Introduction

In the ever-evolving landscape of financial markets, a powerful tool known as fidelity option trading form has emerged. This sophisticated instrument allows astute traders to customize their investments and potentially enhance their returns. For those seeking a deeper understanding, this comprehensive guide will illuminate the intricacies of fidelity option trading form, empowering you to make informed decisions and unlock the opportunities it holds.

Image: www.pdffiller.com

What is fidelity option trading form?

Fidelity option trading form is a type of derivative contract that grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price on or before a predetermined date. Unlike traditional stock trading, options trading provides leverage, enabling traders to control a significant number of shares with a relatively small initial investment.

Key Features of fidelity option trading form

-

Premium: The price paid to acquire the option contract.

-

Strike price: The price at which the trader can buy or sell the underlying asset.

-

Expiration date: The date on which the option contract expires and is no longer valid.

-

Underlying asset: The security or commodity to which the option applies, such as stocks, indices, or currencies.

Types of fidelity option trading form

-

Call option: Gives the holder the right to buy the underlying asset at the strike price.

-

Put option: Gives the holder the right to sell the underlying asset at the strike price.

Image: www.nbcdfw.com

Risk Management in fidelity option trading form

While options trading offers the potential for high returns, it also carries inherent risks. Traders must carefully consider the following:

-

Unlimited losses: Option contracts involve the potential for unlimited losses.

-

Time decay: Option value erodes over time, regardless of the underlying asset’s performance.

-

Implied volatility: The higher the implied volatility, the more expensive the option contract and the greater the risk.

Benefits of fidelity option trading form

-

Leverage: Options trading amplifies potential profits with a relatively small investment.

-

Flexibility: Options contracts offer flexibility in terms of strike price and expiration date, enabling traders to tailor their strategies.

-

Income generation: Selling options can generate income through premiums, even if the underlying asset’s price remains unchanged.

Strategies for Trading fidelity option trading form

-

Covered call: Selling a call option against shares you own to generate income.

-

Cash-secured put: Selling a put option with the cash to buy the underlying asset if the option is exercised.

-

Bull call spread: Buying a call option at a lower strike price and selling a call option at a higher strike price.

Expert Insights on fidelity option trading form

“Options trading requires a deep understanding of market dynamics and risk management strategies,” emphasizes Mark Miller, a renowned options trader. “Thorough research and a disciplined approach are crucial for success.”

Tips for Success in fidelity option trading form

-

Educate yourself: Gain a comprehensive understanding of options trading concepts, strategies, and risks.

-

Start small: Begin with small trades until you develop confidence and experience.

-

Use trading technology: Leverage online trading platforms and tools to facilitate your trades efficiently.

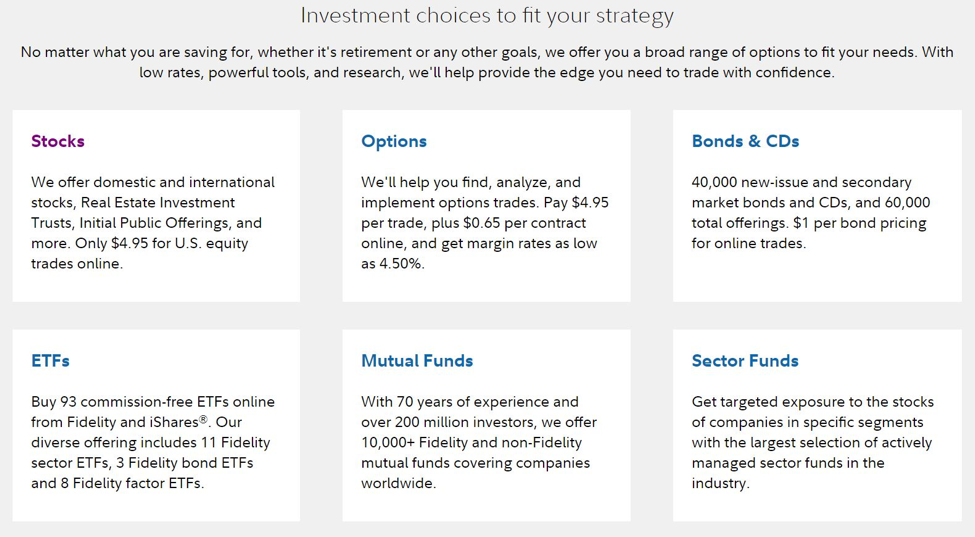

Fidelity Option Trading Form

Image: www.trading101.com

Conclusion

Fidelity option trading form is a potent investment vehicle that, when wielded with knowledge and skill, can unlock significant financial opportunities. However, it is paramount to approach options trading with caution and a thorough understanding of its inherent risks. By embracing the principles outlined in this guide, you will be well-equipped to navigate the complexities of fidelity option trading form and harness its potential to augment your financial portfolio.