Delve into the Exciting World of Options Trading and Profiting from Market Movements

In the realm of finance, options trading offers a unique opportunity to capitalize on market fluctuations and potentially generate substantial returns. Understanding how to calculate profit and loss in options trading is key to achieving success in this thrilling arena. This comprehensive guide will provide you with a step-by-step explanation, empowering you to navigate the intricacies of options trading and maximize your profit potential.

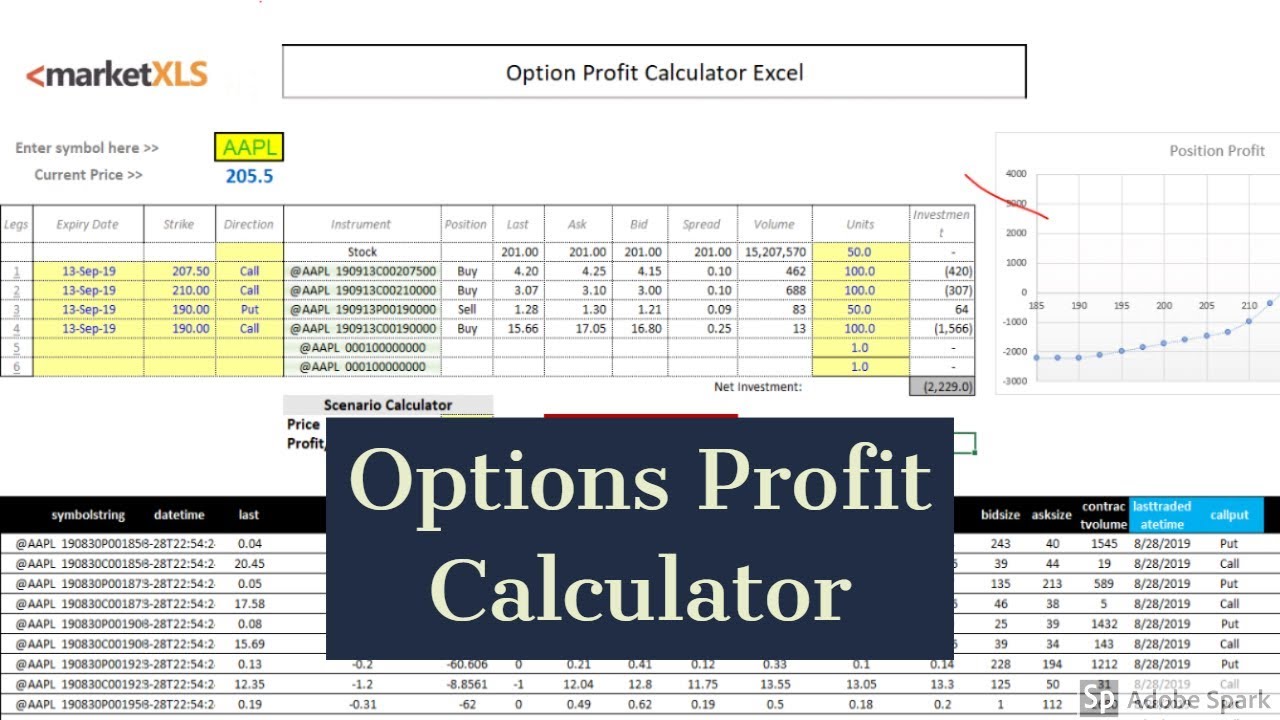

Image: virtoffice.weebly.com

Understanding Options Contracts: The Building Blocks of Profitability

Options contracts are financial instruments that grant the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a specific asset at a predetermined price (strike price) on or before a specified date (expiration date). These contracts provide investors with flexibility and leverage, enabling them to profit from both bullish and bearish market scenarios.

Calculating Profit in Options Trading: Riding the Ups and Downs

To calculate profit in options trading, the following formula is used:

Profit = (Closing Price – Strike Price) * Number of Contracts

The closing price is the price at which the option is sold or exercised, while the strike price is the predetermined price agreed upon at the time of contract purchase. The number of contracts represents the quantity of options held by the trader.

Example of Calculating Profit:

Let’s assume you buy a call option with a strike price of $100 for $5 per contract. If the stock price rises to $120 at expiration, your profit would be calculated as follows:

Profit = ($120 – $100) * 100 contracts

Profit = $20 * 100

Profit = $2,000

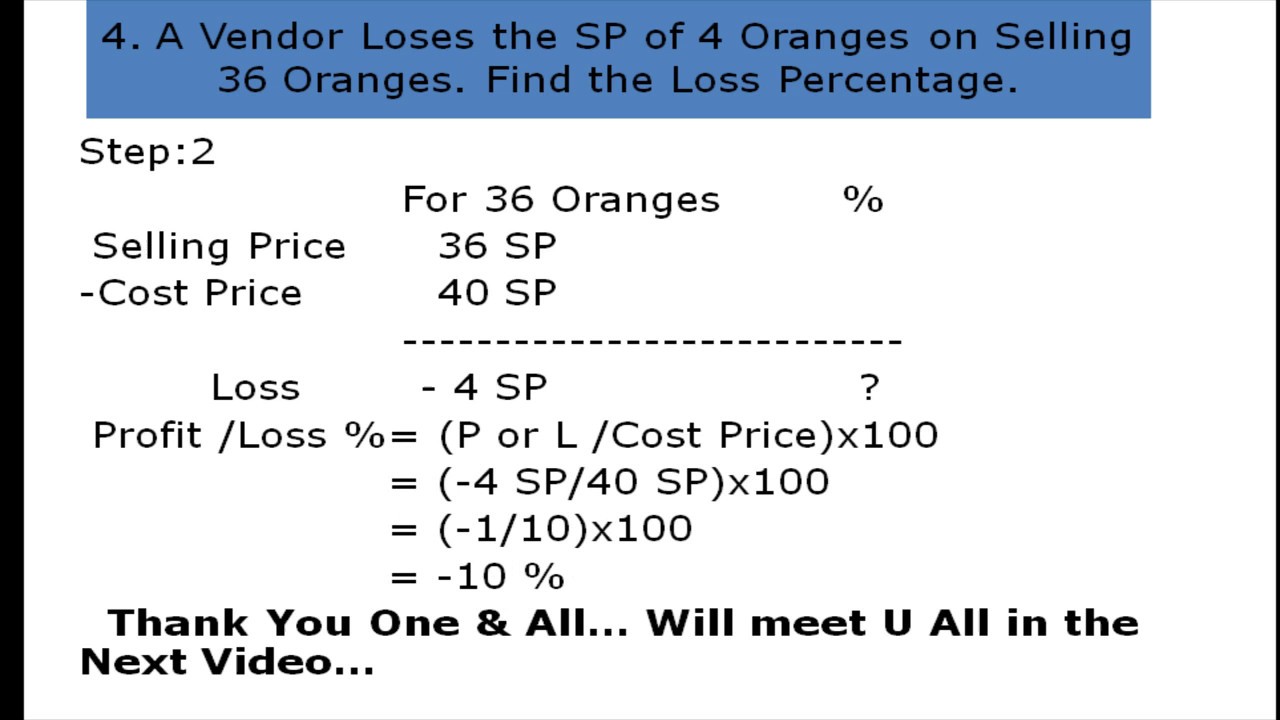

Image: www.youtube.com

Understanding Loss in Options Trading: Minimizing Risk and Maximizing Returns

Just as there is potential for profit, there is also the possibility of loss in options trading. This is calculated using the same formula as profit, but with the subtraction of the initial premium paid for the contract:

Loss = (Initial Premium – (Closing Price – Strike Price)) * Number of Contracts

Example of Calculating Loss:

Using the previous example, if the stock price falls to $90 at expiration, your loss would be calculated as follows:

Loss = ($5 – ($90 – $100)) * 100 contracts

Loss = ($5 – $10) * 100

Loss = -$500

Strategies to Enhance Profitability: Navigating the Market with Confidence

Maximizing profit in options trading requires a strategic approach. Consider the following tips to increase your chances of success:

- Identify Market Trends: Analyze market conditions and forecast potential price movements to make informed trading decisions.

- Choose the Right Options: Select options with appropriate strike prices and expiration dates that align with your investment goals.

- Manage Risk: Employ stop-loss orders to limit potential losses and consider hedging strategies to reduce overall risk.

- Stay Informed: Continuously monitor market news and economic data to stay ahead of the curve and make timely adjustments to your trading strategy.

How To Calculate Profit And Loss In Options Trading

Image: projectopenletter.com

Conclusion: Embracing the Power of Options Trading

Options trading offers a compelling avenue to navigate market fluctuations and potentially generate substantial profits. By understanding how to calculate profit and loss, you gain a crucial advantage in the pursuit of financial success. Armed with the insights provided in this guide, you can approach options trading with confidence, maximizing your returns and minimizing potential losses. Remember, knowledge is the key to unlocking the full potential of this exciting market.