Options trading is a complex and nuanced realm, and understanding how to sell call options is a crucial skill for any aspiring trader. My own endeavor into options trading began with exploring the intricacies of selling call options. It was a transformative journey that taught me the value of calculated risks and the potential rewards that lie beyond.

Image: vantagepointsoftware.com

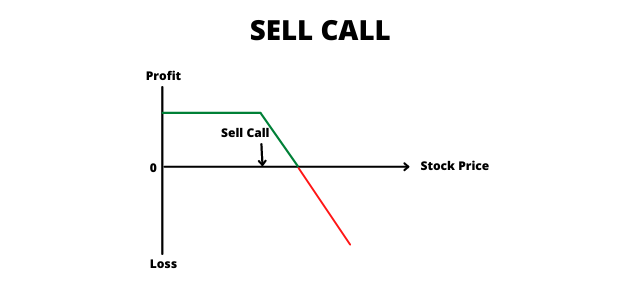

Trading call options involves granting another party the right, but not the obligation, to purchase a specific asset at a predetermined price (the strike price) before a particular date (the expiration date). By selling a call option, you are essentially betting that the asset’s price will remain below the strike price for the duration of the contract.

Understanding the Mechanics of Selling Call Options

When you sell a call option, you are essentially creating a contract with the buyer. The buyer pays you a premium in exchange for the right to purchase the underlying asset at the strike price. You, as the seller, are obligated to sell the asset if and when the buyer exercises their right to purchase.

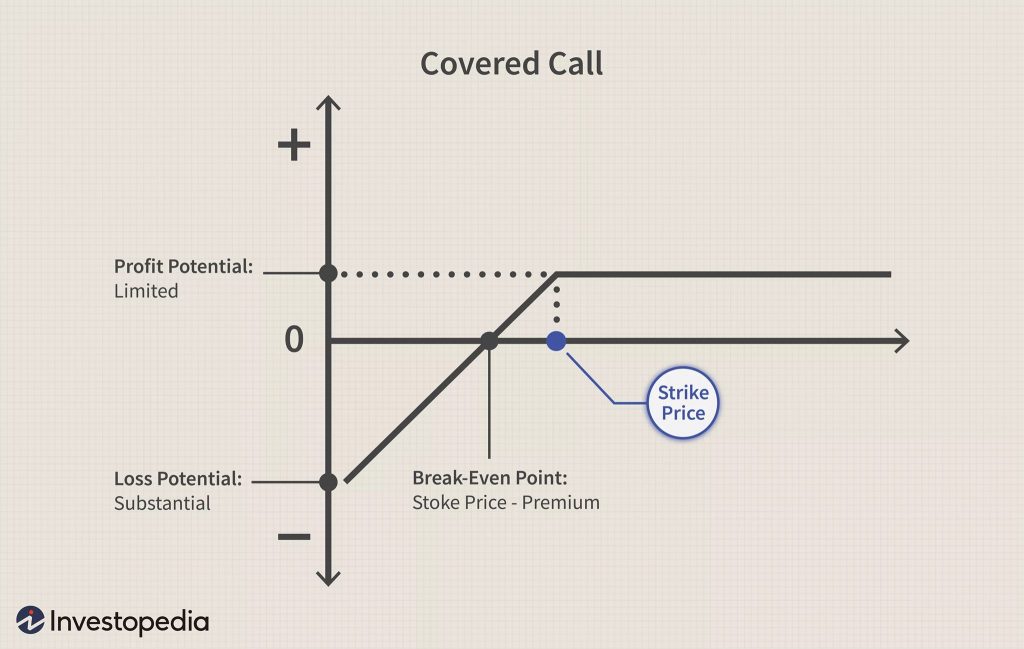

The profit or loss you make from selling a call option depends on several factors, including the asset’s price, the strike price, the time to expiration, and the volatility of the underlying asset. If the asset’s price remains below the strike price, you will keep the premium paid by the buyer, and the option will expire worthless. However, if the price rises above the strike price, the buyer may exercise their option, and you may be required to sell the asset at a loss.

Managing Risk When Selling Call Options

Selling call options can be a lucrative strategy, but it is important to manage your risk carefully. Here are some tips for minimizing your risk:

- Sell options on assets that you own or are familiar with. This will help you better understand the risks involved and make more informed decisions.

- Choose strike prices and expiration dates carefully. The strike price should be above the current price of the asset to give you some buffer, and the expiration date should be far enough out to give the asset time to appreciate in value.

- Manage your position size. Don’t sell more call options than you can afford to lose. Only allocate a small percentage of your portfolio to options trading, and trade with a sum that you’re willing to lose.

- Monitor your positions closely. Track the price of the underlying asset closely and be prepared to adjust your strategy as needed. If the asset’s price starts to approach the strike price, you may need to buy back the option to protect your position.

Frequently Asked Questions about Selling Call Options

Q: What are the advantages of selling call options?

A: Selling call options can offer several advantages, including:

- Generating income through premiums

- Hedging against risk on long positions

- Speculating on the direction of the market

Q: What are the risks of selling call options?

A: The main risk of selling call options is that you may be required to sell the underlying asset at a loss if the price rises above the strike price.

Q: When is it a good time to sell call options?

A: It’s generally a good time to sell call options when the underlying asset is trending sideways or slightly upwards and you expect the price to remain within a specific range.

Image: bse2nse.com

Options Trading Sell Call

Image: www.vietish.com

Conclusion

Selling call options can be a powerful tool for traders who understand how to manage risk and who possess a fundamental knowledge of the options market. The potential rewards can be significant, but it’s essential to approach options trading with a measured and calculated approach.

If you’re interested in exploring options trading further, I encourage you to seek out educational resources and consult with a financial professional. With proper preparation and a disciplined trading plan, you can increase your chances of success in this challenging yet exhilarating market.