusion

Mastering stock selection for options trading in India requires a thorough understanding of options, technical and fundamental analysis, market trends, and expert advice. By implementing the principles outlined in this article, you can take a strategic approach to stock selection and increase your chances of success in the options market. Whether you are a seasoned trader or just starting your options trading journey, the knowledge and tips provided here will empower you to navigate this exciting and potentially rewarding financial instrument with confidence.

Do you find this comprehensive guide on stock selection for options trading in India helpful? Share your thoughts and pertanyaan in the comments section below.