Prologue: Embarking on the Path to Financial Empowerment

In the dynamic world of finance, a compelling opportunity awaits those seeking to amplify their investment gains and manage market risks – the realm of options trading. Often shrouded in mystery, options trading unlocks a vast array of possibilities for discerning investors. This comprehensive guide will serve as your trusted beacon, illuminating the intricacies of this powerful tool and empowering you with the knowledge necessary to navigate the financial markets with confidence and acumen.

Image: finance.yahoo.com

Understanding the Essence of Options Trading

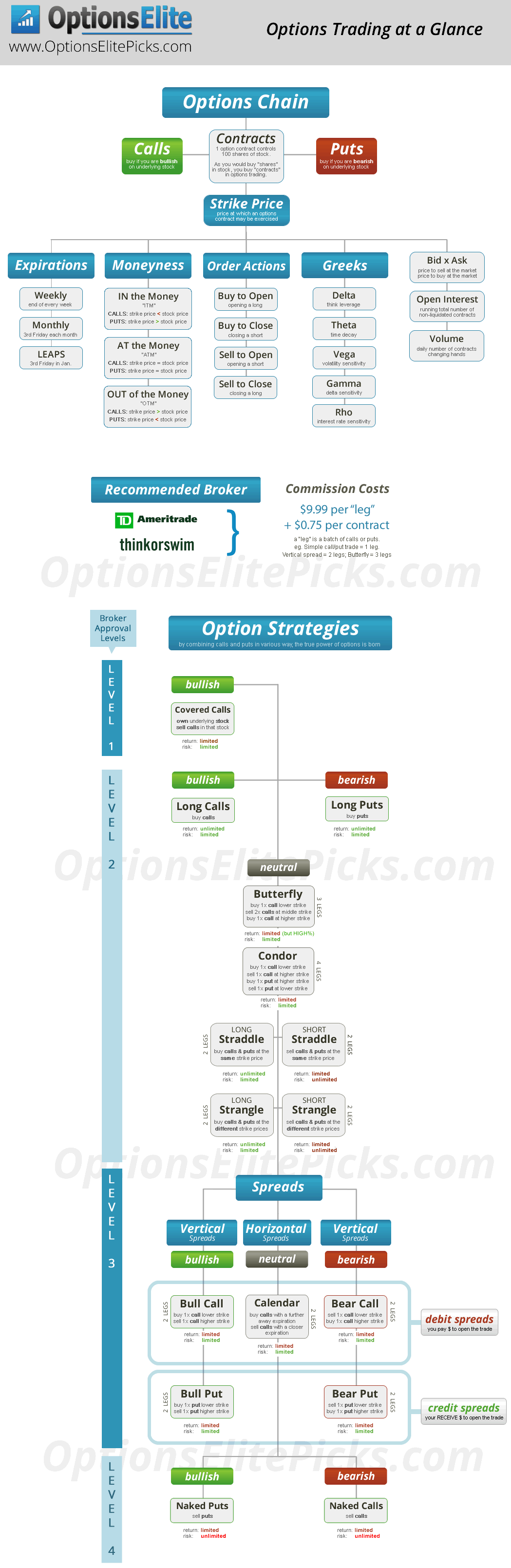

An option, in essence, represents a contract that grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the strike price) on or before a specified date (the expiration date). This flexibility allows investors to tailor their strategies to suit their individual risk tolerance and investment goals. Depending on whether they anticipate the underlying asset’s price to rise or fall, investors can choose between two primary types of options: calls and puts.

Calls convey the right to buy the underlying asset at the strike price before the expiration date, while puts confer the right to sell the underlying asset at the strike price before the expiration date. The versatility of options empowers investors to craft sophisticated investment strategies, including hedging against market downturns, enhancing portfolio returns, and capturing market volatility.

Delving into the Mechanics of Options Trading

Before venturing into the world of options trading, equip yourself with a firm grasp of the key concepts governing this realm. Comprehend the intricacies of strike prices, expiration dates, and premiums. Recognize the interplay between these factors in determining the value and potential returns of options contracts.

Master the art of calculating intrinsic value, the innate value of an option based solely on the difference between the strike price and the underlying asset’s current market price. Delve into the concept of time decay, the gradual erosion of an option’s value as its expiration date approaches. Grasp the significance of implied volatility, a crucial measure of market expectations regarding the future price fluctuations of the underlying asset.

Harnessing the Power of Options Strategies

Options trading extends beyond merely buying or selling individual contracts. Discover the multitude of sophisticated strategies employed by seasoned investors to maximize returns and mitigate risks. Explore the nuances of covered calls, a strategy that involves selling a call option while owning the underlying asset, enabling investors to generate income while maintaining exposure to potential price appreciation.

Uncover the intricacies of protective puts, a defensive strategy that involves purchasing a put option to hedge against potential downturns in the underlying asset’s price. Gain insights into straddles, a strategy that involves buying both a call and a put option at the same strike price and expiration date, profiting from significant price movements in either direction.

Empowering Yourself with Expert Insights

As you embark on your options trading journey, seek guidance from the wisdom of seasoned experts. Consult with experienced financial advisors who possess a deep understanding of options trading and can provide personalized advice tailored to your specific investment goals and risk tolerance. Attend industry conferences and webinars to glean insights from renowned market analysts and portfolio managers.

Engage with online forums and communities dedicated to options trading, where you can connect with fellow traders and exchange valuable knowledge and experiences. Immerse yourself in the wealth of educational resources available, including books, articles, and online courses, to continuously expand your understanding of this dynamic domain.

Image: thestockmarketwatch.com

Trading Options Stock Guide

Image: www.pinterest.com

Conclusion: Unleashing Your Investment Potential

Options trading presents a powerful tool in the arsenal of discerning investors, offering unparalleled flexibility, potential returns, and risk management capabilities. Embrace the knowledge and insights presented in this guide, and embark on your options trading journey with confidence and preparation. Remember, the path to financial success is paved with continuous learning, prudent decision-making, and a commitment to empowering yourself with the knowledge necessary to navigate the complexities of the market.