Are you an investor or trader looking to get started with options trading on Scottrade? Understanding the Scottrade options trading requirements is essential for success in this dynamic market. This comprehensive guide will explore everything you need to know about the qualifications, account types, and margin regulations associated with options trading on Scottrade.

Image: alternativeto.net

Introduction to Options Trading on Scottrade

Options trading involves contracts that give traders the rights, not the obligation, to buy (calls) or sell (puts) an underlying asset at a specified price within a specific timeframe. Scottrade offers a user-friendly platform for options traders of all levels, providing access to a wide range of options markets and trading tools. However, to participate in options trading on Scottrade, investors must meet specific requirements.

Account Types and Eligibility Requirements

- Individual Accounts: Individuals must be U.S. citizens or residents with a valid Social Security number and must be at least 18 years of age.

- Joint Accounts: Joint accounts require all joint owners to be U.S. citizens or residents with valid Social Security numbers and must be at least 18 years of age.

- Corporate Accounts: Corporations must provide proof of their legal existence, such as articles of incorporation or a certificate of good standing.

- Trust Accounts: Trusts must provide the trust document, the trustee’s information, and the beneficiary’s information.

Options Trading Privileges

- Level 1 Options Approval: Grants permission to trade non-complex options, such as single-leg bull calls, bear puts, and covered calls.

- Level 2 Options Approval: Enables trading in more complex options strategies, such as multi-leg spreads, straddles, and strangles.

- Level 3 Options Approval: Allows for participation in advanced options trading strategies, such as naked options and married put options.

To obtain options trading privileges, investors must submit an Options Trading Application to Scottrade and provide proof of their trading experience, financial knowledge, and risk tolerance. The approval process can take several weeks.

Image: kyxenyvoluwes.web.fc2.com

Margin Requirements

Options trading often involves the use of margin, which allows traders to borrow funds to increase their buying power. However, margin trading also carries additional risks. Scottrade’s margin requirements for options trading vary depending on the type of option strategy being employed.

- Initial Margin: The minimum amount of equity that must be maintained in an account to support an options position.

- Maintenance Margin: The minimum amount of equity that must be maintained in an account after an options position has been executed.

It is crucial to understand and manage margin requirements effectively to avoid potential margin calls or forced liquidations.

Additional Requirements

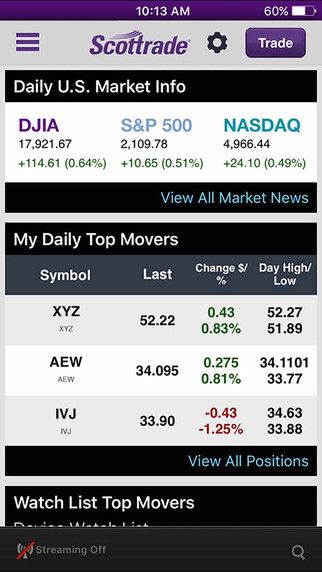

- Trading Platform: Scottrade offers several trading platforms, including a web-based platform, a mobile app, and desktop trading software. Choose the platform that best aligns with your trading style and preferences.

- Data Feed: Real-time data is essential for successful options trading. Consider subscribing to a data feed from Scottrade or a third-party provider.

- Education and Research: Options trading involves inherent risks and complexities. Educate yourself thoroughly before executing your first trade. Utilize Scottrade’s educational resources and conduct independent research.

Scottrade Options Trading Requirements

Image: www.moneysmartguides.com

Conclusion

By understanding the Scottrade options trading requirements and meeting the necessary qualifications, you can open up a world of opportunities in the options markets. Remember to trade cautiously, manage your risk effectively, and seek support from experienced professionals whenever needed. Armed with knowledge and a solid foundation, you can navigate the exciting and rewarding world of options trading on Scottrade.