In the fast-paced financial landscape, options trading has emerged as a potent tool for savvy investors seeking to amplify potential returns. For those new to this exciting arena, understanding the nuances of options trading is paramount. In this comprehensive guide, we’ll delve into the essentials of options trading, empowering you with the knowledge and strategies to navigate this market effectively.

Image: douglasbaseball.com

Unveiling Options Trading

Options contracts are financial instruments that bestow upon the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the strike price) on or before a specified date (the expiration date). These contracts empower investors with a spectrum of opportunities, from hedging against risk to speculating on price fluctuations.

Call Options: Leveraging Price Appreciation

Call options grant the holder the right to purchase the underlying asset at the strike price. As the asset’s market price rises, so does the value of the call option. This makes call options suitable for investors who anticipate a surge in the asset’s value.

Put Options: Capitalizing on Price Declines

Put options provide the holder with the right to sell the underlying asset at the strike price. When the asset’s market price decreases, the value of the put option increases. Thus, put options are ideal for investors expecting a drop in the asset’s value.

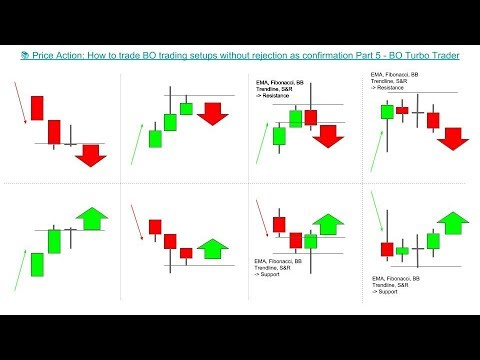

Image: www.duomoinitiative.com

Navigating the Dynamics of Options Trading

Understanding the factors that influence the value of options is crucial for successful trading. Options premiums, which represent the cost of the contract, are primarily driven by:

- Underlying asset price: The market price of the underlying asset has a direct impact on the value of the option.

- Strike price: The proximity of the strike price to the current market price affects the option’s premium.

- Time to expiration: As the expiration date approaches, the time value of an option decays, reducing its premium.

- Volatility: Market volatility, measured by the implied volatility of the option, influences the premium as investors seek protection against price fluctuations.

Strategies for Options Trading Success

Armed with a comprehension of options dynamics, investors can employ various strategies to enhance their trading outcomes:

Covered Call Writing: Generating Income from Owned Assets

This strategy involves selling (writing) covered call options against shares of the underlying asset that you own. The premium received from selling the call options generates income while maintaining exposure to potential upside in the asset’s price.

Bullish Spread: Positioning for Expected Price Increases

A bullish spread is a combination of buying a call option at a lower strike price and selling (writing) a call option at a higher strike price. This strategy benefits from an increase in the asset’s price while limiting potential losses.

Bearish Spread: Capitalizing on Anticipated Price Declines

A bearish spread comprises buying a put option at a lower strike price and selling (writing) a put option at a higher strike price. This strategy profits from a decrease in the asset’s price, providing protection against market downturns.

Expert Tip: To optimize your options trading, consider the following advice:

- Risk Management: Options trading involves inherent risk. Determine your risk tolerance and allocate funds accordingly.

- Technical Analysis: Utilize technical analysis techniques to identify potential trading opportunities.

- Time Management: Monitor options positions closely as they approach expiration.

- Continuous Learning: Stay updated on market trends and advancements in options trading strategies.

Common FAQ on Options Trading

- Q: What is the difference between a call and a put option?

- A: Call options convey the right to buy, while put options confer the right to sell, the underlying asset at a specified price.

- Q: How is the premium of an option determined?

- A: The premium is influenced by factors such as the underlying asset price, strike price, time to expiration, and market volatility.

- Q: What are some popular options trading strategies?

- A: Common strategies include covered call writing, bullish spreads, and bearish spreads.

- Q: Can options trading be used for hedging?

- A: Yes, options can be employed to hedge against potential losses in the value of an underlying asset.

- Q: Is options trading suitable for beginners?

- A: Options trading involves risk and may not be suitable for inexperienced investors. It’s essential to understand the dynamics and strategies of options trading before venturing into it.

Options Trading Reccommendation

Image: www.youtube.com

Conclusion

Options trading presents a potent tool for investors seeking to expand their financial horizons. By comprehending the fundamentals, strategies, and market dynamics, traders can unlock the potential of options to generate income, hedge against risk, and enhance their overall investment returns. Remember, knowledge and prudence are the keys to successful options trading. Are you ready to embrace the opportunities offered by the options market?