Introduction

In the ever-evolving landscape of financial markets, exchange-traded funds (ETFs) have emerged as a cornerstone investment vehicle. Offering diversification, liquidity, and affordability, ETFs have revolutionized the way investors access diverse asset classes. ETF options trading, a sophisticated investment strategy, elevates the functionality of ETFs, allowing traders to strategically navigate market fluctuations while amplifying potential returns.

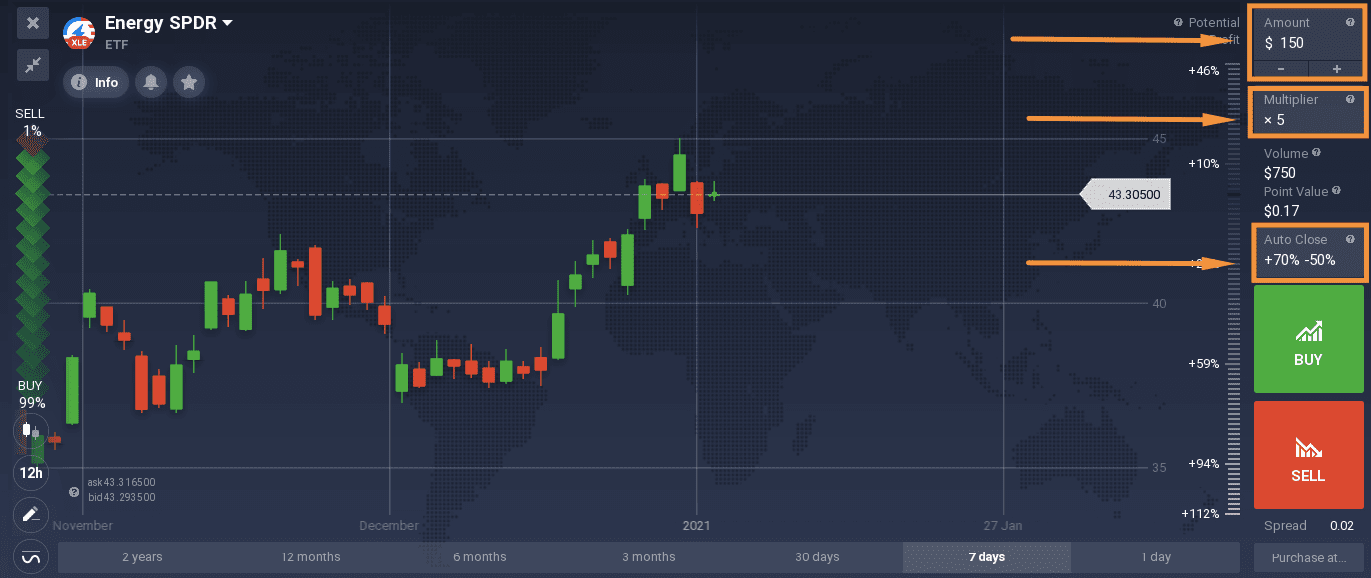

Image: blog.iqoption.com

This comprehensive guide delves into the intricacies of ETF options trading, empowering you with the knowledge and techniques to harness this powerful tool. Whether you’re an experienced trader seeking to enhance your skillset or a novice eager to explore new investment horizons, this article will provide you with the insights you need to strategically leverage ETF options.

Understanding ETF Options Trading

ETF options are derivative contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) the underlying ETF at a specified price (strike price) on or before a set date (expiration date). Unlike traditional options, ETF options are standardized and traded on exchanges, offering a regulated and transparent marketplace.

The distinct advantage of ETF options lies in their versatility. They provide investors with the flexibility to:

- Hedging Risk: Protect existing ETF holdings against potential market downturns or hedge against risk from other investments.

- Speculating on Market Direction: Express bullish or bearish market views by buying call or put options, respectively.

- Generating Income: Implement option strategies, such as selling covered calls or cash-secured puts, to generate consistent income from premium payments.

Key Concepts of ETF Options Trading

Premium: The price paid upfront to acquire an ETF option contract.

Strike Price: The price at which you can buy or sell the underlying ETF if you exercise the option.

Expiration Date: The date on which the option contract expires and becomes worthless.

Intrinsic Value: The difference between the current market price of the underlying ETF and the strike price.

Time Value: The additional value of an option due to its time to expiration.

Real-World Applications of ETF Options Trading

Bullish Market Bets: Purchasing a call option grants you the right to buy an ETF at a set price in the future. If the market rises, the ETF’s value will likely exceed the strike price, allowing you to exercise the option for profit.

Bearish Market Positions: Buying a put option provides downside protection by giving you the right to sell an ETF at a set price in the future. In a declining market, you can exercise the put option to sell the ETF at a higher price than the current market value, protecting yourself from losses.

Income Generation: Selling covered calls involves selling call options against ETF shares you own. By receiving a premium, you generate income while maintaining exposure to potential ETF upside.

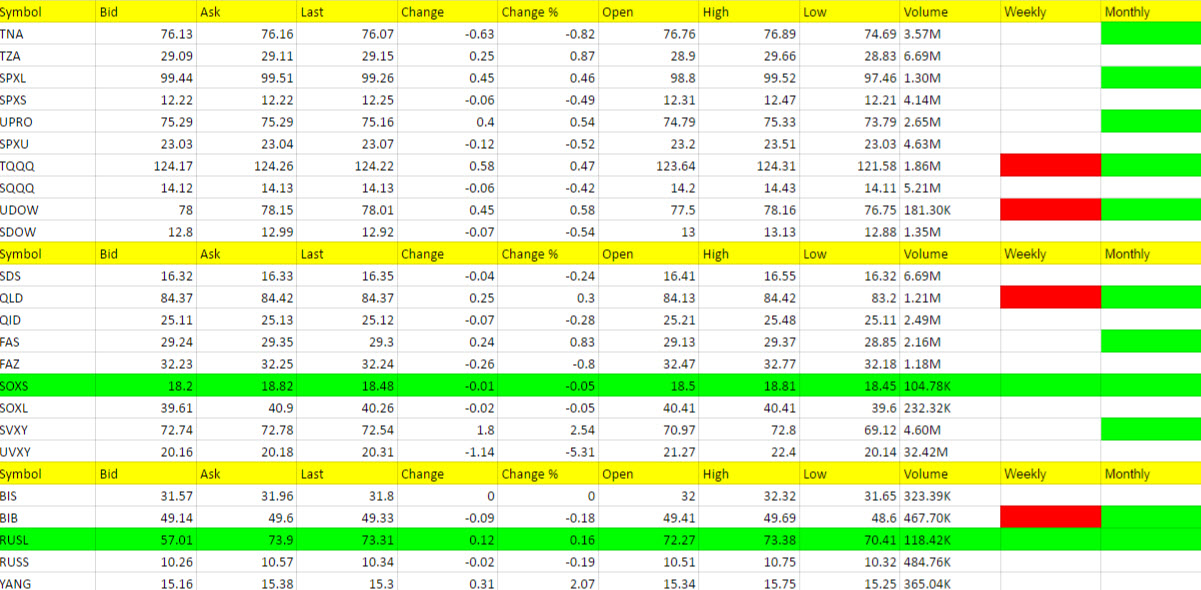

Image: buygoldandsilversafely.com

Market Trends and Developments

ETF options trading has experienced substantial growth in recent years as investors seek alternative investment strategies. The proliferation of low-cost ETFs has made it easier to diversify investments and trade options on various asset classes.

Emerging technologies such as algorithmic trading and artificial intelligence are revolutionizing option trading by providing sophisticated tools for analysis and execution. These advancements enable traders to better manage risk and identify high-probability trade setups.

Etf Options Trading Service

Image: www.youtube.com

Conclusion

ETF options trading offers a powerful tool for enhancing investment strategies and achieving financial goals. By understanding the concepts, applications, and latest trends, you can leverage these versatile contracts to:

- Manage risk effectively

- Capitalize on market opportunities

- Generate income and enhance returns

Remember that options trading involves inherent risks, and thorough research and sound risk management practices are crucial before venturing into this realm. With a comprehensive understanding and a strategic approach, ETF options trading can empower you to unlock new possibilities and navigate the ever-changing financial landscape.