Image: www.youtube.com

Options have emerged as a powerful financial instrument, empowering traders with the flexibility to optimize their investments and manage risks. With the proliferation of options trading platforms, selecting the right tools is crucial for leveraging market opportunities seamlessly. This comprehensive guide delves into the best options trading tools, empowering you with the knowledge to elevate your trading strategies.

Understanding Options Trading

Options trading involves buying or selling contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) by a specific date (expiration date). Options provide investors with the ability to capitalize on market movements without committing to the full purchase or sale of the asset, thus providing flexibility and risk management capabilities.

The Top Options Trading Tools

Navigating the options trading landscape requires tools that enhance decision-making, risk management, and order execution. Here are the most effective tools to consider:

1. Brokerage Platforms

The cornerstone of options trading is a reliable brokerage platform. Look for platforms that offer comprehensive options trading capabilities, low commissions, and user-friendly interfaces. Interactive Brokers, tastyworks, and TD Ameritrade are renowned for their robust offerings in this domain.

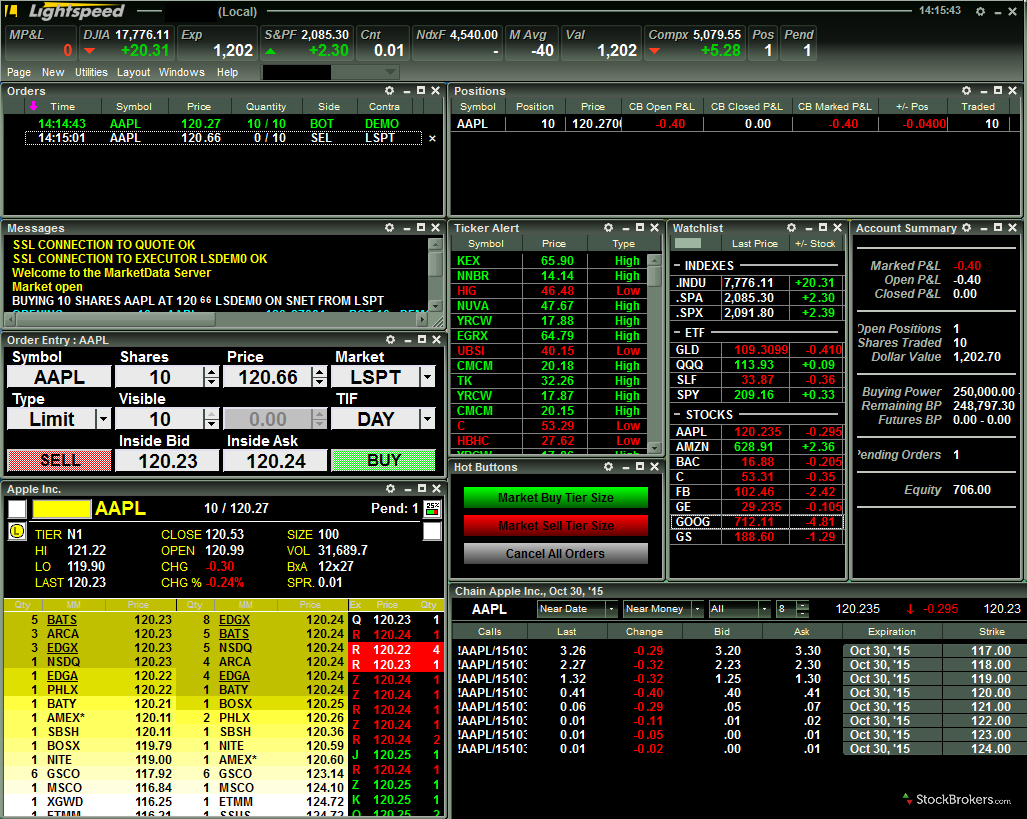

2. Trading Software

Trading software complements brokerage platforms by providing advanced charting capabilities, technical analysis tools, and research reports. TradeStation, Thinkorswim, and ProRealTime are leading platforms that empower traders with a comprehensive suite of features.

3. Market Data Providers

Real-time market data is essential for informed options trading decisions. Market data providers such as Bloomberg, Refinitiv, and FactSet deliver up-to-date market quotes, historical data, and news updates, ensuring traders stay abreast of market dynamics.

4. Option Pricing Models

Option pricing models are mathematical algorithms used to estimate the fair value of options contracts. The Black-Scholes model is the most widely used, while more sophisticated models like the Heston model provide greater accuracy in certain scenarios.

5. Risk Management Tools

Options trading involves inherent risks. Risk management tools like profit/loss calculators, stop-loss orders, and Greeks analysis help traders monitor and minimize their exposure to market fluctuations.

6. Educational Resources

Continuously enhancing your options trading knowledge is paramount. Utilize educational resources provided by brokers, online courses, and books to stay up-to-date on market trends and best practices.

Conclusion

The best options trading tools empower traders with the knowledge, control, and flexibility to navigate market uncertainties and capitalize on opportunities. By leveraging these tools, traders can make informed decisions, manage risks effectively, and maximize their returns in the dynamic world of options trading. Remember, consistent learning and informed decision-making are the keys to unlocking market mastery.

Image: interactivetrader130.hatenablog.com

Best Tools For Options Trading

Image: medium.com