In the realm of investing, the quest for profit is a common endeavor. Options trading presents a unique avenue to potentially maximize returns. However, navigating this complex financial instrument requires a thorough understanding of its mechanisms and potential outcomes. This comprehensive guide will delve into a concise example of option trading profit to shed light on its intricacies and provide actionable tips for aspiring traders.

Image: www.youtube.com

Unlocking Option Trading Profits

Options contracts grant the buyer the right, but not the obligation, to buy or sell an underlying asset (such as a stock or currency) at a specified price on or before a predetermined date. Profit is realized when the option’s value increases above the premium paid to acquire it.

Understanding the Underlying Asset

The underlying asset of an option plays a pivotal role in determining its value. By understanding the asset’s historical price movements, current market conditions, and future prospects, traders can gauge the potential profitability of an option trade.

Here’s an example of a profitable option trading scenario:

Example of Option Trading Profit

- Bayer acquires 100 call options (contracts giving the right to buy) for Apple stock at a strike price of $150, with an expiration date of January 2024. The premium paid for each option is $4.

- Prior to expiration, Apple’s stock price surpasses $160. The value of Bayer’s call options increases substantially, as each contract now grants him the right to buy Apple stock at $150 and sell it at the higher market price of $160.

- Bayer capitalizes on the profit opportunity by exercising his option to purchase 10,000 shares of Apple stock (100 contracts x 100 shares per contract) at a total cost of $1,500,000 (100 contracts x $150 strike price).

- Bayer subsequently sells the acquired shares at the current market price of $160 per share, generating a total revenue of $1,600,000 (10,000 shares x $160 share price).

- By subtracting the initial premium paid ($4 per contract x 100 contracts = $400), Bayer’s net profit from this option trade amounts to $96,000 ($1,600,000 – $400).

This example underscores the potential profitability of option trading, highlighting the significance of strategic decision-making and timing. While options can offer lucrative returns, it’s imperative to remember that they also carry inherent risk due to factors such as market volatility and time decay.

Image: optionstradingiq.com

Expert Tips for Option Trading Success

Embarking on option trading requires a well-informed approach. Here are some expert tips to enhance your trading strategies:

Master Risk Management Techniques

Prudent risk management is a cornerstone of option trading. Employ strategies such as stop-loss orders to limit potential losses and position sizing to allocate capital wisely.

Embrace Volatility

Volatility is a double-edged sword in option trading. While it can magnify profits, it can also amplify losses. Understanding how to leverage volatility to your advantage is crucial for long-term success.

Regularly Monitor Market Dynamics

The financial markets are constantly evolving. Stay updated on economic news, industry trends, and geopolitical events that can impact the underlying assets of your options.

Seek Mentorship or Education

Learning from experienced traders or pursuing formal education can provide invaluable insights into the complexities of option trading. Consider joining forums or attending workshops to expand your knowledge base.

FAQs on Option Trading

- What is options trading?

Options trading involves the buying and selling of contracts that grant the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a predetermined date. - What are the potential benefits of option trading?

Options trading offers the potential for high returns and flexibility in tailoring trades to specific investment goals. - What are the risks associated with option trading?

Options trading carries inherent risk due to factors such as market volatility, time decay, and the possibility of losing the entire premium paid. - How do I get started with option trading?

Before engaging in option trading, it’s essential to gain a comprehensive understanding of the markets, risk management techniques, and trading strategies. Consider seeking mentorship, pursuing education, or utilizing online resources to enhance your knowledge.

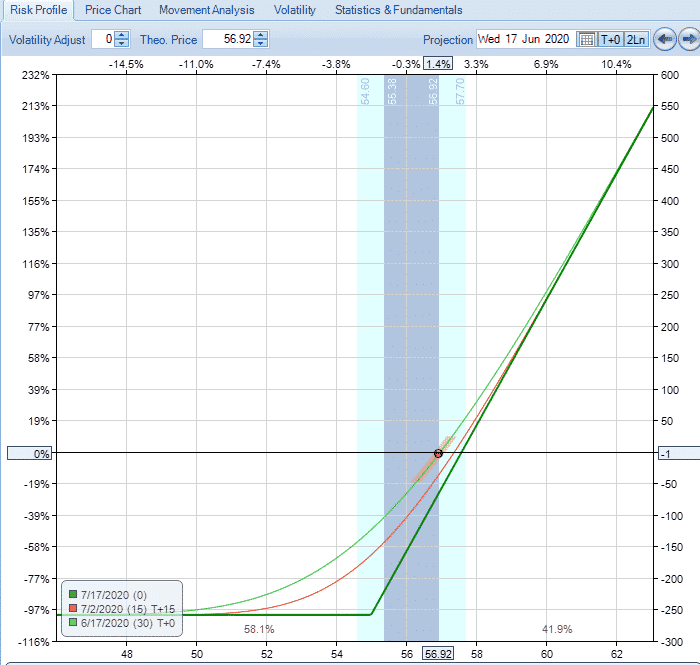

Option Trading Profit Example

Image: www.wealthyoptions.in

Conclusion

Option trading presents a captivating opportunity for potential profit, but it also demands a profound understanding of its intricacies and associated risks. By delving into this detailed example and incorporating expert tips and insights, you can enhance your trading strategies and navigate the world of options with greater confidence. Are you ready to embark on your option trading journey? Embracing knowledge, managing risk, and leveraging market dynamics can empower you to unlock the potential profits it holds.