Introduction

In the turbulent waters of financial markets, options trading offers investors both opportunities and risks. Among the various strategies available, the risk reversal strategy emerges as a compelling choice, empowering traders to navigate market uncertainties and generate consistent returns with limited capital outlay. In this comprehensive guide, we delve into the nuances of risk reversal, exploring its mechanics, advantages, and practical implementation.

Image: www.danielstrading.com

Understanding Risk Reversal

Risk reversal is an options trading strategy involving the simultaneous purchase of a call option and sale of a put option on the same underlying asset with the same expiration date, but different strike prices. The call option conveys the right but not the obligation to buy the underlying asset at a specified price, while the put option gives the holder the right to sell the asset at another set price. By combining these options, traders aim to profit from a neutral or range-bound market where the underlying asset’s price fluctuates within a limited range.

Unlocking the Benefits of Risk Reversal

This strategy offers several key advantages:

- Capital Efficiency: Unlike traditional long call or put positions, risk reversal requires only a fraction of the capital, making it accessible to a wider range of investors.

- Reduced Risk: By balancing the long call and short put options, traders mitigate downside risk and enhance their chances of profitability.

- Flexibility: Risk reversal allows for flexibility in adjusting strike prices and time to expiration, aligning with traders’ specific risk appetite and market outlook.

Mechanics of Risk Reversal

Implementing a risk reversal strategy involves these steps:

- Select the Underlying Asset: Identify an asset expected to remain within a predictable price range during the holding period.

- Determine Strike Prices: Choose a lower strike price for the put option and a higher strike price for the call option, creating a range within which the asset is likely to trade.

- Set Time to Expiration: Select an expiration date that provides sufficient time for potential price fluctuations within the desired range.

Image: foyasuromada.web.fc2.com

Practical Implementation

To illustrate the practical implementation, let’s assume the following scenario:

- Underlying Asset: XYZ stock

- Call Option Strike: $22

- Put Option Strike: $20

- Expiration Date: 3 months

If XYZ stock remains between $20 and $22 during the holding period, the call option will expire worthless, while the put option will generate a small profit. Conversely, if XYZ stock falls below $20, the put option will fully cover the potential loss on the call option.

Maximizing Returns with Risk Reversal

To enhance returns from risk reversal, consider these tips:

- Trade Liquid Options: Focus on options with substantial trading volume and open interest to ensure liquidity and competitive pricing.

- Manage Risk: Select strike prices that create a reasonable tradeoff between potential reward and risk. Avoid overly bullish or bearish stances.

- Monitor Market Dynamics: Actively track market conditions and adjust your strategy as needed. Consider reducing exposure during periods of high volatility or unexpected market events.

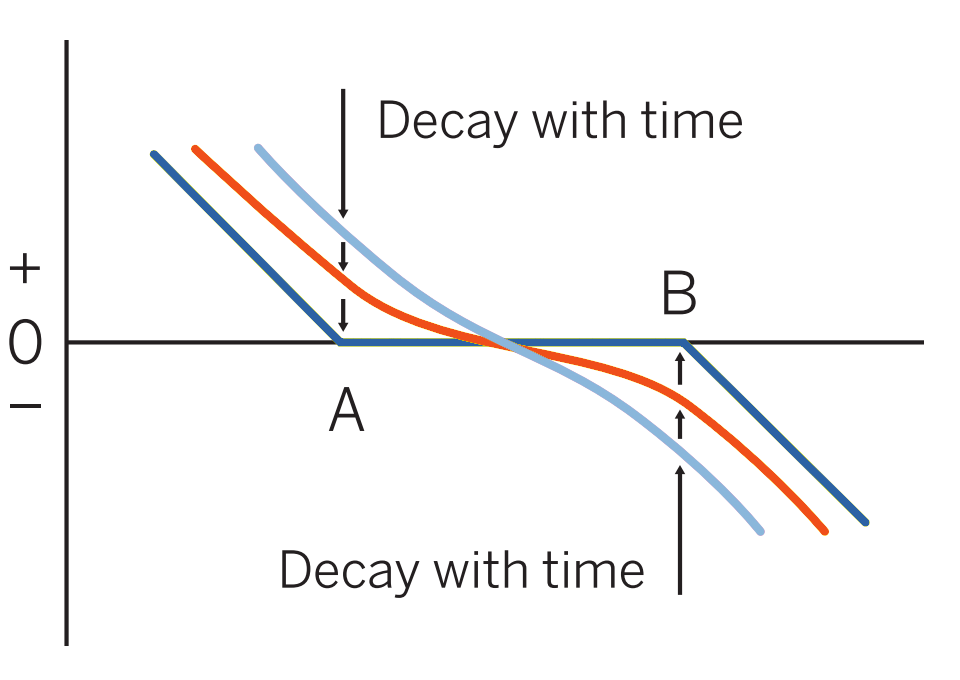

Options Trading Risk Reversal

Image: theoptionsedge.com

Conclusion

Risk reversal is a powerful options trading strategy that combines capital efficiency, risk mitigation, and flexibility. By skillfully balancing call and put options, traders can navigate market uncertainties and pursue consistent returns. While no trading strategy guarantees success, risk reversal offers a compelling framework for investors seeking to enhance their investment portfolio and achieve their financial goals. Embrace this strategy today and unlock the potential of the financial markets with reduced risk and amplified gains.