In the realm of financial markets, traders often navigate two distinct paths: commodity trading and options trading. While both avenues offer investors opportunities for profit, they are characterized by unique complexities and diverse strategies.

Image: tradingcommodityoptions.com

Commodity trading encompasses the buying and selling of raw materials such as oil, gold, and agricultural products. These assets derive their value from their intrinsic utility and are traded on specialized exchanges, such as the Chicago Mercantile Exchange (CME). Commodity prices fluctuate based on factors like supply and demand, weather patterns, and geopolitical events.

Options Trading: A Calculated Gamble

Options trading, on the other hand, involves the buying and selling of options contracts. An option contract grants the buyer the right, but not the obligation, to buy or sell a specific asset at a predetermined price and date. Options trading is commonly used for hedging risk, speculating on price movements, and generating additional income.

Understanding Key Differences

- Underlying Assets: Commodity trading deals with physical commodities, while options trading involves contracts based on underlying assets such as stocks, bonds, or commodities.

- Settlement: Commodities are usually delivered physically upon contract expiration, whereas options can be settled either by delivery or cash.

- Risk-Reward Profile: Commodity trading carries higher risk due to price volatility, while options trading offers varying levels of risk based on the option type and leverage used.

- Leverage: Options trading allows for higher leverage, potentially amplifying both profits and losses.

Trending Tides and Technological Advancements

The world of both commodity and options trading is evolving rapidly, fueled by technological advancements and evolving market dynamics.

In commodity trading, digital platforms and data analytics are transforming the way traders monitor market conditions and execute trades. Blockchain technology is also gaining traction, offering the potential for more streamlined and transparent trading processes. Options trading, too, is embracing automation and algorithmic trading, enabling faster and more efficient execution of strategies.

Image: www.cmcmarkets.com

Expert Insights for Success

- Start Small: Begin with a modest portfolio and trade with manageable amounts to minimize risk.

- Research and Education: Gain a thorough understanding of market dynamics, trading strategies, and potential risks before delving into either commodity or options trading.

- Risk Management: Implement robust risk management practices to mitigate potential losses, such as setting stop-loss orders and diversifying your portfolio.

- Trading Psychology: Develop a strong trading mindset that emphasizes discipline, patience, and emotional control.

- Seek Guidance: Consider consulting with an experienced financial advisor or mentor to provide guidance and support.

FAQs for Enhanced Clarity

Q: Which is better, commodity trading or options trading?

A: Both have merits and risks. Commodity trading offers diversification and potential inflation hedges, while options trading provides flexibility and income-generating strategies.

Q: How do I get started with commodity or options trading?

A: Open an account with a reputable brokerage firm and educate yourself on market concepts and trading strategies. Start with small trades and gradually increase your exposure as you gain experience.

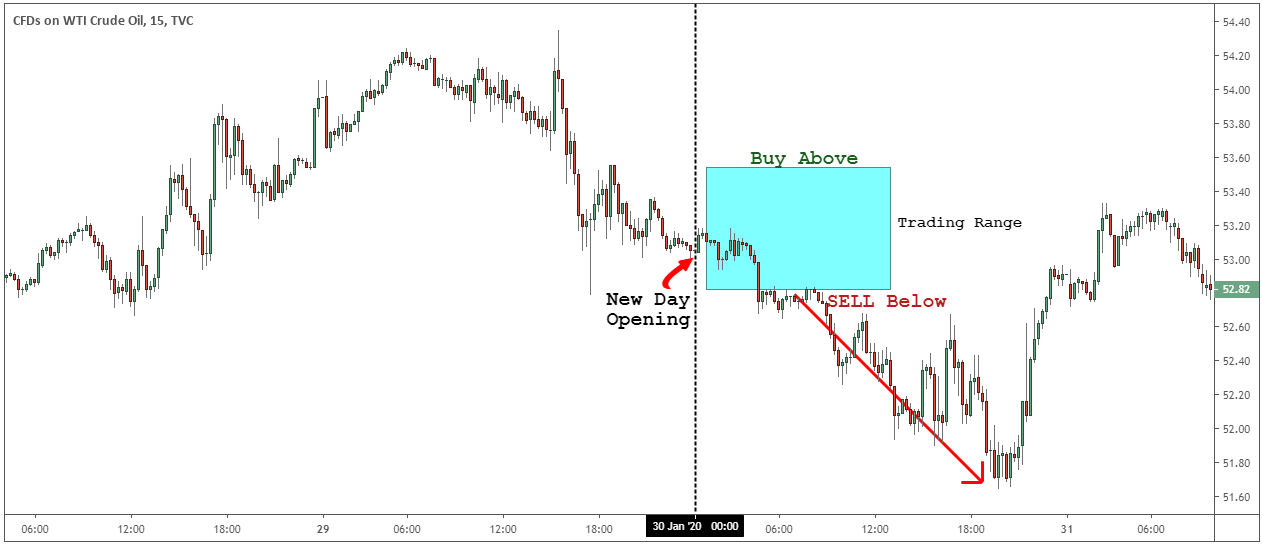

Commodity Trading Vs Options Trading

Image: tradingstrategyguides.com

Conclusion

Navigating the intricacies of commodity trading vs options trading requires a discerning eye and an understanding of the unique characteristics of each. By embracing the dynamic nature of these markets, employing effective strategies, and seeking continuous education, savvy investors can harness the opportunities while mitigating potential pitfalls. Whether your path leads you to commodities or options, remember that the pursuit of financial success is an ongoing journey of knowledge, resilience, and unwavering discipline.

Are you intrigued by the world of commodity trading or options trading? Share your thoughts and questions below, and let’s dive deeper into this captivating realm of financial exploration.