Introduction

Options trading, a sophisticated investment strategy, offers the potential for both significant gains and substantial losses. Before embarking on this complex endeavor, it is crucial for investors to fully understand the risks involved and to ensure they meet the requirements set forth by their brokerage firm. In this comprehensive guide, we will delve into the specific options trading requirements at Scottrade, empowering you with the knowledge necessary to navigate this dynamic financial landscape.

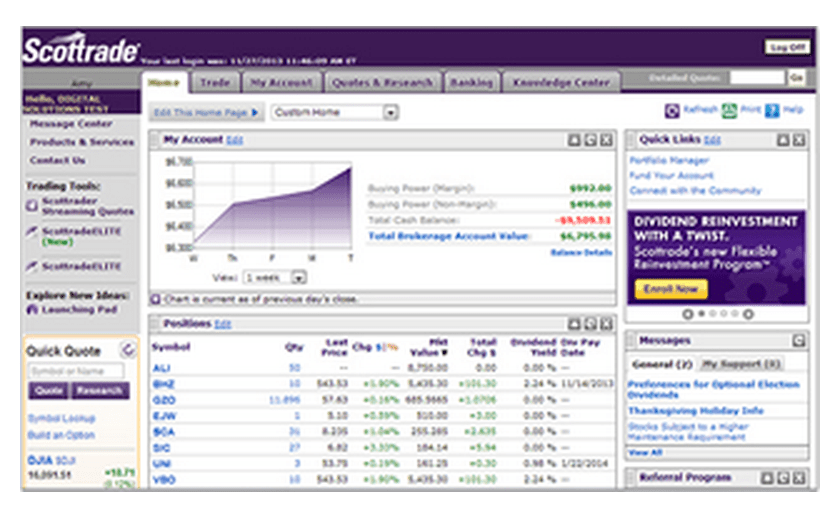

Image: stockhax.com

Defining Options Trading

Options contracts, also known as “options,” convey the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). Options trading provides investors with various strategies for managing risk, taking advantage of market movements, and potentially enhancing returns.

Options Trading Requirements at Scottrade

To commence options trading at Scottrade, individuals must fulfill certain eligibility criteria and complete the necessary steps.

Eligibility Requirements:

- Account Type: Only individual and joint brokerage accounts are eligible for options trading.

- Financial Status: Accounts must maintain a minimum account balance of $2,500 or have made at least four options trades within the past 12 months.

- Investment Experience: Prospective traders must pass a series of knowledge-based assessments covering options concepts, strategies, and risks.

Image: www.frugalrules.com

Application Process:

- Complete an Options Agreement: Review and sign the Scottrade Options Agreement, acknowledging your understanding of the risks and responsibilities involved.

- Submit an Options Application: Provide personal information, trading objectives, and investment experience to Scottrade for review.

- Pass the Knowledge Assessments: Demonstrate your knowledge of options trading by successfully completing the required assessments.

Trading Approvals and Options Levels

Upon successful completion of the application process, Scottrade will assign an options level to your account, determining the types of options strategies you are permitted to trade.

- Level 1 Approval: Basic options strategies, such as buying or selling uncovered call or put options

- Level 2 Approval: More complex strategies, including spreads and combinations

- Level 3 Approval: Advanced strategies, such as naked or married options trading

Specific Requirements for Options Trading at Scottrade

In addition to the general requirements, Scottrade imposes additional conditions on specific aspects of options trading:

Margin Trading:

- Options trading requires a margin account, where trades are partially financed by Scottrade.

- Margin requirements vary based on the type of strategy and the underlying asset.

Trading Hours:

- Options markets are typically open from 9:30 AM to 4:00 PM Eastern Time.

- However, extended trading hours may be available for specific underlying assets.

Exercise and Assignment:

- Exercising an options contract entails buying or selling the underlying asset at the strike price.

- Scottrade reserves the right to automatically exercise or assign options contracts if certain criteria are met.

Expert Insights and Actionable Tips

To enhance your options trading journey, consider these valuable insights:

- Seek Professional Guidance: Consult with a financial advisor or experienced trader for personalized guidance and risk management strategies.

- Start Small: Gradually increase your position size and trading frequency as you gain experience and confidence.

- Control Your Risk: Implement risk management tools like stop orders and hedging strategies to limit potential losses.

- Monitor Market Trends: Stay informed about market news, economic data, and geopolitical events that may impact option pricing.

Options Trading Requirements Scottrade

Image: camupay.web.fc2.com

Conclusion

Options trading at Scottrade offers investors a multifaceted and versatile investment tool. By adhering to the outlined requirements and exercising due diligence, individuals can unlock the potential benefits while mitigating risks. Remember, understanding the complexities of options trading is paramount to maximizing your trading success. Seize the opportunity to educate yourself, seek expert advice, and embrace the dynamic world of options trading with confidence and calculated decisions.